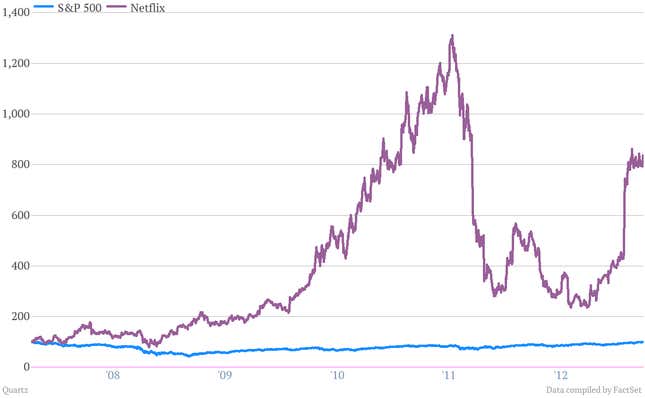

Netflix! If you bought the stock at the closing peak for the S&P 500—Oct. 9, 2007—you’d be up 735% through Wednesday’s close, although you would have suffered some euphoric highs and gut-wrenching declines. Here’s a chart of the index and Nexflix, indexed to 100:

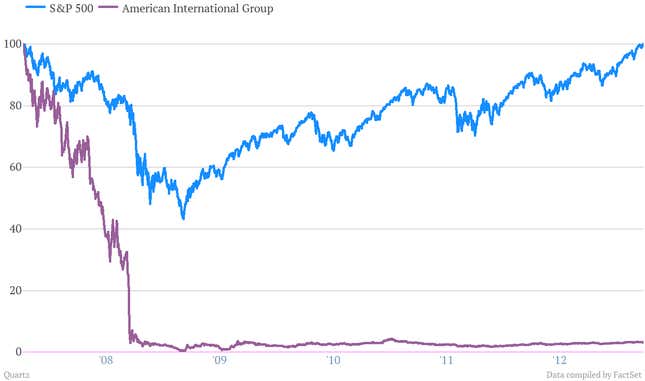

And the worst? American International Group, the insurance behemoth that wrote so much unreserved insurance—called credit default swaps—on junk mortgage bonds that it had to be effectively nationalized by the US government during the financial crisis, for fear of bringing down the entire economy. As befits such a disaster of an operation, the stock lost nearly all of its value. The chart below shows that it has indeed been a painful ride for major holders of AIG shares, which were down 97%—including reverse splits—from the 2007 market peak. Although, off of such a low base, the stock has had good runs at times over the last few years:

Of course, the entire point of buying an index fund is that you don’t believe its possible to consistently pick winning stocks and avoid the AIGs of the world. (Hat-tip to S&P’s senior index analyst Howard Silverblatt for the heads up on Netflix and AIG.)