Japanese factory output slips

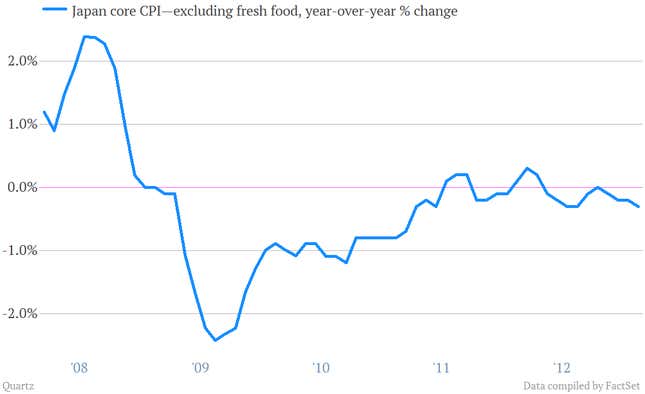

- Industrial production declined 0.1% in February, though survey data show manufacturers are optimistic that efforts to weaken the yen will soon boost business. Meanwhile, in nearby Korea, factory output tumbled, suggesting that Japan’s effort to whip deflation by weakening its currency is weighing on some of its regional exporting rivals.

- But the Bank of Japan has a tough fight ahead of it when it comes to beating back deflation. Japan’s core year-on-year gauge of prices declined 0.3%, showing that deflationary tendencies are still strong.

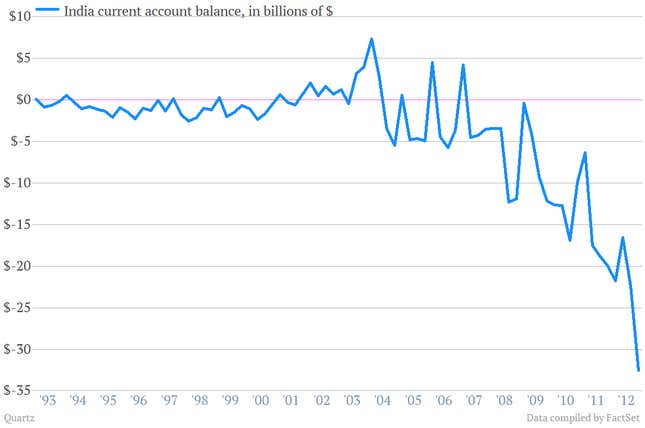

Indian balance of payments get worse

- Reliance on foreign oil imports, along with the current surge of Indian gold mania, drove India’s balance of payments to a record low of $32.6 billion during the fourth quarter, or 6.7% of GDP. The growth of the deficit, which needs to be paid for either through additional borrowing or through a bit of inflation, has been putting pressure on the rupee.

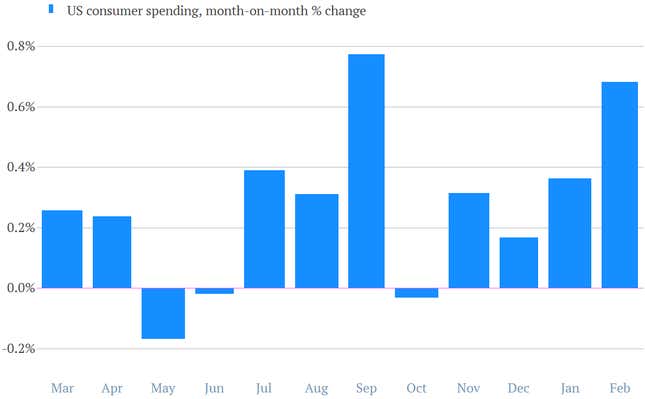

US consumer spending climbs

- The US is a rare source of strength among the major world economies, and consumer spending is its cornerstone—worth about 70% of GDP. So it’s a good thing to see that consumer spending posted a better-than-expected rise in February, increasing by a seasonally adjusted annualized rate of 0.7%, versus a 0.4% gain in January. For an in-depth look at US consumers, click here.