If Trump gets his 20% tax on Mexican imports, these are the US household staples that will be hardest hit

The American taxpayer was never supposed to pay for US president Donald Trump’s proposed wall along the country’s southern border. He always told voters Mexico would pay for it—despite a flat out refusal by the Mexican government.

The American taxpayer was never supposed to pay for US president Donald Trump’s proposed wall along the country’s southern border. He always told voters Mexico would pay for it—despite a flat out refusal by the Mexican government.

The Trump administration has today suggested it would force Mexico to pay for the wall by implementing a 20% tax on all Mexican imports. Such a move by the White House—which isn’t allowed—would hit Americans hard in their grocery carts.

Mexico, after all, is the most important trade partner with the US for fruits and vegetables, and the second-largest US trading partner overall (after Canada) for food products. In 2015, food imports from Mexico totaled $21 billion, making it a considerable force in the US grocery market.

To be sure, the Trump administration can’t unilaterally slap a tariff on Mexico, and its pronouncement Thursday was interpreted by some as grandstanding. Only Congress can make such a change to an existing trade deal, in this case, the North American Free Trade Agreement, or NAFTA.

There is a proposal in the works among congressional Republicans that would, among other things, implement a 20% tax on goods imported from Mexico by companies. That’s called a border adjustment tax, an idea Trump dismissed a week before his inauguration in an interview with the Wall Street Journal (paywall).

Still, that the US president would float the idea of a 20% tariff on Mexico raises questions about the future relationship between the US and its southern neighbor. For starters, it would have wide-ranging implications about access to certain US foods, including staple fruits, vegetables, and alcohol.

It would be difficult for Republicans to engineer a situation in which food companies would not pass the extra cost of doing business to consumers. There isn’t an easy replacement source for these foods, as in many cases Mexico is by far America’s biggest supplier. Over time, the US has grown more dependent on Mexican imports of fresh produce, which rose by 264% between 1999 and 2014.

For instance, US consumers can get tomatoes to eat even in winter now because Mexico grows them and ships them across the border. America imports about 20% of its tomatoes, about 95% of which (pdf) come from its southern neighbor. While Florida supplies the east with tomatoes, most of those Mexican tomatoes go to western states.

The Mexican connection supplies other fruit, as well. In 2016, the US imported 154 million pounds of watermelon, 54% of which came from Mexico, according to the USDA Economic Research Service. What country would supply such produce if the US raised tariffs on Mexico?

Then there’s tequila that teetotaler Trump should consider. Between 2010 and 2014, the US imported on average 26 million gallons of tequila each year, more than half of which came from Mexico. As Republican South Carolina senator Lindsay Graham pointed out on Twitter, a tariff would drive up the prices of that liquor, as well some popular Mexican beer brands, such as Corona.

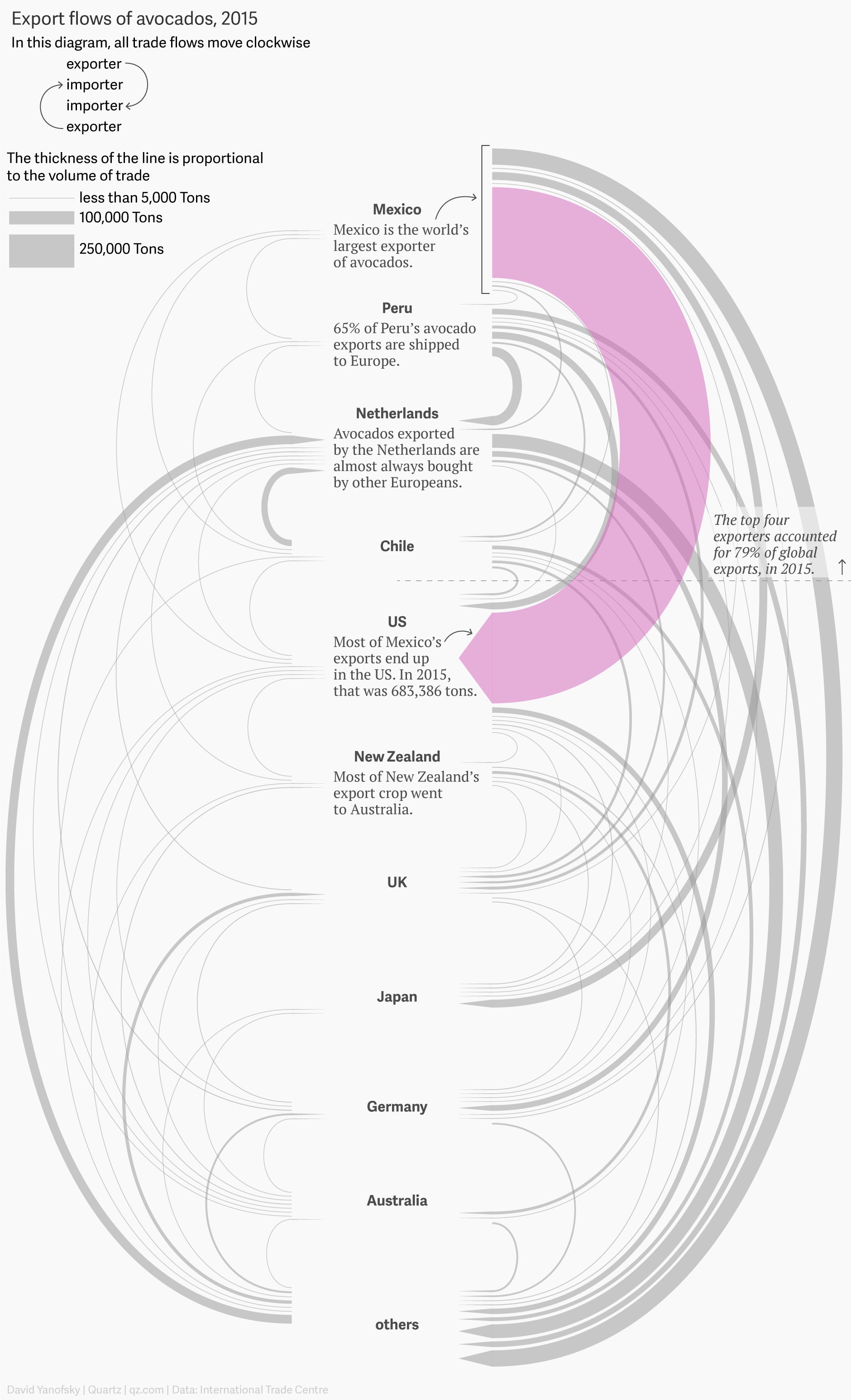

And hipster America would feel a real wake-up call with the price of regular avocados, that staple of Instagram fame as it’s applied to toast for weekend brunching. The US saw the cost of the popular fruit rise in 2016, sparking alarm among small businesses that buy them up for hungry consumers. Mexico exported 750,000 metric tons of avocados in 2015; 79% of those were shipped to the United States, according to the USDA Foreign Agricultural Service (pdf).

Indeed, the American supermarket is the picture of globalization, a single spot in nearly every American neighborhood that brings myriad products from around the world under one roof at affordable prices.

Disrupt that enough and the US might see demonstrations that dwarf the millions who came out for the Women’s March.