Nigeria’s Puma scandal, Ugandan surveillance, African cryptocurrencies

Hi Quartz Africa readers!

Hi Quartz Africa readers!

Nairobi has already made a name for itself as a regional hub of trade, commerce, innovation, and technology. Now, plans are underway to take the city to the next level, and transform it into a global financial center.

Kenya’s launch of the Nairobi International Financial Center (NIFC) last week marks this aspiration while demonstrating the openness of the country’s economy. It also demonstrates its confidence in its own ability to compete on the world stage, says Mark Napier, CEO of FSD Africa, a nonprofit that promotes financial sector development across sub-Saharan Africa.

The center, which has been in the works since 2014, is meant to help direct international investment to Kenya and Africa at large, ensuring companies and investors can take advantage of trade and investment opportunities. It aims to raise more than $2 billion in investments by 2030.

While the NIFC is an investment and job-creation tool, it also brands Kenya as a country ready to embrace new technology and be connected to the global economy, Napier says.

The continent has much to gain. Kenya has a sophisticated financial system, but the flow of money is relatively low. And Africa’s share of international financial flows is minuscule, says Vincent Rague, chairman of the NIFC. He argues that in order for this project to be a success, Kenya will not only need to attract international capital to Nairobi to help finance projects, but also use the capital as a conduit for financing larger projects on the continent.

If Nairobi does this well, it will be a win, not only for the country, but also for the region. —Carlos Mureithi, East Africa correspondent

Stories this week

African fintech companies have a growth problem. Only 5% of the 716 studied in a recent report have been able to scale. Carlos Mureithi explains what the study by the London Business School and the UK Foreign, Commonwealth, and Development Office says about Africa’s fintech industry.

Nigeria’s tough Olympics just got tougher. Nigerian athletes went to Tokyo hoping for a summer of sports and sunshine. Instead, they faced drug test negligence and mismanagement. Alexander Onukwue reports on the latest blow to the country’s Olympics team, the cancellation of a $2.7 million kit deal with Puma.

African central banks want a piece of digital currencies. A number of African countries are looking to launch their own virtual money, backed and issued by central banks, as appetite for digital currency grows exponentially across the continent. Conrad Onyango writes about the motivation behind this move and the various modes different countries are employing.

Tanzania’s taxman looks to mobile wallets. The country’s government recently hiked taxes on mobile money transactions. Priya Sippy takes a look at the subsequent dip in transactions and the strain that businesses and individuals are facing as a result.

Uganda expands surveillance to boda bodas. The Ugandan government was accused of using Huawei’s facial recognition technology deployed in Uganda to crack down on dissent. Stephen Kafeero reports on a new controversial surveillance deal with a Russian firm that will monitor vehicles, including the country’s ubiquitous boda boda motorcycles.

