Good morning, Quartz readers!

Here’s what you need to know

Yoshihide Suga is expected to succeed Shinzo Abe. Voting so far signals that Chief Cabinet Secretary Suga is poised to be elected president of Japan’s Liberal Democratic Party, making him almost certain to be the country’s next prime minister. Support for the 71-year-old, who has been a key figure (paywall) in Abe’s government, suggests the Party is aiming for continuity.

TikTok’s algorithm isn’t for sale. ByteDance will not transfer or sell the source code behind the video-sharing app. The report comes ahead of the Trump administration’s ultimatum, which gave the company until Sept. 15 to sell TikTok’s US operations. China recently revised its export rules to give Beijing a say in the deal.

SoftBank is close to selling Arm Holdings to Nvidia for more than $40 billion. The Japanese tech conglomerate bought the British chip designer four years ago for $32 billion. If completed, it would mark one of the largest semiconductor deals (paywall) in history.

The Afghan government called for a ceasefire with the Taliban. The leader of the government’s delegation said there is “no winner through war,” as the two sides started their first-ever direct peace discussions in Qatar. The Taliban’s leader reiterated that Afghanistan should be under Islamic law.

China and the EU hold a summit. Xi Jinping will likely use the meeting with German chancellor Angela Merkel and EU leaders to make the case for closer ties between Beijing and the bloc ahead of US elections. The summit follows a week-long European tour by foreign minister Wang Yi, whose diplomatic offensive was overshadowed by human rights concerns.

What to Watch For this Week

Monday: Japan’s Liberal Democratic Party expected to elect Yoshihide Suga as president; Huawei to stop receiving shipments from most suppliers; China’s Xi Jinping to meet with EU officials; India’s parliament opens its session; Earnings: US home construction company Lennar.

Tuesday: Trump administration deadline for ByteDance to sell TikTok’s US operations; US releases industrial output data; Canada factory sales data released; China retail and industrial production data released; Apple has a “special event” for the media; Asian Development Bank to publish revised economic outlook; Earnings: FedEx.

Wednesday: US Fed, Bank of Japan, and Brazil central bank policy announcements; US retail sales data released; Tokyo lifts curfew on bars.

Thursday: Bank of England policy decision due; US housing starts and business data reported; WeChat users in San Francisco court try to block Trump’s app ban.

Friday: Shanghai Stock Exchange to review Ant Group IPO application; US Fed president James Bullard to speak about “The Covid Recovery Challenge.”

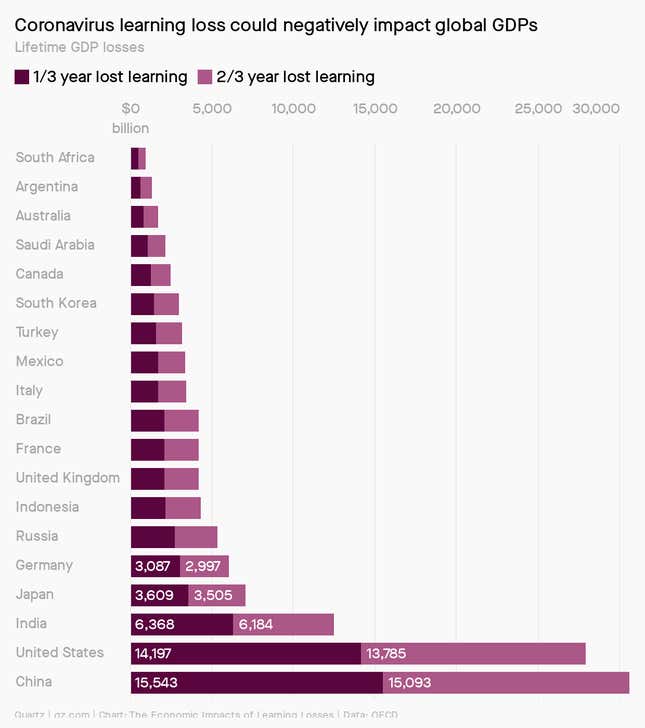

Charting the economic impact of school closures

As schools all over the world struggle with how to educate their students while preventing the spread of Covid-19, economists have begun modeling the potential long-term damage to those students’ livelihoods and to the global economy. According to a new OECD report, researchers found that students in grades 1-12 affected by school closures will see approximately 3% lower earnings in their careers—and likely more for disadvantaged students.

