There’s glee breaking out everywhere in the Keynesian web. Why?

Serious questions are being raised about an economics paper that proved insanely influential in the aftermath of the financial crisis. Co-authored by Harvard University’s Kenneth Rogoff and the University of Maryland’s Carmen Reinhart, the paper, “Growth in a Time of Debt” (pdf), is based on the same data that served as the basis for the pair’s highly successful and influential book This Time is Different: Eight Centuries of Financial Folly, published in 2009.

The paper’s central finding is that high levels of government debt—around 90% of GDP—result in slower economic growth. And like the book, the paper provided intellectual heft for those who argued that governments should prioritize cutting deficits after the financial crisis. As a data-driven analysis from well-respected academics, the paper had instant credibility.

But for anyone who has even the vaguest grasp of US economic history, it never really made sense.

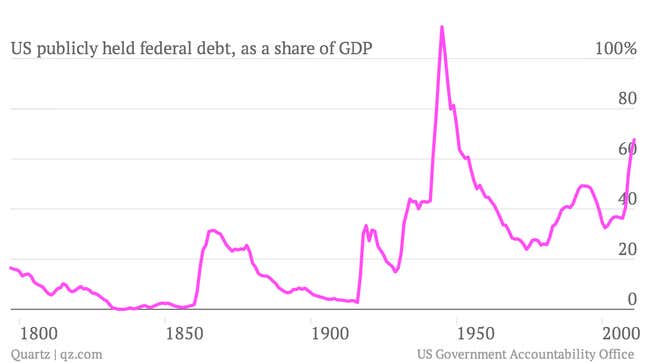

Here’s why. After World War II the US government was laboring under the heaviest debt it had ever hoisted.

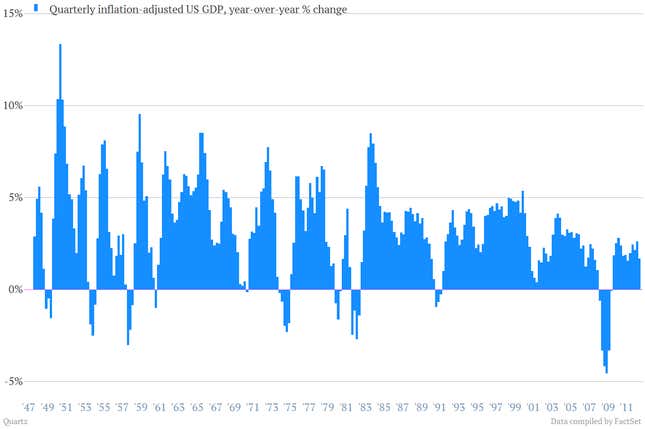

And yet the post-war years are remembered as an economic miracle, not a disaster. Looking at the easily available data for inflation adjusted economic growth, which start in March 1948, you can see that quarterly growth averaged 3.78% between March of 1948 and March of 1958. From 1958 to 1968 it averaged 4.3%. And from 1968 the end of the first quarter in 1978 it was a respectable 3.2%. Sure, the there were recessions. Even some nasty ones. But you can see from the chart, US growth after World War II, adjusted for inflation, was some of the fastest on record.

Now in the paper, Reinhart and Rogoff did make a passing acknowledgement that growth after wars could be an exception to their 90% threshold rule.

In principle, the manner in which debt builds up can be important. For example, war debts are arguably less problematic for future growth and inflation than large debts that are accumulated in peacetime. Postwar growth tends to be high as wartime allocation of manpower and resources funnels to the civilian economy. Moreover, high wartime government spending, typically the cause of the debt buildup, comes to a natural close as peace returns. In contrast, a peacetime debt explosion often reflects unstable political economy dynamics that can persist for very long periods.

That may be true. But it’s not backed up by any conclusive research. It’s an argument for why it might make sense for large wartime debt to be an exception to the large debt rule. And one of today’s new critiques of Reinhart and Rogoff’s analysis is that it inexplicably excluded episodes of high debt and solid growth in the post-war period from New Zealand, Canada and Australia, which might have undermined some of their findings. (They have posted an initial response and say the new analysis of their work “seems entirely consistent with our original interpretation of the data.”)

But as a broad aside, for most of recorded history, the entire reason why sovereign entities took on debt was to pay for wars. And for the US, World War II is the moment when the US actually crossed the 90% threshold that Reinhart and Rogoff warn against. So it’s a little strange to simply treat the post-war period as a special case.

Now, for the record, This Time is Different remains a must-read for anybody interested in public debt. And, so far, I haven’t heard any questions about Reinhart and Rogoff’s other key point from their research—that economic growth tends to be a lot slower in the aftermath of financial crises.