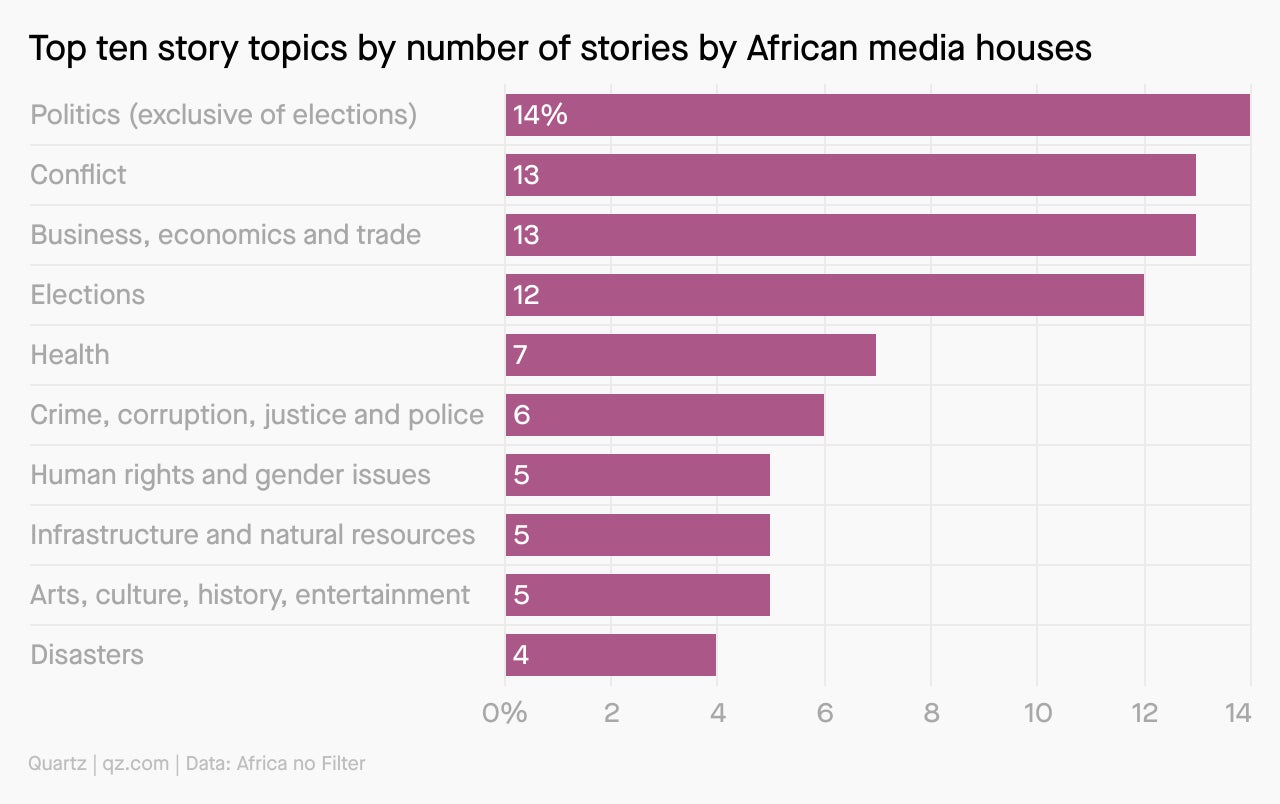

Charting African media coverage of Africa

In 2005, the late, great Kenyan writer and activist Binyavanga Wainaina’s Granta essay on “How to write about Africa” went viral.

Nearly two decades later, it is worth assessing how far modern-day coverage of Africa has come. Last year, Africa No Filter (ANF), a collaborative group that aims to “support the development of nuanced and contemporary stories that shift stereotypical and harmful narratives within and about Africa,” surveyed 38 African editors and analyzed over 300 articles from 60 African news outlets in 15 countries. It found an alarming percentage of stories focused on conflict and crises.

“Africa’s media has a lot to answer for,” says Moky Makura, ANF’s executive director. “Despite what we have come to believe, they, not the Western media, are complicit in reinforcing the persistent narrative that Africa is broken.”

Dealmaker

Naked, a South African insurtech startup, has raised an $11 million Series A round to aid its plans for growth. This was led by Naspers Foundry, which invested $8.3 million, with existing investors Yellowwoods and Hollard providing the balance. Founded in 2018, the startup uses AI and automation as insurance tools.

CreditFins, an Egyptian credit card management and financial wellness platform, has closed an undisclosed pre-seed round to develop its product and build its customer base. This was led by Flat6Labs, AUC Angels, and TA Telecom Holding, and also featured additional angel investors.

Kuda Bank, the Nigerian neobank, has raised $55 million in a Series B round at a valuation of $500 million to drive new services in the country and an expansion across the continent. The round was co-led by existing investors Target Global and Valar Ventures, while SBI Investment and other previous angels were participants. A $25 million Series A round closed four months ago.

One big number

$366.9 million

61 days in, this is how much Nigeria’s twitter ban has cost the country, according to research by Top10VPN. The British firm estimates that the ban alone makes Nigeria one of the worst affected countries in Africa by internet shutdowns. Alexander Onukwue reports on the ongoing impact of the ban and the global economic costs of the internet going dark.

Quartz Gems

Below is a snippet from the first installation of The Forecast, one of four new member emails we introduced this week, available exclusively for members.

