When Chinese president Xi Jinping rolls up to Mar-a-Lago today for his powerful-guy pow-wow with US president Donald Trump, it’s bound to be a little awkward. Trump has blamed “cheating” China for the decline of US manufacturing. He has undermined previous US policy by recognizing Taiwan’s president as an equal (China claims the island nation remains one of its provinces). And he continues to tweet ominously about the summit.

Trade is an obvious point of contention and an important item on the leaders’ agenda—something Trump made clear in tweets shortly after the summit was announced.

Despite a good bit of bluster on both sides, the diplomatic face-off in Florida provides a much-needed chance to (re)calibrate the power dynamic between the world’s two biggest economies. And it has important domestic implications for both countries as well. After his promised health care plan imploded, Trump could really use a deal with China on trade or security to burnish his much-vaunted negotiating skills. This should be doable given that presidents typically have more power over foreign policy than they do over other issues. Meanwhile, Xi’s core task is looking good in advance of the twice-a-decade party conclave in October, a critical chance for him to consolidate power. Coming across as an equal to Trump will help.

Unfortunately, finding common ground in this complicated relationship might prove tough. For one thing, Trump has adopted an aggressive line on Chinese exports. A central theme of his campaign, Trump’s China-bashing on trade has continued since he took office. His main beef is that China consistently exports to the US vastly more than it buys in return.

Trump has said he wants to impose tariffs on Chinese exports to the US, arguing that China’s currency manipulation and unfair business practices cheapen its exports, putting US companies out of business. In a recent meeting, Stephen K. Bannon and Jared Kushner, two of Trump’s top advisers, complained to Trump that “China was deliberately depressing its currency, which undercuts American goods,” reports the New York Times (paywall).

If Trump goes after Xi on currency manipulation, he risks coming away looking foolish—and squandering precious diplomatic capital. It’s true that China unfairly helps its companies, including by banning foreign companies from investing and competing in many sectors. And for a long time, allegations that China was cheating through currency manipulation were also true. And then there’s the fact that China’s currency has lost a lot of value against the dollar since 2014.

But the loss of value is more complicated than simple “cheating.” As Chinese growth has slowed, money has gushed out of China, driving the yuan’s value down. Since then, contrary to what Trump claims, the government has been selling down its reserves of foreign currencies in order to prop up the yuan. In other words, it’s been making the yuan, and consequently China’s exports, more expensive than they should be.

Compared with the currencies of its major trading partners, the yuan is still quite a bit overvalued.

“We should welcome the helpful role that China has played keeping its trade-weighted exchange rate stable for the past year,” says David Dollar, an expert on China’s financial system, in a blog post. “Naming it a currency manipulator would be inaccurate and unhelpful.”

So will Trump rag on Xi for cheapening the currency even though the facts don’t really support him? It’s possible. The president told the Financial Times that ”when you talk about currency manipulation, when you talk about devaluations, [China’s leaders] are world champions.” Then again, he also said,”I don’t want to talk about tariffs yet, perhaps the next time we meet.”

Trump seems to be approaching trade as more of a means than an end. This brings us to one of the summit’s top priorities, North Korea, which has been testing missiles dangerously close to US allies Korea and Japan, and is still developing a nuclear weapons program despite calls from the UN to cease and desist. Experts estimate the country already has between 10 and 40 nuclear warheads. On top of that, Kim Jong Un also claims to have a hydrogen bomb in the works.

Trump wants Xi to impose sweeping sanctions on North Korea. China wields tremendous power over the rogue nation, both political—technically, the two countries share the same ideology—and economic. In fact, nearly all of the goods North Korea legally buys from the outside world come from China—as the White House noted in a pre-summit press briefing. In other words, Chinese trade sanctions would devastate North Korea.

And yet, despite all of its clout, China hasn’t done much to force North Korea to the table. And why should it? Sanctions could cause the Kim regime’s demise. That “would create a far worse situation—the near-certain reunification of the two Koreas and the consequent loss of China’s security buffer against the US,” notes Minxin Pei, an expert on Chinese politics at Claremont McKenna College. In addition, a collapsing North Korea risks sending massive inflows of North Korean refugees into China.

How might Trump make China play ball? ”I think trade is the incentive,” he told the FT when asked about what might persuade China to help the US on the North Korea issue. “It is all about trade.”

And here he has a point.

Conversely, China is a much smaller source of demand for US goods.

Along these lines, another plank of leverage over China is US foreign investment, which China needs to help meet Xi’s stated goal of becoming more innovative. So it’s plausible that Trump holds enough economic power to compel China to sanction North Korea. Another important lever is Trump’s threat to go it alone, echoing US secretary of state Rex Tillerson last month, who said that ”all options are open” on North Korea.

Then there’s North Korea itself; if it launches another missile during the summit, as it did earlier today, Xi would “have a hard time not responding,” says China expert Bill Bishop.

What, then, would constitute a victory for Xi in Florida? To slightly tweak a Woody Allen quip, a lot of his success comes simply from showing up. By setting up the meeting in Mar-a-Lago instead of the White House, the administration has already “ceded a powerful source of leverage over their Chinese counterparts,” says Ely Ratner, former national security adviser to the US vice president. And in the absence of a clear China strategy, the meeting validates the “two world powers” dynamic that China aspires to.

