Good morning, Quartz readers!

Here’s what you need to know

Economic data painted a grim picture. India and Italy suffered historic gross domestic product contractions in the second quarter of 2020. For the former, a 23.9% drop marked the biggest decline among major Asian economies. Italy’s 17.7% GDP decline was even worse than expected—all eight European economies that have reported second-quarter GDP have now officially entered a recession.

Pranab Mukherjee, India’s former president, has died. The statesman, whose death at age 84 comes just days after his illness was announced, was awarded India’s highest civilian award last year by prime minister Narendra Modi, who called him “the outstanding statesman of our times.” Mukherjee had been hospitalized for a blood clot in his brain, and tested positive for Covid-19 after the procedure, before dying of sepsis caused by a lung infection.

Wang Yi attempted European inroads. In a bid to strengthen ties on the continent while relations with the US careen towards rock bottom, the Chinese foreign minister has visited five EU countries. The reception hasn’t always been warm, as leaders grilled Wang on Xinjiang’s internment camps and civil rights in Hong Kong. On Monday, Wang spoke from Germany, his final stop, to warn of the consequences of challenging the One-China policy, referring to Czech Senate speaker Milos Vystrcil’s recent visit to Taiwan.

Hong Kong begins universal coronavirus testing. Following calls over the weekend from healthcare workers and pro-democracy activists to boycott the Universal Community Testing Program, just around 400,000 Hong Kongers have so far signed up. Critics say that universal testing is inefficient, likely to lead to false results, and threatens increased surveillance.

Apple, Tesla, and Zoom rocked the markets. Both Apple (📈 3%) and Tesla (📈12%) saw a post-split bounce following their respective 4-for-1 and 5-for-1 stock splits on Monday. Zoom also gained over 8% ahead of an earnings report that showed quadrupling revenues and pushed the company’s market value over $100 billion in extended trading.

Obsession interlude: Future of Finance

There’s macroeconomics and microeconomics. And then there’s biological economics.

The latter is the specialty of John Coates, a pioneer in studying the interplay between hormones and financial markets. Before he trained in neuroscience and endocrinology at Cambridge, Coates worked on trading desks at Goldman Sachs and Deutsche Bank. His research suggests that testosterone can spur traders to take irrational risks, while the hormone cortisol can make them unreasonably fearful. The studies indicate that hormones could be exaggerating financial booms and busts.

These days Coates is using wearable tech to monitor the human body’s reaction to stress, to see if it can help traders make better decisions. “We are producing these incredibly accurate predictive signals through our physiology, but we haven’t thought about accessing them,” he told Quartz.

Keep tabs on the Future of Finance obsession here. To keep reading, try:

- How the pandemic is changing cash and money

- Why the US unemployment rate is so much higher than Germany’s

- A Chinese fintech is worth more than Goldman Sachs and Wells Fargo put together

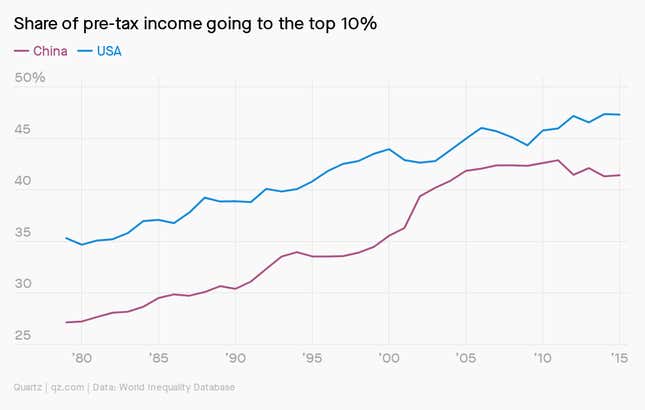

Charting China’s wealth imbalance

Capital and Ideology, the most recent book by French economist Thomas Piketty, got a frosty reception from Beijing, despite Chinese president Xi Jinping personally praising Piketty’s earlier work, Capital in the Twenty-First Century, which took aim at Western countries.

Now, the Chinese government wants Piketty’s publisher to remove parts where the author draws on extensive research to show growth in economic inequality to a level comparable to that of the US. Piketty has so far refused to remove the offending passages, which means Capital and Ideology most likely won’t be sold in China.

