For the first time since the depths of the Great Recession, the the total value of materials consumed by all the world’s makers of microchips was down—2%, to $47.11 billion. But that’s just one of the stories told by data from the annual tabulation of the total value of materials consumed by all the world’s makers of microchips, compiled by industry association SEMI.

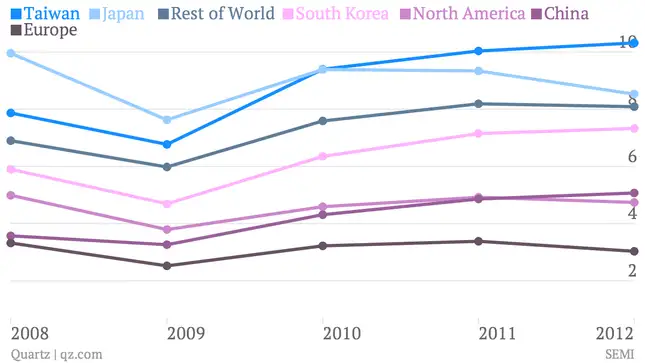

Assembling data from SEMI’s last four annual reports—which together cover the past 5 years, a number of trends are apparent.

China is now a bigger consumer of the raw materials used for making microchips than North America is.

This is a huge change from 2008, when China consumed only $3.57 billion of silicon ingots and the other materials used for semiconductor manufacture, compared to $4.99 billion consumed by North America. This means that the number and productivity of plants for making microchips—which are high-investment, high-tech, finished product type manufacturing operations requiring a high level of expertise—are expanding in China even as they decline in North America. Compared to 2008, consumption of semiconductor materials in North America is down $250 million to $4.74 billion, while in China consumption has shot up 42% to $5.07 billion.

The decline of the PC is probably to blame for the overall drop in consumption of microchip materials in 2012.

In 2012, manufacturers shipped record numbers of mobile devices. Demand for set-top boxes and embedded systems (e.g. industrial control systems and the computers that go into cars) remained soft on account of a troubled global economy, but to see a drop in semiconductors shipped in the absence of an outright recession suggests that what’s really going on here is the decline of the PC—and the expensive, materials-hungry processors and memory it incorporates.

Production of microchips in Japan is declining rapidly.

What a difference five years makes. Japan, in 2008 the world’s most rapacious consumer of semiconductor materials, has seen production crash, especially in the 2011-2012 period—down 8% to $8.35 billion. Compare that with nearly $10 billion in 2008.

The harder it is to make microchips, the more consolidation there is in the hands of fewer manufacturers.

From 2011 to 2012, consumption of microchip precursor materials was flat or down in every region except for China and Taiwan. Taiwan has come to dominate this industry, with contract manufacturers like Taiwan Semiconductor Manufacturing Company churning out chips for countless chip design companies that do not own their own manufacturing facilities—including mobile and telecommunications giants like Qualcomm and now, Apple.

What’s going on here is that, as we approach the end of Moore’s Law—which says, essentially, that we can expect microchips to improve at a rapid clip on a predictable timetable—we are reaching the physical limits of current manufacturing. That means factories are more expensive than ever, with price tags into the billions for a single facility. If a manufacturer wants the latest and fastest chip technology, there are only a few companies that can play at that level, and you can count them on one hand: TSMC in Taiwan, Intel and Global Foundries in North America, and Samsung in South Korea.

Consumption of microchips in China is exploding—and more and more of them are being sourced locally.

In 2012, China consumed 33% of the world’s integrated circuits (i.e. microchips) while the US consumed only 13.5%. Much of that, of course, is incorporated into products that will ultimately be exported—like iPhones. China’s share of world microchip consumption came to $137.5 billion in 2012, according to SEMI China. Meanwhile, the total value of microchips produced in China was only $28.5 billion. Closing that gap are companies like Semiconductor Manufacturing International (SMIC), Shanghai Huali Microelectronics (HLMC), Shanghai HuaHong NEC Electronics Company (HHNEC), Grace Semiconductor Manufacturing and Advanced Semiconductor Manufacturing (ASMC).

In the long run, the general emphasis on electronics manufacturing in China, along with this gap between production and demand, indicates that China is, as usual, the sleeping giant in this field. While mainland China’s production of microchips lags behind most other regions, in 2012 it saw the biggest percentage growth in consumption of microchip materials and matched the absolute value of growth in Taiwan, the only other region that saw growth last year.

Here’s the thing about microchips: China’s government views them, rightly, as an important strategic asset. It’s a stretch to compare them to, say, oil, but they are clearly very important in our increasingly connected world. It’s hard to imagine a future in which they are any less important an economic enabler than they are now. So the overall trend in where they are manufactured has implications for everything from national defense to overall competitiveness in high tech.