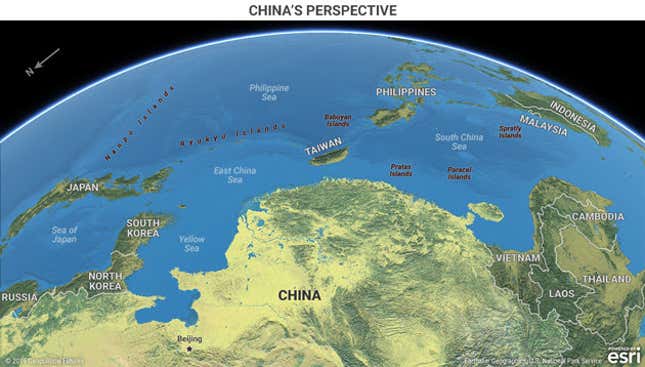

China’s ultimate goal is to edge the US out of Asia and stop it from trying to contain China through alliances with the other smaller Asian nations that geographically box it in. This map gives a pretty good sense of why China is so anxious to expand its influence and territorial control.

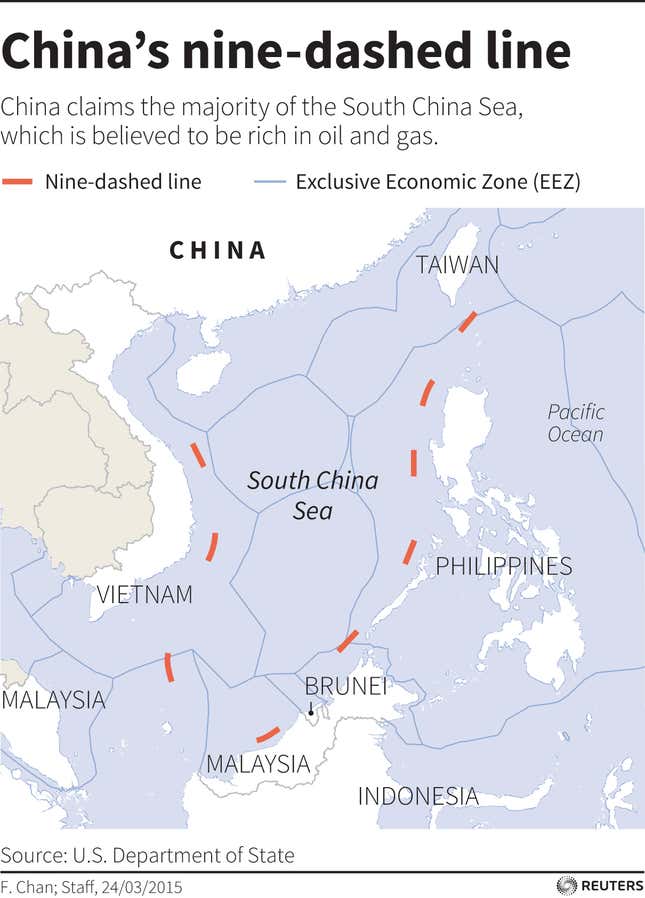

Despite the ”Asian pivot” that was supposed to deepen engagement in the region during former president Barack Obama’s tenure, China has been establishing military outposts on small atolls of rocks and sand throughout the South China Sea, allowing it to extend its range of military and commercial control.

China’s territorial claims and island-building bonanza in the South China Seas is a direct threat to the interests of southeast Asian countries, which rely on the US “to back them up when they stand up to China,” says Michael Fuchs, a former deputy assistant secretary of State for East Asian and Pacific affairs.

“After the meeting, it’s likely that China will do what it often does: quietly send its diplomats around the region to spread the message that the US is cutting deals with China at the expense of America’s regional partners,” writes Fuchs in a blog post. Trump’s erratic behavior in the region makes this easier to swallow. If the summit ends with Trump seeming to prioritize his relationship with China above other Asian nations, the US’s regional alliances will weaken. That boosts China’s regional clout—another clear win for Xi.

So what does a Trump win look like? We can expect that, following in Japanese prime minister Shinzo Abe’s footsteps, Xi will announce Chinese plans to invest in the US—a big number that’s conveniently tweetable. But this concession is more a PR move than an actual boost for the US. Investment in some sectors—particularly real estate, a Chinese favorite—actually drives up asset prices instead of building productive capacity. And it won’t necessarily shrink the trade deficit. (For one, Chinese investment in the US drives up the value of the dollar against the yuan.)

China may even dangle investments focused on Wisconsin, Michigan, and Ohio—states key to Trump’s surprise victory in the 2016 election—according to Elizabeth Economy, a senior fellow at the Council on Foreign Relations. Clearly, Xi and his team know what makes Trump tick. But if Trump sells himself too cheaply, he may be unable to extract meaningful policy concessions from China on North Korea and trade policy.

This summit, a meeting of the two most powerful men in the world, is Trump’s first major foreign policy challenge. What will be worth watching is whether Trump settles for short-term concessions that make for good sound bites—or tries to play the long game by prioritizing keeping China contained and Asia stable.

____________________________________________________________________________