If you’ve got money you can afford to lose and a penchant for gambling, there’s no better time than now to plow that cash into bitcoin, the alternative currency that plunged in value over the past two days after hitting astronomical highs.

Let me be clear: I am not saying that, in the long run, bitcoin is a viable alternative currency. Many sophisticated thinkers have, at great length, established that it isn’t. And I’m not saying it’s a good investment. Bitcoin is far too volatile, and it’s not a good idea to bet on a single asset, anyway. In 2014, the price of a single bitcoin, currently trading at around $70, is as likely to be zero as $1000.

What I am saying is that there are plenty of reasons to believe that, as in many other classic economic bubbles, the world is full of “greater fools” ready to continue buying bitcoin and drive up its price again, even in the wake of the latest crash. Here’s an incomplete list of reasons why investors like the Winkelvoss twins are probably going to continue to pour money into bitcoin.

1. A large number of people are ideologically and materially invested in the success of bitcoin.

Bitcoins are generated through “mining”—a process that requires powerful computers to crack hard math problems, which sometimes reward their owners with a new cache of bitcoins. This isn’t some weird second-order outgrowth of how cryptocurrencies work—it’s a deliberate feature of bitcoin.

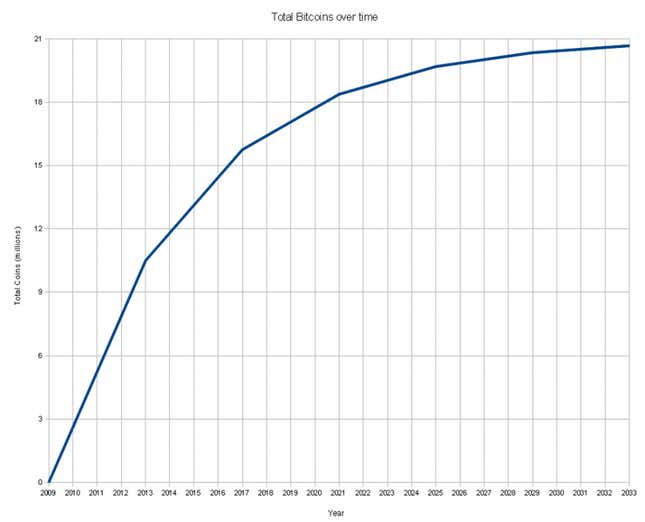

You can even graph, more or less exactly, the rate at which new bitcoins will be produced for the foreseeable future.

But mining those bitcoins doesn’t come cheap. One bitcoin miner told me that when he started less than a year ago, he and his team spent $3,000 on a high-performance PC workstation that generated 8 to 16 bitcoins a day, at a time when they were trading at $6 apiece.

But the process of mining bitcoins is getting harder. Today, he notes, a rig that generates bitcoins at that rate—like a system from Avalon that is designed solely to mine bitcoins at the fastest possible rate—will cost you 75 bitcoins, or $4,500 at today’s conversion rate. A few days ago, when bitcoin was trading at an all-time high of more than $220, a system from Avalon would have cost an eye-popping $16,500.

The folks who continue to mine bitcoin aren’t about to give up on the currency, no matter how much it looks like a speculative bubble that might never translate into a real means of exchange.

2. Bitcoin’s central bank is currently printing Bitcoin at a decent clip, propping up its viability.

Wait, you’re saying, bitcoin doesn’t have a central bank to print money: The whole point of the currency is that there can only ever be 21 million bitcoins in circulation. This is true. But it misses a more subtle point, which is that as of this writing, there are still only 11,015,725 bitcoins in circulation, or just over half of the ultimate number of bitcoins out there. This keeps the bitcoin miners active, and actively invested in the currency, because they’re all hoping to get rich. For now, bitcoin is essentially subject to a de-facto expansionary monetary policy, notes Pascal-Emmanuel Gobry in this fascinating post on the subject.

Printing money generally devalues a currency, but in this case, it’s been having the positive effect of keeping everyone excited about snatching up new bitcoins as they shake out of their mining rigs. The rate at which new bitcoins are being generated is, clearly, being swamped by speculation on their “real” value.

3. Every day, there are more ways to trade and use bitcoins, which helps maintain the idea that it’s a “real” currency whose value will only increase.

Every day, it seems, new startups devoted to bitcoin are announced. And nascent bitcoin currency exchanges like Coinsetter will allow people to trade bitcoin on margin and even short the currency. As with just about any other instrument, the more ways there are to trade bitcoin, the more liquid the market for it will become—up to a point.

As for retail, there are now electronics stores that accept only bitcoin, and ecommerce sites aimed at expats in China that skirt local banking strictures by accepting bitcoin. And that’s just two among an ever-growing list of hundreds of (mostly online) merchants that accept bitcoin.

4. The financial crisis in Europe has people spooked and looking for alternatives, and gold bugs are flocking to bitcoin.

Erik Voorhees, who makes his entire income from bitcoin, outlined in a post at Reddit a number of forces pushing investors into the currency, including “Cyprus scared the hell out of everyone,” and “An increasingly wide swath of the libertarian/gold & silver ‘hard money’ types are buying into bitcoin.”

5. The media will not shut up about bitcoin.

Yes, I know, this article is part of the problem. But the fact remains that the tech press is bonkers about bitcoin—Quartz included. Bitcoin has all the elements of a good story. What could be better than mysterious hackers trying to create a stateless alternative to the world’s occasionally frighteningly mismanaged fiat currencies, with a roller-coaster ride of a market thrown in to keep the story surfacing in the news cycle again and again.

It’s a safe bet that, outside of techies, news and finance junkies, most of the world still has not yet heard of bitcoin. To the extent that bitcoin is a Ponzi scheme, dependent on ever more fools to buy into it in order to provide early adopters with profit, this is perhaps the most important reason why the value of bitcoin could continue to appreciate. Indeed, the Winkelvoss twins are explicit that this is their bet, too.

So should I buy bitcoin?

That depends. Because of the wild gyrations in price and possible black swans like theft, bitcoin is not something anyone should hope to hold onto for any length of time or rely on as a means of exchange. But should you gamble on bitcoin? That depends on whether you’re the type to wager money for fun and occasional profit. Just remember that, if you stick around long enough, the house always wins.