The era of free money is waning, if not over, in Silicon Valley, and startups are buckling down. That’s true even in the once red-hot on-demand sector, filled with businesses competing to bring you things or provide you with services ordered at the touch of a button.

Global financing to on-demand startups tumbled from a high of $7.3 billion in the third quarter of 2015 to just $1 billion in the first quarter of 2016, according to data from CB Insights. It’s a dramatic plunge for a sector that investors have poured money into for the last two years, largely in hopes of landing the next Uber or Airbnb.

The on-demand category includes giants like Uber, Airbnb, and Didi Kuaidi, whose huge deals can easily swing the numbers in any one quarter. Over the first nine months of 2015, those three companies collected 65% of all on-demand funding. Discounting them, the on-demand financing drop-off is still noticeable.

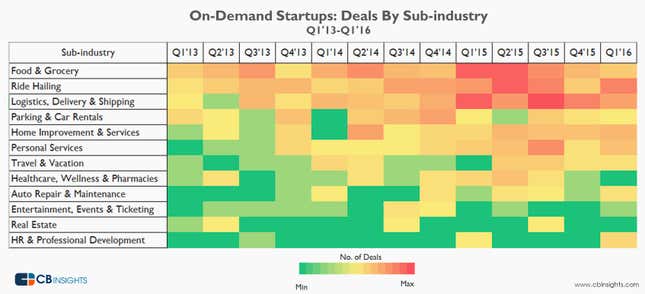

Where is money still going to in the sector? CB Insights put together a heat map, showing funds are still flowing to the logistics and delivery, ride-hailing, and home services sub-sectors of on-demand companies. Meanwhile, deals have cooled for food and grocery startups, and for parking and car-rental services—which is probably not surprising, when you consider the recent fates of Zirk, Luxe and Instacart.