Leading up to Apple CEO Tim Cook’s testimony on his company’s dubious-if-legal tax strategies tomorrow, here’s the report (pdf) members of Congress are up in arms about.

1. Almost all of Apple’s foreign operations are run through an Irish company with no employees.

The company told investigators that it lost all records concerning why Apple Operations International was originally set up in 1980, and why all of Apple global sales go through it. You might have a few ideas why if you keep reading.

2. Apple pays 2%—or less—in corporate income tax in Ireland.

The already low-tax country gives Apple special treatment with a negotiated 2% income tax rate. But that’s just the top-line number: Between 2009 and 2011, one Irish subsidiary, Apple Sales International, earned $38 billion and paid $21 million in taxes, for an effective rate of .06%.

3. Apple Operations International, which provided 30% of Apple’s worldwide net profits from 2009 to 2011, doesn’t pay taxes anywhere.

This move is devilishly brilliant: The US decides if it can tax you based on where you incorporate your company. Ireland decides if it can tax you based on the location of the people managing the company. So if you incorporate a subsidiary in Ireland, and manage it from the US, you don’t (so far) have to pay taxes in either country. And that’s exactly what Apple has done, not filing a tax return for AOI anywhere in the world in the last five years.

4. Apple’s US profits keep ending up in Ireland, too.

The report alleges more than just the avoidance of US taxes on foreign sales of Apple’s products. It also argues that Apple is effectively sending US profits to its Irish subsidiaries, too. How? Transfer pricing. Apple has set up a cost-sharing agreement with its Irish subsidiaries that gives them a disproportionate share of the profit from research and development that occurs in the United States. From 2009 to 2012, Apple allocated $4 billion in R&D costs to its US unit, which had $38.7 billion in profits, while its Irish subsidiary had $4.9 billion in R&D costs—and $74 billion in profits.

5. Most of the $102 billion Apple is keeping “overseas” is in US banks.

Just as its Irish companies are managed by US employees, Apple’s Irish cash is mostly kept in US financial institutions, largely managed by Braeburn Capital, Apple’s financial engineering nexus in Nevada.

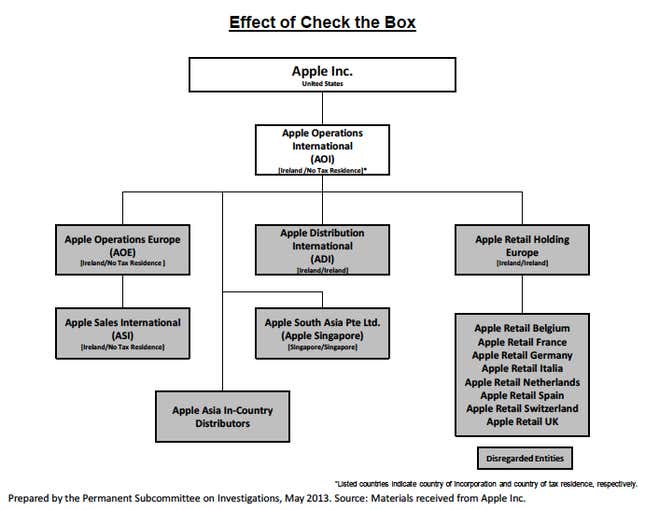

6. The magic of “check-the-box” makes whole companies disappear

One of the most favored tax loop-holes for multinationals is known as “check-the-box.” It allows companies to instruct the government to completely disregard certain foreign subsidiaries for tax purposes. Apple’s main Irish subsidiary, AOI, checks the box for its entire global distribution network. This allowed the company to avoid paying $12.5 billion in taxes that would have been assessed for foreign sales by its network of global distributors.

7. Apple is seemingly terrible at estimating its own taxes

In annual reports between 2009 and 2011, the company told investors it was setting aside $13.7 billion to pay federal taxes—but it has actually paid only $5.3 billion. Those set-asides are only advance estimates, but it’s pretty strange that each year they’re off by many billions of dollars. As a result, Apple’s actual US tax rate is only 20.1%, much lower than the 24% to 32% it said it was paying. Absent this congressional investigation, we wouldn’t know the difference.