Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

You may have heard—probably from me—that we just published a bunch of stories about the future of banking. One of the things I kept thinking about was the difference between financial manufacturing and distribution.

The idea is that manufacturing is a commoditized, low-margin business. The factories that make, say, toasters are more digitized and automated these days. But the real commercial innovation in the past decade is in how these toasters get sold. We’re not picking them up at Sears—we’re ordering from Amazon, and it’s e-retailers who are getting rich during this century, not toaster manufacturers.

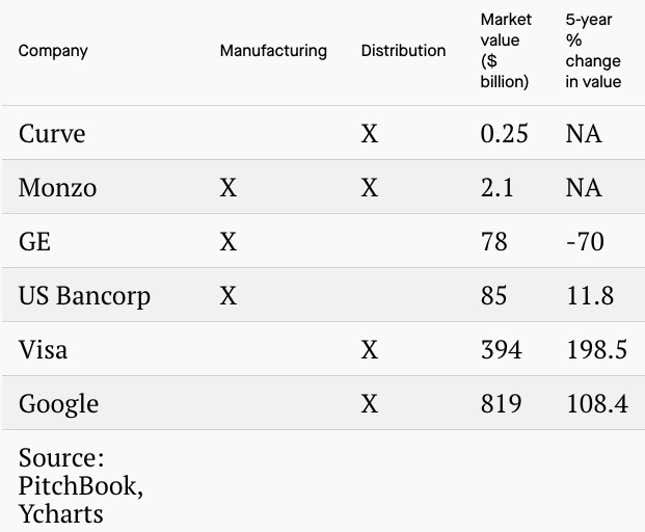

You can apply this thinking to all sorts of industries, including, as QED Investors partner Frank Rotman pointed out in a presentation, finance and fintech. If you look at the change in valuations in recent years for manufacturers versus distributors, you can see why the financial platform Curve, which just finished a crowdfunding campaign, is betting all-in on distribution:

You can and should argue with the choices I’ve made in this table, because I’ve taken an obscene number of liberties with it. But hear me out: Google makes some smartphones, but clearly their primary business is distributing news and information and selling advertising accordingly. An example in the finance world is Visa, which is a giant electronic network for payments: It’s a platform and a trusted distributor of information—in this case, transaction data. These distribution networks have monopoly characteristics, which protect their profits.

In banking, US Bancorp is in the distribution business, for now—it has around 3,067 bank branches, down from 3,018 a year ago. Branches still matter, but I’m assuming they’ll be less important over time as digital distribution takes over. If it’s not careful, US Bancorp will end up in the manufacturing business—it will provide bank accounts and loans and things, but some digital player will provide the distribution. Maybe that will be Google’s search engine, or maybe that will be a fintech platform that bundles everything together.

A lot of companies want to be that platform. One of them is Monzo, which is a licensed bank in the UK and also offers lending and other services from third parties. That means it’s a hybrid manufacturer and distributor. Industry stalwart HSBC has been toying with this.

Curve founder Shachar Bialick has been patiently explaining the manufacturing-versus-distribution idea to me for a while. Unlike others, he’s staying completely out of the manufacturing business: With Curve, the idea is that you can keep all your accounts and payment cards within its system and switch between them digitally. His pitch is that there’s no need to create a better bank account than, say, the one at HSBC. His company adds features on top of that.

What’s wrong with the hybrid approach? For Bialick, becoming a bank brings with it a bunch of extra costs, particularly compliance, which blocks the company’s ability to do anything else. He says it’s better to stay nimble and, invoking Harvard Business School’s Clayton Christensen, make sure that distribution is the company’s DNA. Netflix and Amazon made their names in the distribution game before they started making their own products. Bialick held out the possibility of becoming a bank in the coming years after the company’s culture is set.

Perhaps finance is different, however. There’s an element of trust that comes from using a company that has bank licensing. With so many apps and websites springing up, it at least helps sort out which companies are likely to be credible.

Bialick noted that a lot of consumers move smaller sums to a digital bank to take advantage of the whizzy features, and leave most of their cash in a traditional bank. (An Accenture study backs up this claim.) His aim is to capitalize on this behavior: “If you only focus on distribution and allow people to keep their money where their trust is, at least today, then you don’t need this level of trust,” Bialick said.

This week’s top stories

1️⃣ Stripe is getting into lending. The most valuable fintech startup is launching Stripe Capital, which will provide financing for online companies.

