Hello readers!

My first journalism job, so to speak, was writing free book reviews. I was working for a textbook publishing company in Chicago, trying to figure out how to become a journalist. You have to start somewhere, so I offered to review books in my spare time for a website called Bookslut, whose proprietor happened to live down the street from me. The first book I was given to review was War, Evil, and the End of History by French philosopher Bernard-Henri Lévy, also known as BHL. I think the assignment was a test? A form of hazing? Both?

This is a long way of saying that I have some experience reviewing books, and this week I came across Anne Boden’s The Money Revolution. Boden, fortunately, is not a French philosopher (as far as I know): She’s the founder and CEO of Starling, a digital bank based in London.

The book, published this month, isn’t an autobiography, although I would like to read one about her. Boden studied computer science and chemistry before going to work in the financial industry, and over the years she’s been an executive at UBS, RBS, and ABN Amro. She started Starling in 2014, the UK’s first mobile-only checking account. “Being a woman in finance or tech is tough,” she wrote last year. “We generally have to work twice as hard, for twice as long, to get half as far as men.”

Her book is divided into two parts, and I prefer the second one. The first is, among other things, about lessons Boden learned about banking from years spent working in them, and it contains standard neobank criticisms about more traditional institutions, which are depicted as reliant on hopelessly out-of-date technology, unable to adapt, and stuck with customer-unfriendly business models. This is probably true. But I’m not convinced they’re hopeless—many of the biggest banks have survived and adapted to decades of tech change, not to mention multiple business cycles. The latest crop of fintechs have yet to prove themselves during a single downturn. Let’s return to this in a couple of years.

Part two is titled “Fintech money makeover,” and it describes a bunch of handy apps available in the UK and US for dealing with your finances. It promotes Starling here and there, of course, but it also names more than a dozen other fintechs. (It is delightful when Boden describes another startup as “interesting”—a word that in British parlance can be loaded with a terabyte of meaning. Is she throwing shade? Intrigued? Both?)

This section is broken down by category, and here are a few of the apps she mentions:

- Credit score: Totally Money, Credit Karma

- Loyalty points and programs: Perkd, Flux

- Savings and investment: FlyPay, Yolt

- Pay-as-you-go insurance: Teambrella, Friendsurance

- Mortgages: Atom, Roostify

- Charity and philanthropy: GiveTide, Snapdonate

- Bill management: BillTracker, Bean

- Retirement savings: PensionBee, Moneyfarm

- Investing: MoneyBox, True Potential

- Travel cash: Flymble, Airfordable

- Borrowing: Zopa, SmartBiz

It’s a sign of the times, when many startups are seeking to become the Spotify for money, that a finance exec is willing to discuss the merits of other firms. I don’t think Boden is necessarily vouching for any particular app, and users still need to do their homework (UK regulators are wary peer-to-peer investments, for example). But in a world of unbundled information overload, Boden’s curation narrows the list to help someone get started, and it comes from an expert who has skin in the game. Fintech apps can be sort of fun (more fun than editing textbooks at least), and Boden’s entry-level explanations for things like credit scores and mortgages are useful and even a bit soothing.

One of Boden’s messages is that money doesn’t have to be so mysterious, and dealing with personal finance doesn’t have to make us miserable. The Money Revolution suggests that the fintechs flooding into the sector could help.

This week’s top stories

1️⃣ For proof that payment privacy matters, look no further than the protests in Hong Kong. Scores of people were paying for subway passes using cash, as the government has used card data in the past to press charges against protestors.

2️⃣ The UK’s banking startups aren’t ready for a recession or a messy Brexit. Regulators haven’t said which firms they’re worried about, but said they all could find it hard to raise funds during a downturn.

3️⃣ The CEO of Line says its fintech businesses could break even in one or two years. Japan’s most popular payment platform is looking to transform itself into a super-app similar to China’s WeChat.

4️⃣ Amazon’s lending business has languished. The e-commerce giant is gearing up for another try.

5️⃣ Vanguard has formed a joint venture with Ant Financial. The partnership suggests that Ant Financial could offer some of Vanguard’s services to Chinese consumers.

Heard on headphones

“There are women of Wall Street, there are women in hedge funds, but this was really something that we heard a lot as we believe that, within financial services, there are a lot of women who gravitate to the ETF ecosystem,” Sharon French, head of beta solutions for Oppenheimer Funds, said on the Masters in Business podcast with Barry Ritholtz. “We have really drilled down with some theories on this, but we would love to get a research partner to prove it.”

The future of finance at Quartz

Square founder Jack Dorsey says now is the time to build a global currency for the internet. He declined to discuss speculation about a Facebook coin, but said he hoped private companies would see the value of a stateless currency all people can access.

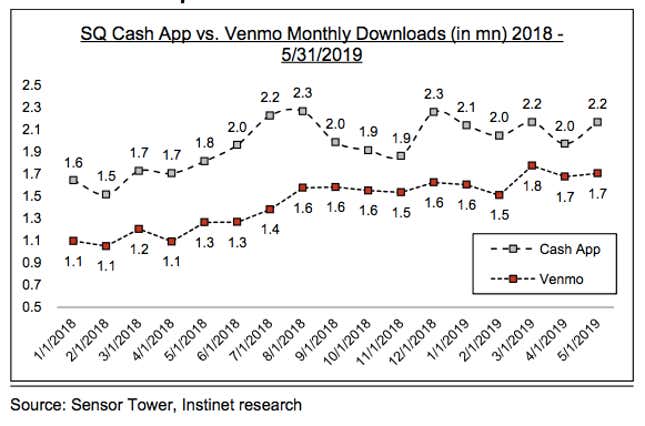

Monzo is going to try its luck in the US. The neobank has more than 2 million users in the UK and will be up against the likes of San Francisco-based Chime, which has twice that many users in America. Meanwhile, Nomura Instinet estimates show Square’s Cash App and Venmo are each getting around 2 million downloads a month:

Uber is reportedly making a big push into fintech. It’s a playbook that Asian mobility companies have been using for at least four years: India’s Ola made fintech a priority in 2015.

Mobile money is getting a boost in Europe. A new initiative plans to make six of the region’s smartphone wallets interoperable with each other, creating a total network of 5 million users in 10 European countries.

Here’s everything you need to know about the Amazon Credit Builder card, which is a play for the e-commerce giant to get more low-income Americans shopping on the site.

Always be closing

- Symphony, the Bloomberg challenger, raised $165 million. The messaging platform was valued at $1.4 billion.

- Facebook invested in Meesho, an Indian social commerce app that connects small sellers with customers on platforms such as WhatsApp, Facebook, and Instagram.

- UK-based Crane Venture Partners closed a $90 million seed fund for Europe.

- Sweden’s Trustly is merging with US-based PayWithMyBank, aiming to build a transatlantic payment network for online shopping that uses funds directly from bank accounts instead of cards.

- Lightning round: Australian payment startup Verrency raised A$10 million. Cleveland-based Splash Financial, a student loan refinancing company, raised $4.3 million. The UK investment fund Augmentum Fintech has made follow-on investments into Tide, Monese, and DueDil. JPMorgan invested $1.6 million in non-profit Accion.

I hope your weekend is invigorating and profitable (pick your own metric). Please send any book recommendations, tips, and informed opinions to jd@qz.com.