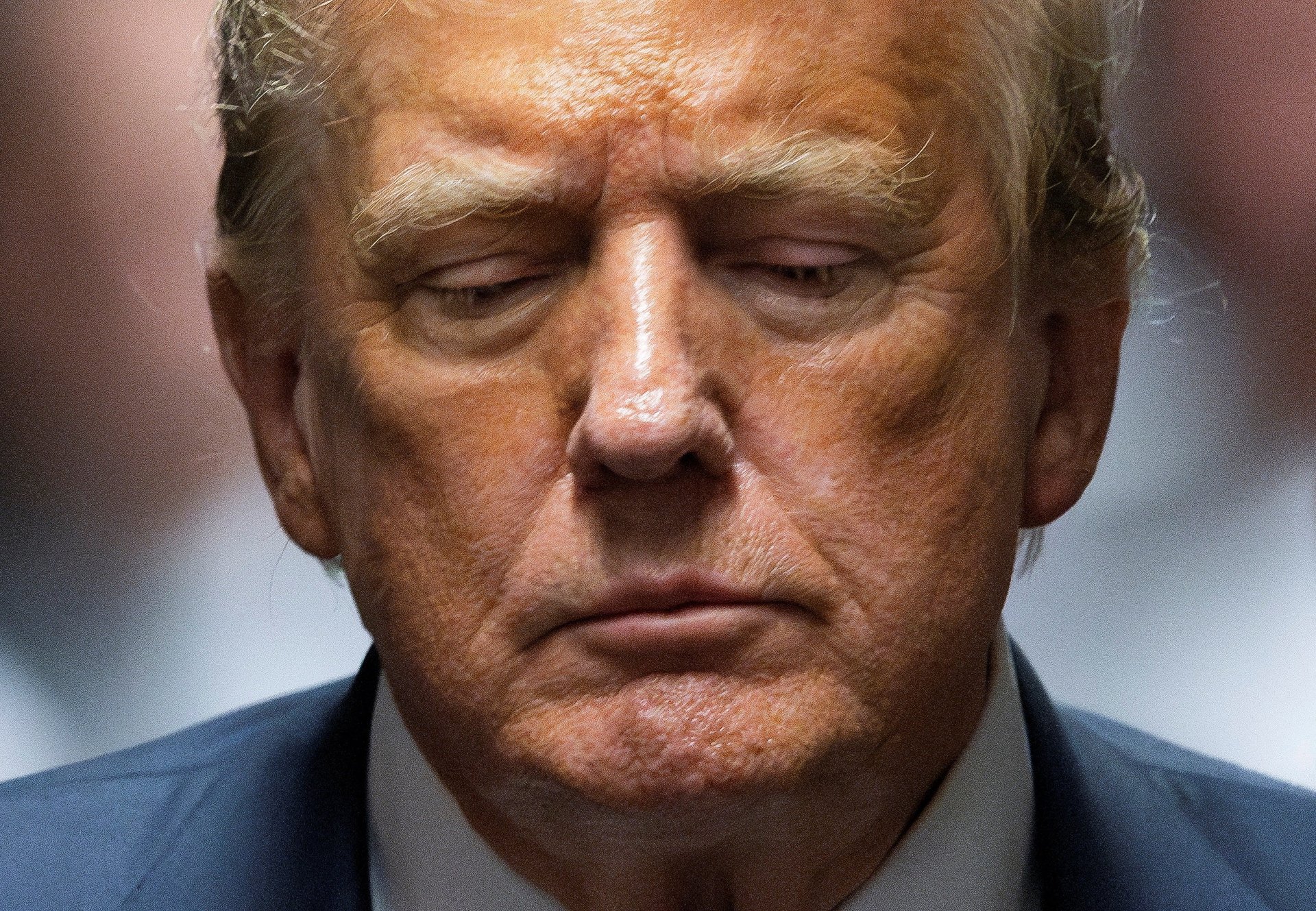

Trump Media stock is swinging back and forth after Donald Trump was convicted

The stock fell sharply Thursday after the former president was convicted, popped right back up Friday morning, and then fell again

Former President Donald Trump was convicted on 34 felony counts on Thursday night. Stock of the media company bearing his name has fallen, and surged, and fallen again since then.

Suggested Reading

Shares of Trump Media & Technology Group, which owns the right-wing social media platform Truth Social, fell by as much as 15% in after-hours trading Thursday after a New York jury convicted Trump on all counts of falsifying business records related to a hush money payment to porn star Stormy Daniels during the 2016 presidential election.

Related Content

In pre-market trading on Friday, however, the stock rose as much as 6% and opened the trading day up 3%. But it wasn’t long before Trump Media shares fell again, sinking as much as 6% on Friday morning. Trump Media stock closed up 1.41% on Thursday — prior to the conviction — at $51.84 per share, giving the company a market capitalization of $9.16 billion.

Trump is by far the largest owner of Trump Media stock, holding 64.9% of outstanding shares, up from 57.6% in March.

Last week, the company reported a loss before income taxes of $327.6 million in the first quarter of the year, for a net loss of $3.61 per share attributable to shareholders, according to regulatory filings. Revenue also plunged year-over-year from $1.12 million to to $770,500 for the three-month period ending in March.

Trump Media debuted on the Nasdaq on March 26 following years of delays, after successfully merging with Digital World Acquisition Corp. (DWAC), a special purpose acquisition company, or SPAC.

In the weeks since its debut, the company’s stock has been extremely volatile — skyrocketing to highs and plunging to lows from day to day, sometimes without any apparent explanation. Some analysts have compared this erratic trading to that of meme stocks, like GameStop.

Meme stocks refer to company shares that become wildly popular online and are traded feverishly by retail investors, sending prices soaring regardless of the company’s actual operating results or prospects.

On its first trading day, shares traded as high as $79.38. By the end of its first trading week, it had a market capitalization of more than $8 billion. One week later, shares began to free-fall following the disclosures of multi-million dollar losses from operations in 2023, the registered resale of substantially all of its outstanding securities, and the announcement of its own live TV streaming platform.

In recent weeks, shares have popped up once again, despite the fact that the company hasn’t made any announcements that would shed positive light on its business prospects.

John Rekenthaler, vice president of research at Morningstar, told Quartz last month that Trump Media investors are likely trading more on sentiment, and fanaticism for the former president, rather than on actual business performance (as is the case with traditional stocks).

“I think anytime Donald Trump is in the news is oxygen for the stock, in any way,” he said.