Good morning, Quartz readers!

Was this newsletter forwarded to you? Sign up here. Forward to the friend most likely to have oat milk in their fridge.

Here’s what you need to know

A Russian airstrike hit a theater in Mariupol. Hundreds of Ukrainians are feared trapped underneath the rubble, just as peace talks appeared to be progressing.

Volodymyr Zelenskyy spoke to the US Congress. His requests included military aid and a complete departure by US companies from Russia. US president Joe Biden put an offer together.

An intellectual property waiver for covid-19 vaccines is coming. The US, the EU, India, and South Africa have reached a tentative agreement.

The Bank of England is following the Fed. The central bank is expected to lift borrowing rates again today in an attempt to combat inflation.

Starbucks ordered a grande. Kevin Johnson is stepping down after 13 years, and legendary former CEO Howard Schultz has volunteered to steer the ship in the interim.

Walmart has 50,000 vacancies in the US. By the end of April, the retail chain will add staff not just in stores, but also in health and wellness and advertising.

What to watch for

Quadruple Witching Day—which really could have been an alternate title for the 1996 film The Craft—is when stock index futures, stock index options, stock options, and single stock futures all expire simultaneously. The day is known for heavy trading volume and there can be a great deal of unpredictability in the market because “hedges are no longer needed or are adjusted for new positions,” said George Pearkes, an investment analyst at Bespoke Investment Group.

With Russia’s invasion in Ukraine creating new economic pains and a quarter percentage rate hike from the Fed, this Witching Day could be especially unpredictable.

The day can increase volumes so much that sometimes it makes it difficult to tell whether a stock is moving because of contracts expiring or business fundamentals. While a Witching Day doesn’t automatically mean more volatility in the market, some traders—especially new ones—choose to sit the day out.

The US Federal Reserve is fighting inflation

The most powerful central bank in the global economy is making it more expensive to borrow in dollars to lower prices.

Yesterday, the US Federal Reserve raised the rate at which US banks can lend to one another by 0.25%, which in turn will make car loans and mortgages more expensive. Fed officials think they’ll probably raise rates seven times this year (the median forecast).

Interest rates are a crude instrument to address inflation that’s largely been driven by supply chain shortages. Making borrowing more expensive disproportionately hurts Black Americans and doesn’t increase the number of semiconductors or houses in the economy.

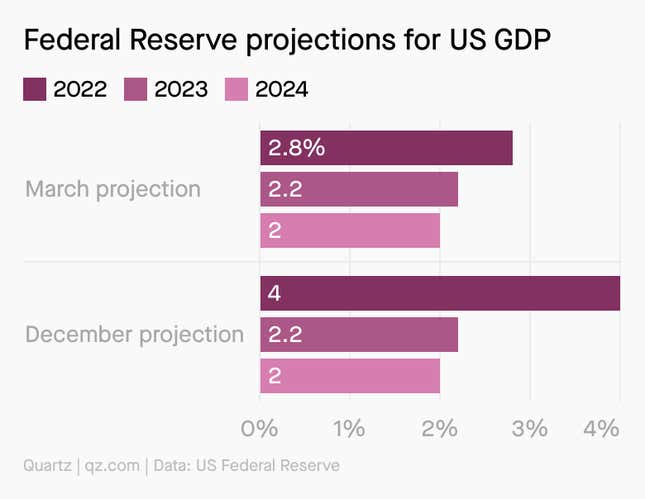

The hope is that the Fed can lower prices without damaging economic recovery. That remains to be seen as Fed officials downgrade their US GDP forecasts for 2022 from 4% to 2.8%.

The next decade of innovation

Ten years ago, Quartz published a story about the most disruptive technologies of 2012. The list included gesture-based interfaces, augmented reality, compressed air batteries, autonomous electric vehicles, and ultra-cheap web devices.

Now we’re looking at the decade ahead. The first chapter of our Next Ten Years series looks at five innovations we can expect to make earthshaking impacts on the global economy.

Handpicked Quartz

🔮 China has big economic plans for its “little giant” companies

⛽️ The price of diesel in Nigeria has doubled

🗺 Where can Indians get a golden visa?

🚛 A fleet of volunteer truckers is keeping aid flowing into Ukraine

💎 Russian sanctions could boost conflict-free, lab-grown diamonds

🙈 Corporate greenwashing is about to get harder

Surprising discoveries

Well, Earth’s asteroid alarm works. A 6-foot rock tested an early detection system hours before breaking up in the atmosphere—bigger ones would be seen sooner, don’t worry.

Public school children in Tokyo can now choose their underwear color. It’s part of a rollback of strict rules that also included having to dye their hair black.

Scientists have a plan to trap lusty invasive hornets. They can attract them using sex pheromone chemicals—from the hornets, not from the scientists.

Cane toad tadpoles evolved to cannibalize. The behavior seems to be an evolutionary response to reduce toad numbers in Australia, where they are an invasive pest.

The next step in prosthetics is a brain upgrade. And, naturally, Elon Musk is pursuing it. Listen to the latest episode of the Quartz Obsession podcast to learn about how prosthetics went from repairing the body to enhancing it.

🦿Listen on: Apple Podcasts | Spotify | Google | Stitcher

Our best wishes for a productive day. Send any news, comments, neural modifications, and love-drunk hornets to hi@qz.com. Get the most out of Quartz by downloading our iOS app and becoming a member. Today’s Daily Brief was brought to you by Ana Campoy, Nate DiCamillo, Susan Howson, Morgan Haefner, Ananya Bhattacharya, and Hasit Shah.