Online reviews company Yelp reported a net loss yesterday and has yet to report a profit since it went public in 2012. Yet its shares were up by a whopping 27% today, hitting a record high of $32.38. They even rose slightly higher in-after hours trading.

Investors didn’t mind Yelp’s loss because the company had better-than-expected revenue for the first quarter and raised its earnings forecast. As internet companies struggle to figure out their mobile strategy, Yelp shows that it’s on the right track.

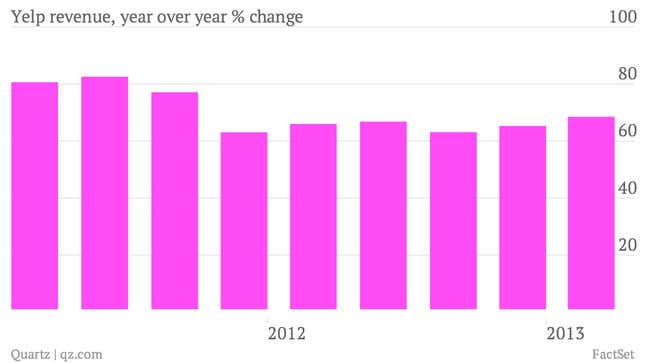

Yelp’s revenue rose by 68%, to $46.1 million, in the first quarter. Its active local business accounts rose by 63%, to about 45,000. Yelp was helped by its partnership with Apple and expanded search ads on its mobile app, where about 45% of Yelp searches start. The app was used on about 10 million mobile devices a month. Display ads were also launched on mobile in the first quarter.

The company said that, for 2013, it expects revenue of at least $216 million, which represents an almost 60% increase from the previous year. Yelp does have to control its costs at some point, including compensation. It also spent more money on marketing to gain advertisers and business accounts. But it did narrow its loss, despite facing more competition from Facebook, which also reported earnings yesterday. (Facebook revenues rose by 38%, but its expenses also climbed.)

As long as Yelp shows its strategy is working, investors seem willing to shrug off a profit loss for some time. Yelp has been one of the best performing IPO stocks debuting out of Silicon Valley in the last few years. While other consumer interfacing companies like Facebook, Groupon, and Zynga have fallen since their debut, Yelp had its biggest gain today since it went public in March 2012.