SoftBank just became one of Apple’s most important suppliers

Japan’s SoftBank is bidding to acquire British chip designer ARM Holdings for $32 billion in cash. If it succeeds, it will be the UK’s biggest technology acquisition ever. SoftBank is shelling out a hefty 43% premium for the chip designer, based on its share price before the bid was made. What does it get in return?

Japan’s SoftBank is bidding to acquire British chip designer ARM Holdings for $32 billion in cash. If it succeeds, it will be the UK’s biggest technology acquisition ever. SoftBank is shelling out a hefty 43% premium for the chip designer, based on its share price before the bid was made. What does it get in return?

For starters, SoftBank just bought a critical part of the world’s computing infrastructure. ARM’s chip designs are in 95% of the world’s smartphones, including Apple’s iPhones. ARM designs have provided the foundation for Apple’s A-series chips, which power its phones and tablets. The company’s asset-light model means it focuses all its efforts on chip design, licensing that intellectual property to others, such as Qualcomm and Samsung, to fabricate the silicon wafers.

It’s a model that has allowed it to stay ahead of the competition, providing customers like Apple with key innovations, including the Secure Enclave, the mini computer on a chip that prevents iPhone data from being hacked. So important is ARM’s design knowhow to Apple that it’s no surprise the iPhone maker has been constantly linked to a buyout of the British firm over the years.

But smartphones are a maturing market. Smartphone shipments were flat, for the first time ever, in the first quarter of 2016, according to research firm IDC. The firm is forecasting growth of 3% in smartphone shipments this year, down sharply from 10% in 2015.

Slowing smartphone growth means ARM, like its competitor Intel and partner Qualcomm, has been searching for new markets elsewhere. The most promising opportunity is the Internet of Things (IoT), in which connected homes, industrial devices, and vehicles will need billions of new chips. Market research firm Gartner reckons that connected devices will grow from 3.8 billion devices in 2014 to more than 20 billion in 2020. That’s a market worth $1.7 trillion in 2020, according to IDC estimates.

ARM spent $350 million to acquire computer vision company Apical two months ago, as part of its IoT investment strategy. Computer-vision capabilities would give ARM a way in to connected cars, where it’s needed to process the stream of data flowing in from radars and cameras, and in home products like security cameras, where it could be used for facial or object recognition, as Nest has done.

