Government bonds tend to do well when investors think a nation’s situation is improving, but fall in value when sentiment is negative.

So a really odd thing has happened in Japan of late. It is less than a fortnight since the central government got behind “Abenomics,” a plan kickstarted by new prime minister Shinzo Abe to boost the country’s long-ailing economy by printing loads of new money to reverse decades of stagnation and price declines and introduce some much-needed inflation.

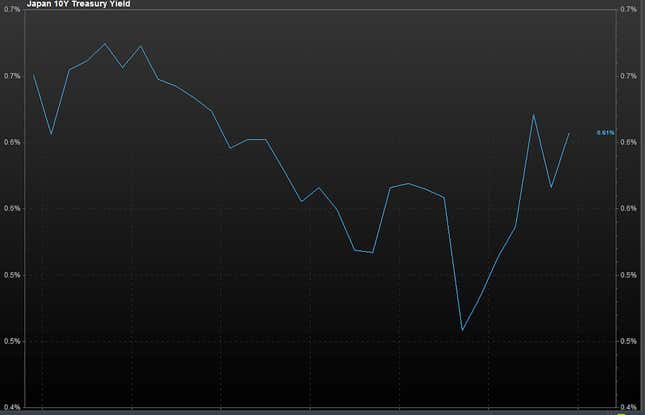

Since then, and despite the fact Japanese stock market investors whooped at the news, Japanese government bonds have fallen in value. Or, to put it in wonkish investor-speak, Japanese government bond “yields” have risen (the “yield” is the interest payment on a bond relative to its price. As a price falls, yield goes up, and vice versa).

Because bond buyers are effectively lenders, they think of bonds in terms of yields in just the way a banker thinks of interest rates. A rising yield can mean bond buyers believe the borrower—in this case the Japanese government—is becoming less creditworthy. So they set a lower price for the debt.

Since March 1, Japanese government bonds first fell (good), seemingly in step with rising optimism, then rose again (bad).

Quartz has suggested that the euphoria about Abenomics may be misplaced. But that is probably not why Japanese bonds are looking gloomy.

Instead, it could be that bond investors expect the money printing strategy to work, and to stoke growth by encouraging inflation. A return to rising prices would lift Japan out of its two-decade economic death spiral, where prices have fallen continually and consumers then delay purchases believing prices will get lower in future. It would also raise the prospect of the Japanese government hiking interest rates to stave off asset bubbles. And bond investors demand higher yields when they think interest rates will go up.

As London consultancy Capital Economics commented in a note April 12: “There are several ways in which central bank purchases of government bonds can put upward pressure on their yields. One is by raising expectations for economic growth, inflation and/or the average level of interest rates over the life of the bond.”

Bond investors could be cooling on Japanese debt for another reason: they expect Abenomics to work so well that domestic savers and banks will stop buying bonds, which are viewed as safe haven assets in slow growth or moribund economies, as Japan has been.

Instead, the Japanese could excitedly plough their cash into equities and real estate. Quartz has already noted that Japanese real estate stocks are having a good ride on the back of Abenomics-inspired euphoria.

A clue as to what may happen next comes from recent US market history.

Abenomics is remarkably similar to the US Federal Reserve’s money-printing economic rescue scheme. Interestingly, yields on US government bonds, known as Treasurys, also rose in the 12 months following the start of Fed chairman Ben Bernanke’s quantitative easing (QE) project, which began on November 25 2008.

And at the same time that US Treasury yields rose following the introduction of QE (this made the government look bad) American stocks recovered (which made the government look good). This chart shows just how well the S&P 500 did in the 12 months following November 25 2008:

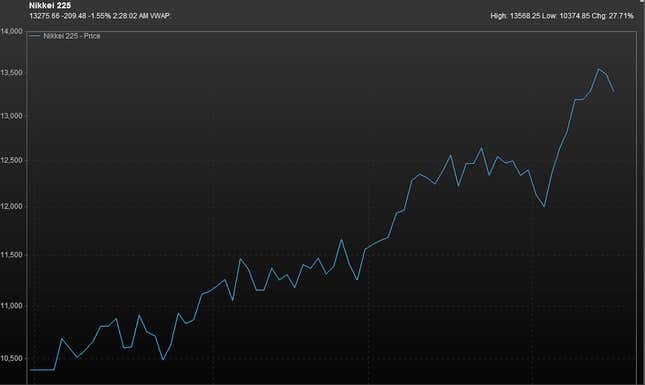

That is similar to what is happening in Japan, where the stock market is on a blistering growth tear.

And because Abenomics is so similar to Bernankenomics, Japanese markets may follow this trend for a while yet.