In This Story

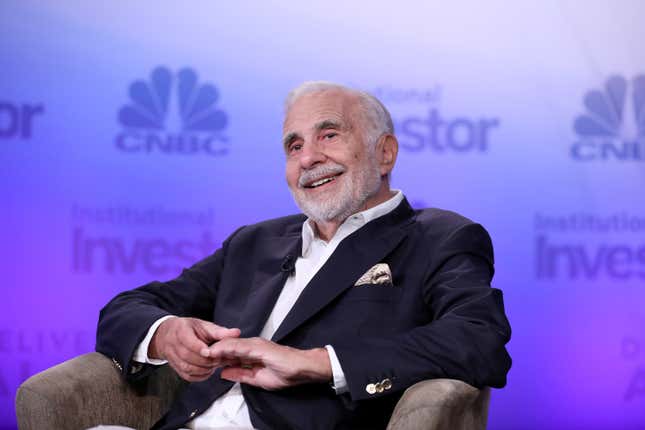

The Securities and Exchange Commission has charged Carl Icahn and his company, Icahn Enterprises, for allegedly failing to disclose stock pledges used as collateral to secure personal loans worth as much as $1.8 billion.

Icahn and his company agreed to pay a total of $2 million in civil penalties to settle the charges, as well as to a cease and desist from future violations, without admitting or denying any of the regulator’s findings, the SEC said Monday. Icahn Enterprises stock fell more than 5% Monday morning.

According to the SEC order, the 88-year-old activist investor allegedly pledged approximately 51% to 82% of Icahn Enterprises outstanding securities as collateral to obtain personal margin loans totaling billions of dollars from various lenders, without publicly disclosing the moves. Stock pledges are when investors use their shares in a publicly traded company to secure a loan.

“The federal securities laws imposed independent disclosure obligations on both Icahn and [Icahn Enterprises],” Osman Nawaz, chief of the SEC Enforcement Division’s Complex Financial Instruments Unit, said in a statement. “These disclosures would have revealed that Icahn pledged over half of IEP’s outstanding shares at any given time. Due to both disclosure failures, existing and prospective investors were deprived of required information.”

Between Dec. 31, 2018 and July 10, 2023, Ichan allegedly did not file amendments to Schedule 13D, a required filing for significant shareholders of public companies that reflects what they are doing or planning to do with the company’s stock. Icahn is the founder, controlling shareholder, and chairman of Icahn Enterprises.

The outstanding principal amounts of the individual loans ranged from $150 million to $1.8 billion, the SEC alleged.

Sunny Isles Beach, Florida-based Icahn Enterprises also allegedly failed to disclose Icahn’s pledges of its securities as required in its annual reports for at least two fiscal years. That was until Feb. 25, 2022, when the firm first disclosed in a footnote for the 2021 fiscal year that Icahn had pledged 167 million Icahn Enterprises depositary units, or 57% of all its outstanding depositary units at the time, as collateral to secure personal margin loans.

As of the end of 2023, Icahn Enterprises had approximately $20.9 billion of assets and approximately 429,033,241 depositary units outstanding, according to the SEC’s order against the firm.