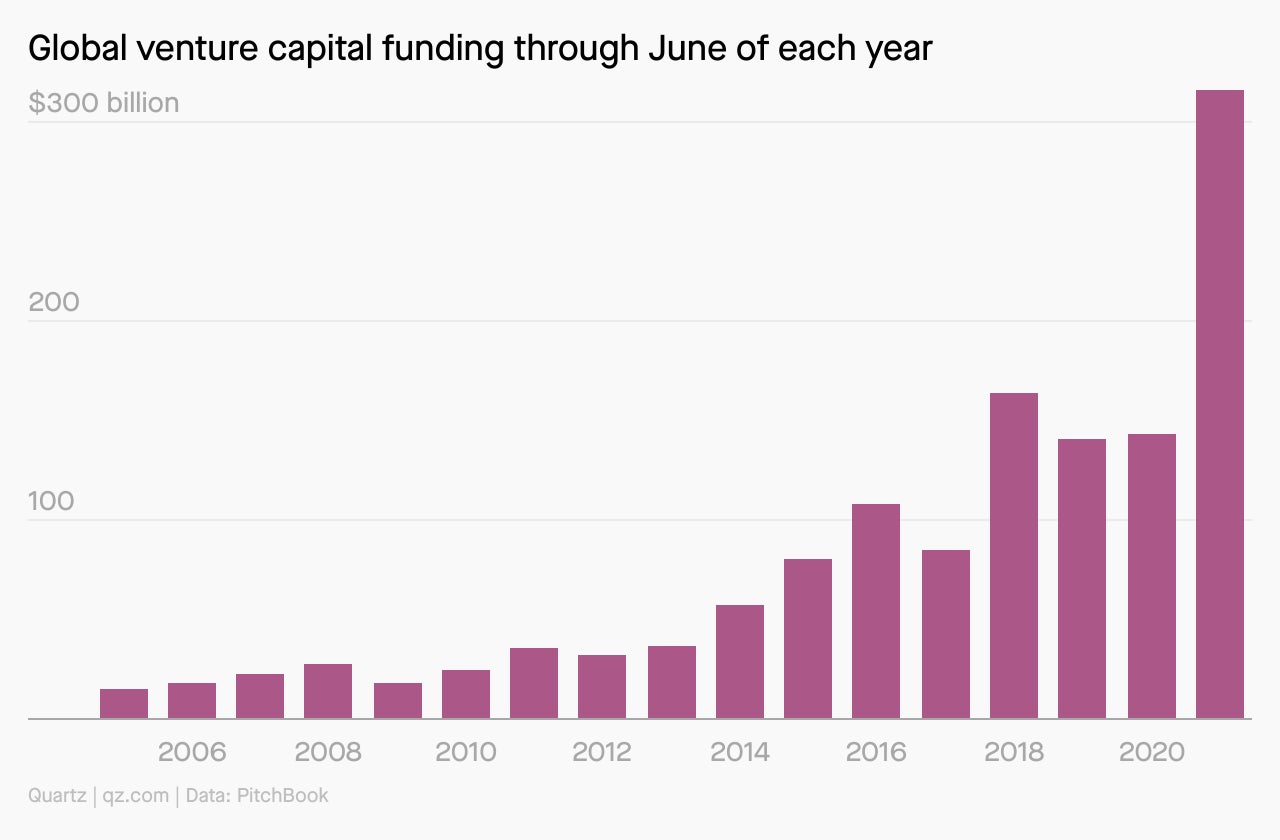

📈 Charting the rise of VC investment

A little more than a decade ago, VC was a niche corner of finance. Its focus was on highly risky technology companies—mostly in computer hardware and software, biotech, and medical devices—with the potential to get really big. And the assumption was that not many companies fit the bill.

But since the Great Recession, VC investment has exploded. Globally, it’s more than 10 times what it was just 15 years ago. In the US, VC investment is now well above its dot-com era peak.

With more and more money available, tech startups are challenging seemingly every industry, from consumer products to entertainment to banking to space travel. The question is how far the Silicon Valley model of starting and funding businesses can extend itself—and whether it’s due for another crash.

Like what you just read? Become a Quartz member—now 40% off with code QZEMAIL40—and you’ll get your choice of four new emails to keep you in the know about industry trends, companies to watch, and a lot more.

Other things we liked

Dancing to Maggie’s beat. Fueled by lockdown blues, Maggie Mkandawire’s ingenuity is helping Karonga, a northern Malawi town, combat Covid-19. The 24-year-old music student’s movement has helped the fight against vaccine hesitancy, masking, and Covid-19 myths, writes Thoko Chikondi in Mail and Guardian.

Durban’s Muslim community is left shaken. South Africa’s Muslim community has been ripped apart by the deadly riot, particularly in KwaZulu-Natal, fueled by racial tension between Indians and Africans. Muslim activists and intellectuals are now proposing a new antiracist structure to prevent this from happening again, reports Anna Majavu in New Frame.

Transatlantic reptiles. A new report explores the potential link between the transatlantic slave trade and the widely found African house gecko. In the New York Times, Sabrina Imbler elaborates on how this study is reconstructing the evolutionary history of the stealthy, resilient stowaway lizard.

Honoring the mother of contemporary African dance. Germaine Acogny of Senegal is still making moves in the global dance world at 77 years old. Vogue’s Liam Freeman interviews the legend, who recently received the Golden Lion for Lifetime Achievement award at the Biennale Danza in Venice.

Nigeria’s top-earning CEOs. According to a new PwC report, CEOs of Nigerian-listed companies are among the top-earners on the continent excluding South Africa. Bloomberg analyzes these figures in the context of the pandemic and rising income inequality on the continent.

ICYMI

Sharing ideas and experiences. The International Conference on Economics and Business Research will give participants the opportunity to share their ideas and experiences. (Aug. 10)

Empowering African genomic scientists. The Africa Center for Translational Genomics is offering scholarships to emerging genomic scientists. (Aug. 15)

Transitioning from fossil fuels. The next installment of the PwC and Invest Africa Energy series will explore carbon neutrality in Africa. (Aug. 17)

🎵 This brief was produced while listening to “Stepping Good” by A-Star feat. Sho Madjozi (Ghana and South Africa)

Our best wishes for a productive and ideas-filled week ahead. Please send any news, comments, suggestions, ideas, Puma kits, and African dance moves to [email protected]. You can follow us on Twitter at @qzafrica for updates throughout the day.

If you received this email from a friend or colleague, you can sign up here to receive the Quartz Africa Weekly Brief in your inbox every week. You can also follow Quartz Africa on Facebook.