2️⃣ Google Pay is winning in India. The Silicon Valley firm’s payments app powered 59.75% of all United Payments Interface (UPI) transactions in August, well ahead of PhonePe and Paytm.

3️⃣ UK digital banks are forecast to reach 35 million customers around the world within the next year, according to Accenture. But their deposit balances lag behind incumbent banks, with an average of £350 ($430) per customer, compared with £9,000 for incumbents.

4️⃣ Amazon is testing tech that would let its customers pay with a hand wave, according to the New York Post. It could speed up checkouts, and help people forget how much they’re spending.

5️⃣ I looked around for the best article about Marty Chavez’s departure from Goldman Sachs. Among them is this Wall Street Journal (paywall) interview. This take from Matt Levine, who points out that Chavez doesn’t understand how code names are supposed to work, also made me LOL.

The future of finance at Quartz

Here are some highlights from this week’s series about the future of banking for Quartz members. If you’re not already signed up, you can support our journalism and save 50% with promo code JD2912 at checkout.

- Top-tier banks are under pressure from a legion of specialist firms. In investment banking, Evercore is poised to break into the top five global dealmakers for mergers and acquisitions. In retail banking, Starling built its bank from scratch for less than £20 million.

- Current CEO Stuart Sopp went from trading on Wall Street to starting a fintech for youngsters. The average age of its users is 27, and about 50% of them are in their teens. The average age of customers using traditional banks is around 53.

- Former Barclays CEO Antony Jenkins isn’t giving up on old banks. He thinks it’s cheaper to move them to new technology than it is for a neobank to spend hundreds of millions of bucks on marketing.

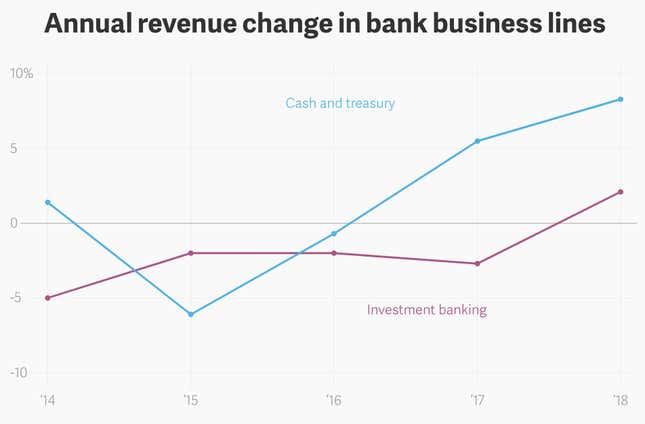

- American banks are dominating global banking because the US economy is healthier and their home market is less fractured. Also, trading is out, and boring old treasury and cash management is the new sexy:

Choose our next adventure

You know what I’m feeling right now? Freedom. I feel freedom because I just finished reporting a bunch of stories and I’m trying to decide on the next project. Here are three ideas, but I suspect you may be able to do even better, and I’m wide open to suggestions. Anything you send me is considered anonymous unless you explicitly tell me otherwise. Send me an email at jd@qz.com. Or hit me up on Signal and Telegram if you have something extra spicy (email for the info).

Here’s what I’ve got in mind so far:

- As bank branches disappear, how are farmers and other rural businesses getting financing?

- Protestors are targeting BlackRock for its investments in companies that fuel climate change. Do protestors misunderstand how passive investing works, or is this actually a savvy way to pressure companies?

- Big financial companies have been buying up scores of startups. How is this working out for the founders, and are any of these deals anticompetitive?

(Also, this is not an invitation for a barrage of press releases, but nice try.)

Always be closing

- Curve set multiple crowdfunding records on Crowdcube: The fintech raised £1 million within five minutes, and hit £6 million in five hours. Some 9,586 people invested—the largest single investment was £25,000, and the smallest was £10.

- Mexican fintech Credijusto raked in $42 million in its Series B financing. Point72 Ventures and Goldman Sachs led the the round.

- PayBright, a Canadian lending and payments provider, raised $34 million.

- Even Financial, which provides recommendations for personal finance websites, raised $25.5 million. Citi Ventures led the deal.

- Amazon and Gojek have had talks on a partnership, according to the Wall Street Journal (paywall), whereby the Seattle-based company would make an investment in the Indonesian ride-hailing startup.

- Square and TSB started a partnership intended make it easier for TSB customers to accept card payments.

I hope your week has been a profitable one (pick your own metric). Please send any spicy story suggestions, tips, and other ideas to jd@qz.com.