At a bar several hours outside of downtown Buenos Aires, a group of 16 strangers gathered around a table to learn about a new way to circumvent Argentina’s inflation. Only this time it wasn’t another clandestine way to accumulate illegal US dollars; the group had traveled to the outskirts of Argentina’s capital to hear about Bitcoin.

That was over six months ago.

Today, the meetups have ballooned to include as many as 100 locals interested in learning the basics of Bitcoin, and the latest developments in its evolution. But unlike Bitcoin enthusiasts elsewhere, who buy and sell bitcoins as a means of exchange, Argentines are hoping bitcoins will help them save, Wences Casares, a Buenos Aires-born entrepreneur who founded lemon.com and organized the original meeting that took place last fall, explained. “In Argentina, people use Bitcoin to save. They never trusted their currency and they saved in dollars, but some don’t even trust dollars anymore,” he said.

And it’s not like Wences’s Bitcoin discussion groups are the only ones being held in Buenos Aires; similar meet-ups are happening all the time, all over the capital. Trading activity has more than doubled since Februrary, and Tradehill, inc., a San Francisco-based bitcoin exchange, is planning to open its first Latin American office in Argentina because of the country’s increasing demand.

Scared, and scarred

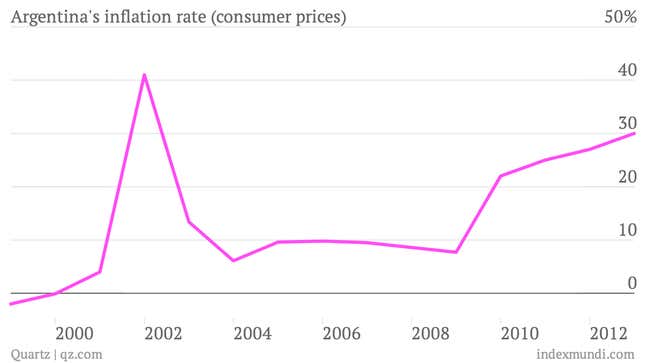

Argentina is dangerously nearing another economic collapse, and few have forgotten the country’s crippling default in 2001 that prompted a flash devaluation of the Argentine peso, which effectively halved the country’s wealth. If Argentina defaults on its debt again, which could happen very soon, no one wants to be caught off-guard. So, Argentines are scrambling to store their wealth in anything but the volatile Argentine peso.

That’s where Bitcoin comes in.

Anything but Argentine pesos

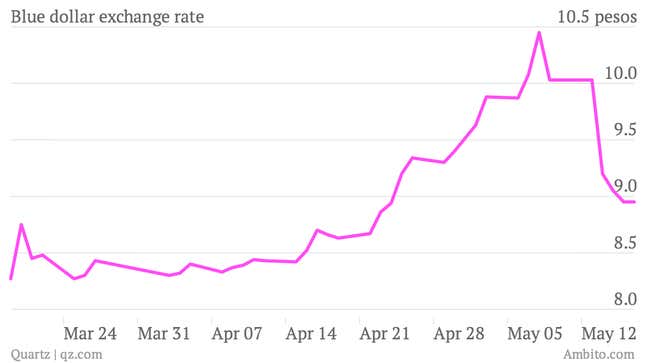

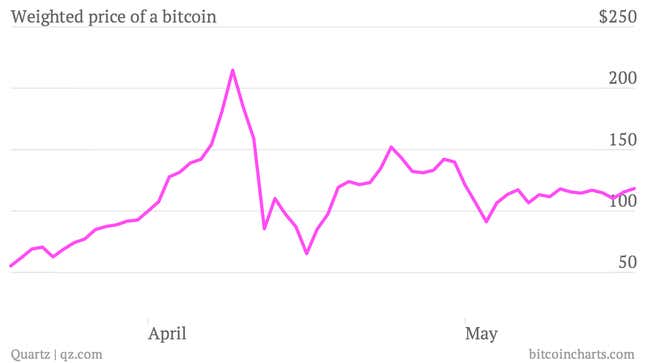

Bitcoins aren’t exactly vehicles of stability—their value has fluctuated a good deal over the past few months, and at one point dropping from $234 to $79 in a matter of days—but given the economic volatility in Argentina of late, they’re increasingly seen as a viable alternative to the Argentine peso. The black market, or “blue,” rate for US dollars in Argentina has risen sharply over the past month, reflecting the rising demand for US dollars. But the Argentine government has made it virtually impossible to acquire US dollars legally. In their desperation, locals are seeking financial refuge in many other—and often far less intuitive—investments, like luxury cars and high-end properties.

