The Bank of Japan is under enormous pressure to jolt Japan’s economy out of its decades-long repose. Expectations are high for its first monetary policy announcement under the new governor, Haruhiko Kuroda, on Thursday April 4.

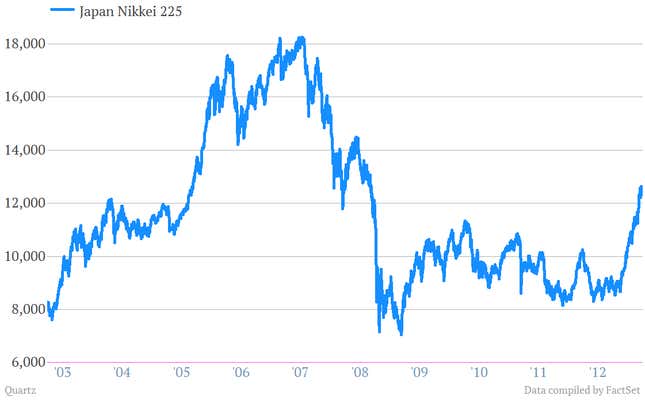

The Nikkei caught fire back in November, as it became clear that Shinzo Abe would be elected prime minister after virtually promising to get the BoJ to take Federal Reserve-style extraordinary action to try to get the economy moving. It’s the first time the Japanese stock market has done much of anything since the financial crisis hit.

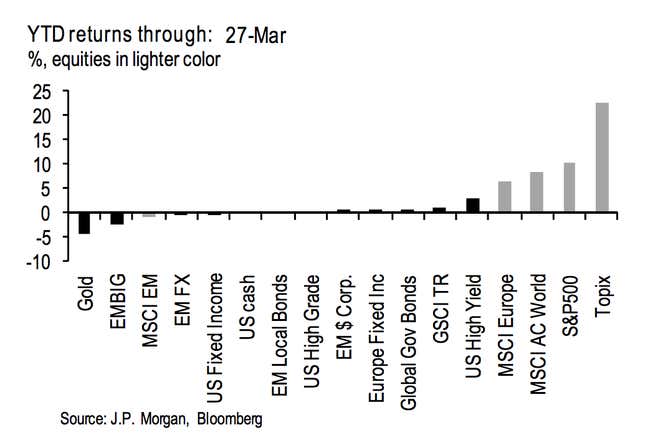

That run has made Japanese stocks one of the best asset classes to own so far this year. The Tokyo Stock Exchange’s Topix index is the darling of asset classes in this chart from JP Morgan analysts. Gold is the dog in the class.

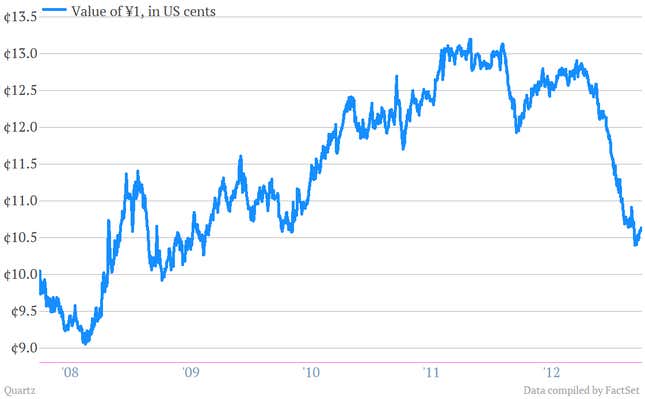

And the yen has been weakening substantially. That’s a sign investors expect the BoJ to start the kind of money creation—quantitative easing (QE)—that the Federal Reserve under Ben Bernanke has been using for a long time to push interest rates lower and asset prices higher, in an attempt to boost the economy. In Japan’s case, a weak currency provides a helpful tailwind to the all-important export sector, because it makes Japanese goods cheaper for foreign buyers.

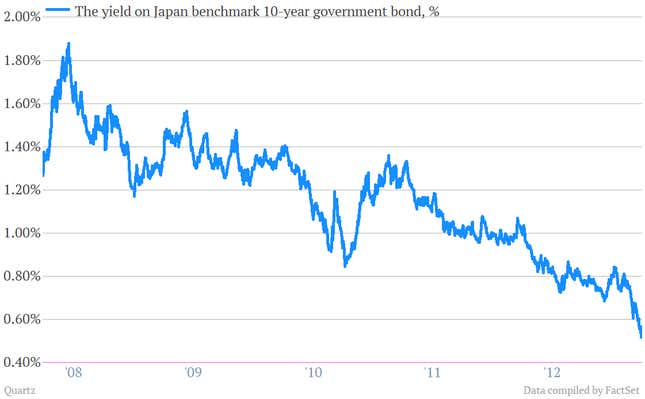

Meanwhile, rates on long-term Japanese government bonds have been tumbling. That, too, is a sign that traders are expecting quantitative easing. Since QE entails the BoJ buying financial assets, including government bonds, speculators hope that by buying them first, they’ll see a profit when the BoJ starts snapping them up and pushes up the price. (Quick refresher: A fall in bond rates, or yields, means a rise in bond prices.)

The amazing thing is that all of this has taken place though the Japanese central bank hasn’t done anything substantial yet. (Indeed, back in January, when it was under the control of outgoing head Masaaki Shirakawa, the bank disappointed markets with an muddled announcement on a few half-measures.) That bond yields and the yen have continued falling, and the stock market has continued rising, suggests investors really believe the new head of the bank, Kuroda, will follow through with Fed-like persistence.

That’s pretty remarkable, given Japan’s history of taking one step forward and two steps back. But our guess is it won’t take much for financial markets to lose faith at the first sign of hesitancy. And that means Kuroda will have to make a big splash Thursday.