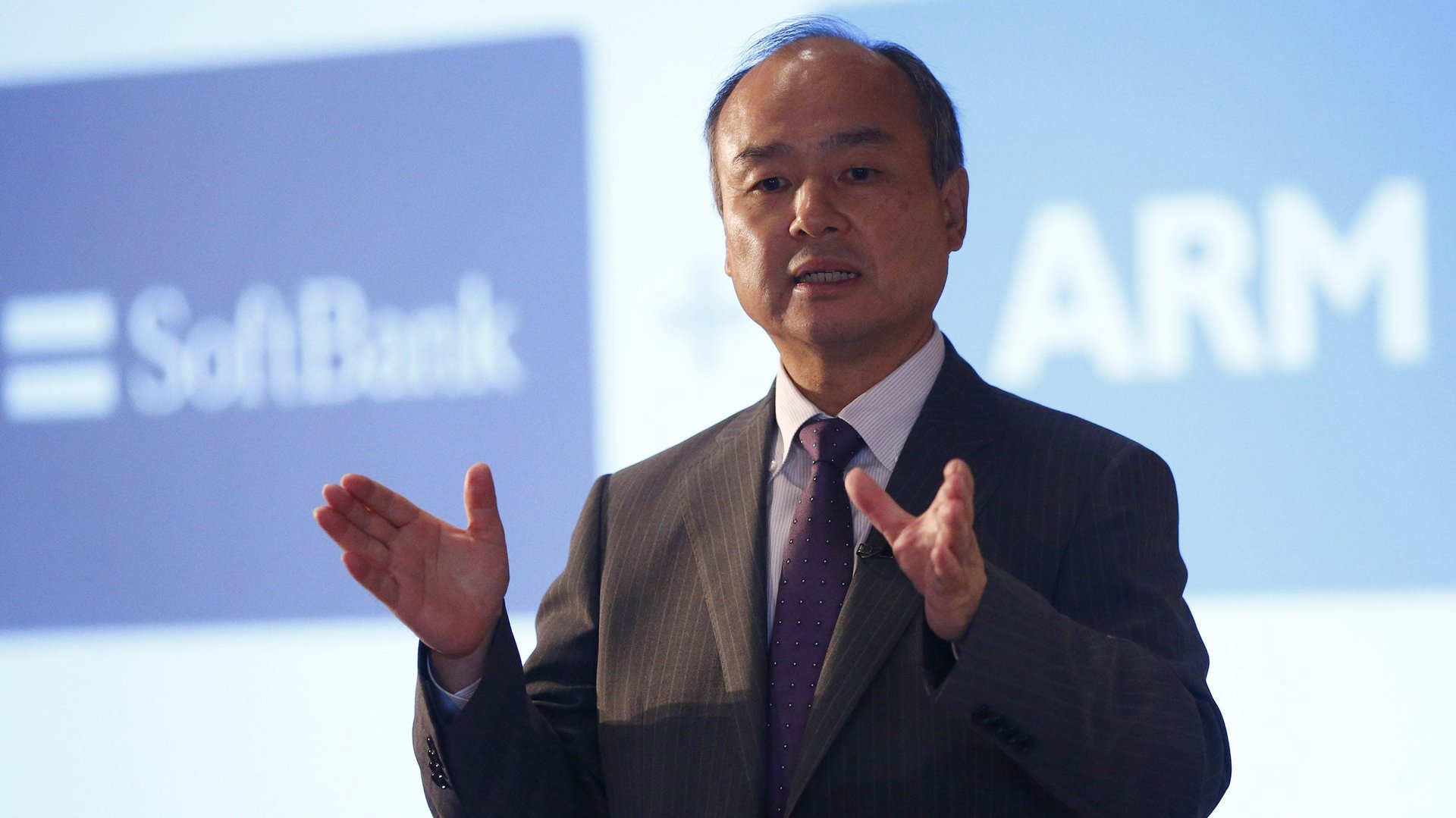

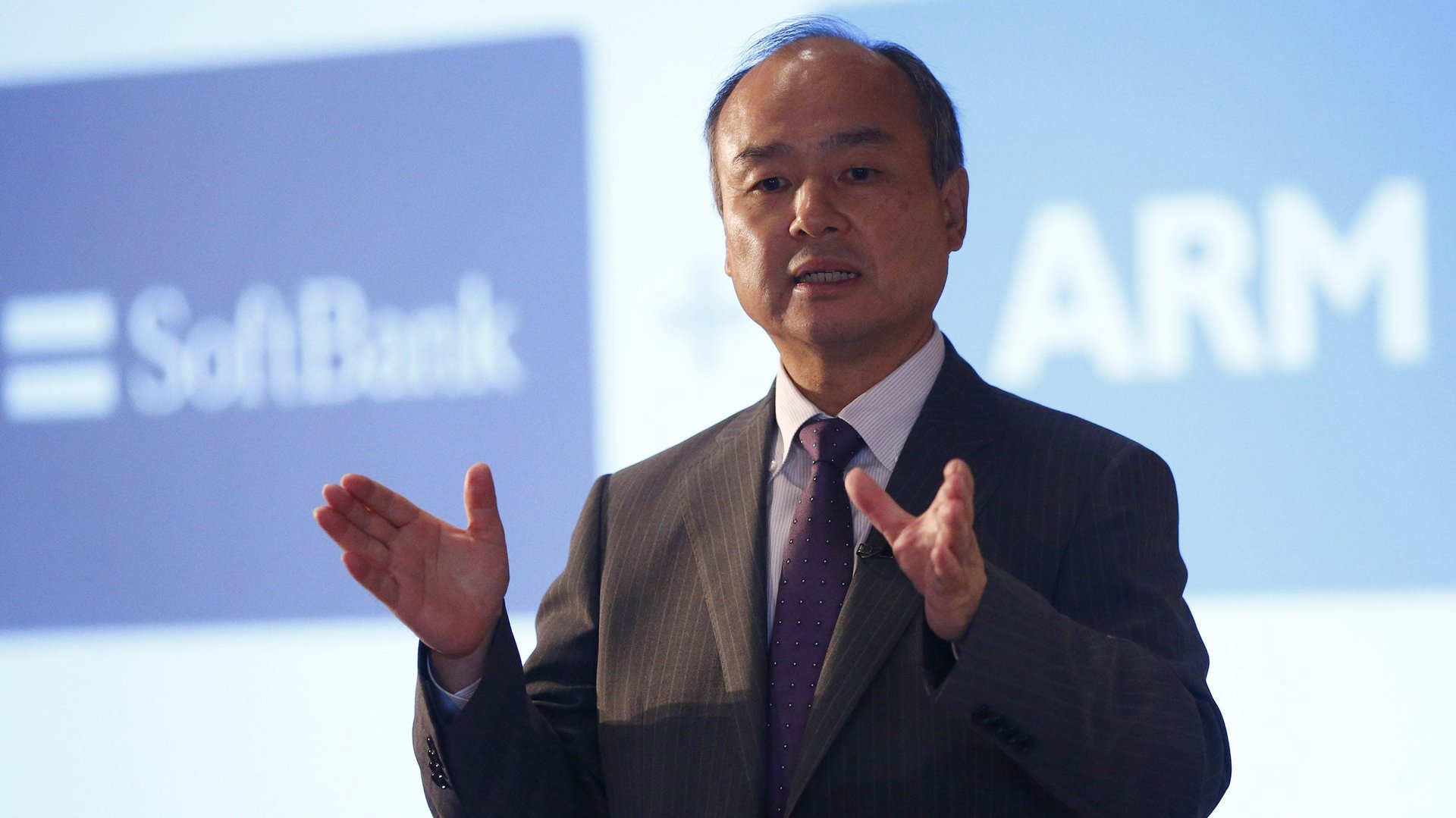

SoftBank’s Masayoshi Son has come to a similar conclusion. Having made his fortune in mobile telephony infrastructure, he’s argued that the future will feature hundreds of connected devices per capita. The ARM deal would give Softbank a central position in the world’s mobile computing ecosystem and a front-row seat to the Internet of Things, which the world’s chip-makers hope presents the next great proliferation of processors.