Buying Bitcoins offers Argentines a direct, if unconventional, entry to the greater (and more stable) world market. “Storing money in the cloud is giving Argentines the same freedoms as people living in other, freer economies,” Tuur Demeester, a Bitcoin expert who helps people invest in Bitcoin and spends a lot of time in Argentina, told Quartz.

El Bitcoin boom

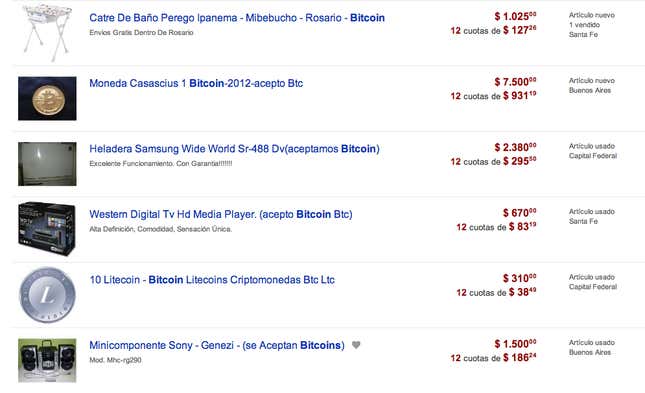

A quick search on mercadolibre.com in Argentina, the equivalent of Ebay, affords a pretty good sense of how widespread the appeal of Bitcoin is becoming in the country. Locals are selling everything from tables to freezers, media players and boom boxes with hopes of receiving Bitcoins in return.

One listing even advertises a swath of beachfront land, with a note emphasizing that they also “accept Bitcoins.”

While another advertises the sale of a one bedroom apartment, with a note that “payment is accepted with Bitcoins at [Mt. Gox’s] daily rate,” and clarification for those still unaware: “Bitcoin is a virtual coin.”

There’s even a short film that promotes the use of Bitcoin in Argentina, which both Forbes and Coindesk have written about.

The fact is, everyone from Argentina’s entrepreneurs to its taxi drivers is receptive to the cloud-based coins, Demeester explained.

It really strikes me how rapidly people in Argentina have become interested in Bitcoin. And I mean everyone—even taxi drivers ask me about where they can find it and how they can buy it. This level of interest you really don’t find anywhere else. The need for it in Argentina is really, really big. You just can’t store purchasing power in the local currency.

While Bitcoin is helping Argentines circumvent their country’s broken financial system, it isn’t liberating them from risk entirely.

Bitcoin is pretty risky

Anyone who exchanged their Argentine pesos for Bitcoins at its peak value back in April saw their investment almost quartered in a matter of days. Even today, those same cloud-based assets would be worth about 50% of what they were. Although the price of a Bitcoin has held steadily at just over $100 since the beginning of the month, it’s impossible to predict with any sort of accuracy what will happen to the to their value next month, let alone tomorrow.

Even so, at its worst, right now Bitcoin is the lesser of two evils.

Where there is risk, there could also be reward

Former IMF director Claudio Loser is skeptical of Bitcoin, but said he understands its appeal in Argentina. “Some Argentines are willing to take very risky investments and bet on this thing which feels almost like a ponzi scheme because they feel their options locally are even more dangerous,” Loser told Bloomberg last month.

It’s mere speculation to call Bitcoin a ponzi scheme, but as Loser points out, Argentines would rather bleed at the hands of any animal other than their own government.

If Bitcoin plummets, it will bring the growing pool of progressive investors in Argentina down with it. Mt. Gox, the world’s largest Bitcoin exchange, is already being pressured to close, and there’s always the chance that Kirchner will ban Bitcoin entirely.

But Argentines have little to lose; even the riskiest investment is better than relying on their monetary system these days.