Countries can expect at least a 1.5% drop in GDP for the rest of the century. The only solution is to catch kids up by making schools better than they were before the pandemic.

Read more about the cost of closing schools here.

We interrupt this programming

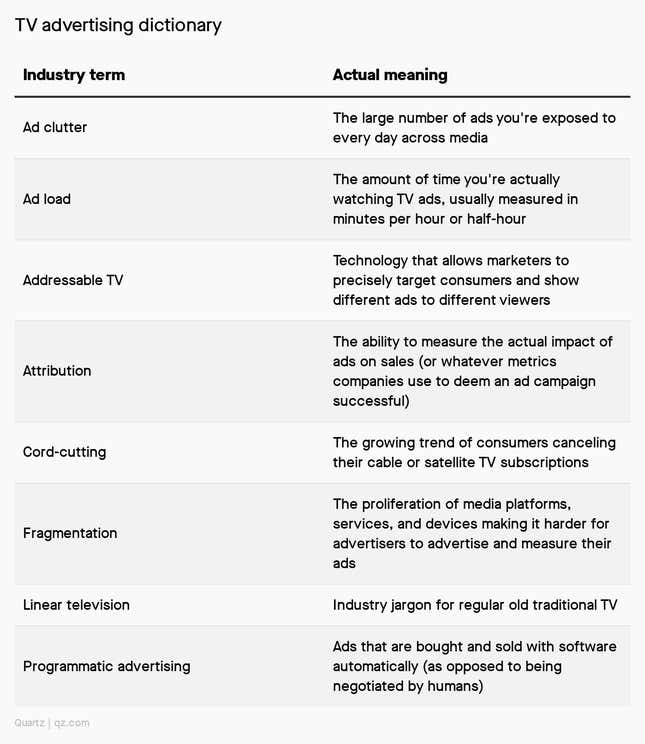

For the big brands that rely on the $70 billion TV advertising industry to drive awareness, and the global media conglomerates that produce the content between the commercial breaks, the next five years will be the most critical since televisions first entered living rooms.

Companies that depend on TV ads will have to adapt to a rapidly changing media landscape or risk falling into irrelevance—and that means embracing a level of innovation they’ve never considered before.

This week’s field guide is all about the future of TV advertising, and it includes a handy list of some ad industry jargon you might see mentioned throughout:

Now that you’ve brushed up on your industry definitions, read the full guide here.

Obsession interlude: How we spend

What does it mean to be obsessed with how we spend? We asked culture and lifestyle editor Oliver Staley:

Consumer spending is about 40% of China’s gross national product. In the UK, it’s about 63%. In the US, it’s closer to 70%. It’s not a coincidence that the tech companies driving the US stock market—Amazon, Apple, Google, and Facebook—make their money selling or advertising stuff to consumers. When people spend less, the economy suffers. President George W. Bush was criticized for urging Americans to shop after the terrorist attack of Sept. 11, 2001, but he wasn’t wrong to do so. Shopping keeps the global lights on.

Increasingly, consumers are using all that power to force whole industries to change. Their increasing excitement about clean vehicles helped to make Tesla more valuable than Ford and GM, combined. Their disdain for cable companies gave us Netflix.

Read more about How We Spend here, or splurge on these recent stories:

Macy’s is planning a future outside of malls

Why the US can’t stock dumbbells fast enough

Surprising Discoveries

Australia’s backpacker drought is threatening its harvest. The country’s horticulture industry relies almost entirely on foreign workers, many of whom are young backpackers.

Virginia is sending around empty school buses. It’s one way to justify keeping drivers on the payroll.

Vinyl records are more popular than compact discs. Sales of records in the US surpassed CDs for the first time since 1986.

Louis Vuitton plans to sell a plastic face shield for nearly $1,000. The premium personal protective equipment features LV-embossed gold studs.

A fraud-prevention startup is under investigation… by the US Securities and Exchange Commission for an alleged fraud.

Our best wishes for a productive day. Please send any news, comments, luxury face shields, and sightings of empty buses to hi@qz.com. Get the most out of Quartz by downloading our app on iOS or Android and becoming a member. Today’s Daily Brief was brought to you by Katherine Bell, John Detrixhe, Walter Frick, Alexandra Ossola, and Oliver Staley.