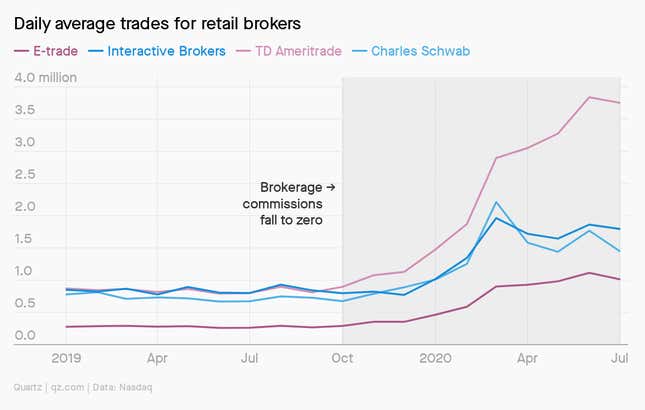

Trading on steroids

Two decades after the day traders went wild over technology stocks, they’re storming the market again, helping to push the S&P 500 to record highs—despite a US economy that has about 10 million fewer jobs than before the coronavirus pandemic hit. There are several factors contributing to the outbreak in retail fervor:

- 📱 Trading has never been easier, with slick smartphone brokerage apps just a download away.

- 0️⃣ A price war between companies like Charles Schwab and Robinhood drove trading fees to zero, as brokerages leaned into other, more controversial ways of making money.

- 🏦 Interest rates have plunged as central banks like the US Federal Reserve do whatever it takes to keep their economies going. This hunt for yields drives massive money flows to stocks.

- 💸 Some investors likely saw the downturn as a chance to get stocks on the cheap, and some may have more money in their pockets thanks to government benefits.

And then there’s the steroids. Read more in our field guide on the next bubble.

✦ One thing makes good financial sense: half off a Quartz membership. We’ve extended our 50% off sale through this week, so take half off of using code “SUMMERSALE.”

You asked about wearing masks outside

Many of us think that being outdoors, especially with a light breeze, is a safer environment to be with other people, with a 6-foot spacing but without masks. Is this safe?

When we think about Covid-19 transmission, what we’re really thinking about is tiny droplets that can contain the virus and potentially be inhaled. Research dating back to the 1800s first suggested that what scientists call “larger” droplets (five microns in diameter or more) can travel a maximum of two meters, or about six feet. Pandemics and other more recent infectious diseases back this theory up. The tricky question has to do with “small” droplets (smaller than five microns), which are also known as aerosols. These droplets can evaporate and travel even farther than six feet—maybe up to 27 feet!

Outside, particles in the air are quickly dispersed and diluted, as a recent article in the scientific journal the BMJ points out. This means that theoretically, yes, being outside with a light breeze is less risky than being indoors, but the risk still isn’t zero; we’re emitting large and small droplets as we talk and breathe all the time, and breathing heavily from physical activity may propel these droplets further.

A preprint of a paper from researchers based in Japan suggests that being outside is 18.7 times less risky than being indoors, but as with so many other topics we’ve covered here, no one knows exactly what that risk is at the present time.

Surprising discoveries

2+2=5. This assertion recently caused a nerdy online stir, but an open-minded approach reveals that numbers are just abstractions of a very messy real world.

Now to add some more monkeys. Because vaccine researchers say that we’re running out.

Special viewfinders let color-blind travelers enjoy the foliage. EnChroma lenses, such as those used on scenic viewfinders at Tennessee leaf-peeping spots, decrease red-green color-blindness.

Luxury brands are using employees as models. Mass-marketers were on the cutting edge of this concept, which has finally trickled up to Acne and Burberry.

We’ll have to come up with a better name for “nuclear waste.” A battery-maker says radioactive nuclear byproducts can be used to power its nano diamond batteries for years.

Our best wishes for a productive day. Please send any news, comments, weird math problems, and model employees to hi@qz.com. Get the most out of Quartz by downloading our app on iOS and becoming a member. Today’s Daily Brief was brought to you by Susan Howson, Katherine Ellen Foley, Daniel Kopf, and Max Lockie