Because of China’s mounting bad debt problem, its banks are being told by regulators to rein in their lending.

But the banks, under pressure themselves from local governments to help burnish GDP figures, cannot stop stoking China’s credit-fuelled growth machine. So they are disguising loans that regulators would frown upon with a complicated conjuring trick that makes them appear as something else entirely.

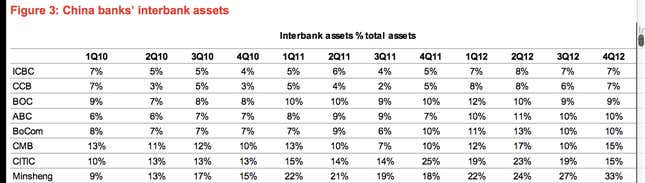

Research from Malaysian bank CIMB shows the Chinese lenders are transforming corporate loans into what is known as “interbank assets” via a series of complicated maneuvers. ”Interbank assets” are the term for money banks lend to each other, and crucially, they are not included in Chinese lenders’ loan to deposit ratios (LTDs) A higher LTD makes a bank seem more risky. So the sorcery (which CIMB tactfully calls “innovation”) makes lenders seem healthier and disguises signs of them being over-extended.

CIMB’s study shows recorded interbank assets surged 8.5% in China from the third quarter of 2o12 to the fourth quarter. Actual loans in the system only rose 2.6%.

The hustle is complex. Here is a summary:

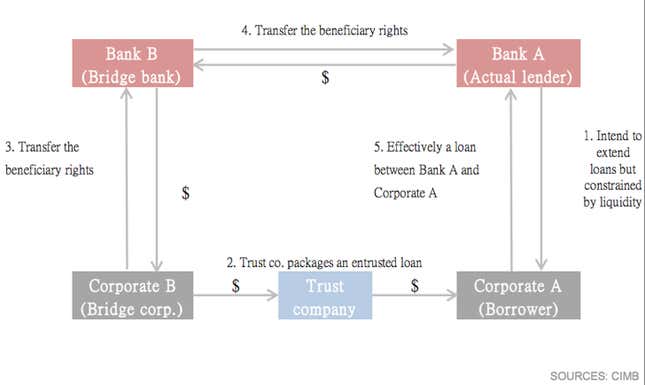

- A bank (Bank A) wants to lend money to a corporate customer, which we will label “Company A”. But it has reached the limit of its government-imposed loan quota.

- The bank enlists the help of a “trust company”, which is an organisation that buys loans from banks and then sells them on to outside investors

- The trust company buys Company A’s loan from Bank A. And it then briefly sells it to a second Chinese company it has pulled in to help out, who we will call “Company B”.

- Immediately afterwards, Company B sells what are called “beneficiary rights” to collect Company A’s debt to a second bank (Bank B).

- The last stage of the alchemy is for Bank B to transfer ownership of those “beneficiary rights” back to Bank A. According to CIMB, this allows the first bank to record the original corporate loan as an “interbank asset”.

If this seems confusing, it is meant to be. The ruse is designed to fool China’s banking regulators. And here, though it is probably harder to understand than our written explanation, is CIMB’s flow chart illustrating the “innovation”.

The institution with the biggest proportion of alleged “interbank assets” on its balance sheet is China Minsheng Bank, which also reported a monster 34.5% profit rise for 2012. This was much higher than the 15% rise in net income reported by China’s largest bank and industry bellwether ICBC. Banks increase their profits by growing the size of their loan books, which enables them to collect extra interest payments from borrowers.

CIMB’s report serves as additional validation that credit ratings agency Fitch was right to downgrade China’s local credit rating based on undisclosed risks building up in its banking system.

As anyone who lost money on shares of US or European banks in the 2008 financial meltdown knows full well, when banking becomes fiendishly complex, the lenders are usually hiding something bad.