Welcome back! If you’re new, sign up here to receive this free email every week.

Hello Quartz readers!

As China tries to stop the spread of the coronavirus, it’s worth looking at how severe acute respiratory syndrome (SARS) reshaped the Asian country during the outbreak in 2002. Back then, efforts to contain the disease inadvertently gave a boost to internet companies like Alibaba. Something similar could happen now.

Like now, many streets became empty as people tried to avoid exposure to the virus. That meant hundreds of millions of people were bored at home, at a time of increasing access to high-speed internet. Like now, they went online for things they could no longer go outside for, like shopping. It took a while to gain force, but this “was the genesis” of China’s e-commerce boom, according to Duncan Clark’s Alibaba: The House that Jack Ma Built.

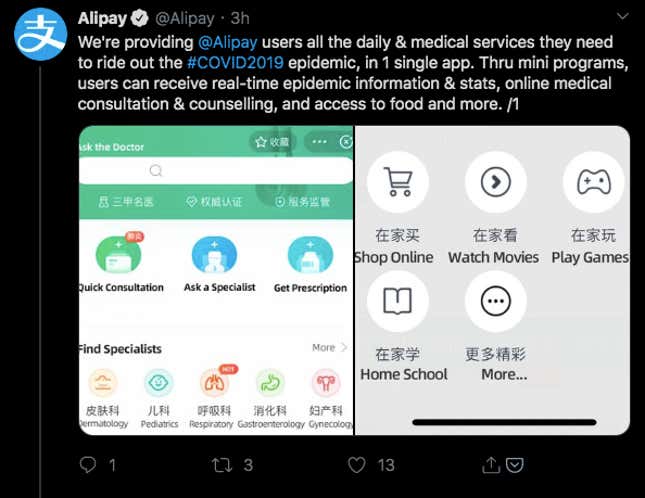

Will coronavirus have a similar impact? It’s too soon to say, but Ant Financial isn’t letting a good crisis go to waste. The financial conglomerate operates the ubiquitous Alipay app and was last valued at $150 billion (Alibaba owns a 33% stake). Chinese people use the app for everything from payments to real-time epidemic information, as well as, potentially, finding out the likelihood that they have coronavirus.

To assess peoples’ likelihood of having the virus, Ant is providing development support for a national health code system. Once it’s launched, the color-code system will be operated by local governments and available on other platforms as well. According to Technode:

“To apply for a code, residents must register with their name, national identification number, and phone number and provide details to basic questions including travel history and health status. Residents with a green code means [they] are allowed to move around the city freely. Yellow means a seven-day quarantine is required, and red requires a 14-day quarantine.”

There’s a case to be made that the Chinese government is also making the most of the crisis by tightening its grip on surveillance and control. A decline in data privacy appears to be one likely result of the crisis, says Fraser Howie, co-author of Red Capitalism: The Fragile Financial Foundation of China’s Extraordinary Rise.

“Everyone is pulling the same direction,” Howie said in an interview from Singapore. “You’ve got a willing population, you’ve got a government who certainly wants to move that direction, and you’ve got tech companies that want to move that way.”

In the meantime, Ant has also rolled out other, less controversial, measures. Its MYbank service is offering business loans to companies, hit by the worker shortages and disrupted supply chains, on preferential terms. And Ant has paused its credit rating service Zhima credit, reportedly because users could miss payments on account of the virus outbreak.

There’s a political and patriotic element to these moves, as the tech giants can’t been seen as sitting on their hands, says Vey-Sern Ling, a senior analyst at Bloomberg Intelligence. But he thinks it’s also a huge opportunity. The measures have ideal timing because investors are already expecting Ant and Alibaba to take a hit on profit and sales, and the cost of these efforts could actually be considered marketing, Ling said.

“This is a good time to gain new customers, who can potentially be retained in the future because of goodwill generated or because they have a good experience with the service,” Ling said. “It’s possible that the loans extended now at cheap rates can get them new customers who will stay with them in future. Likewise for every other app that gained users these couple weeks.”

Morgan Stanley + Etrade

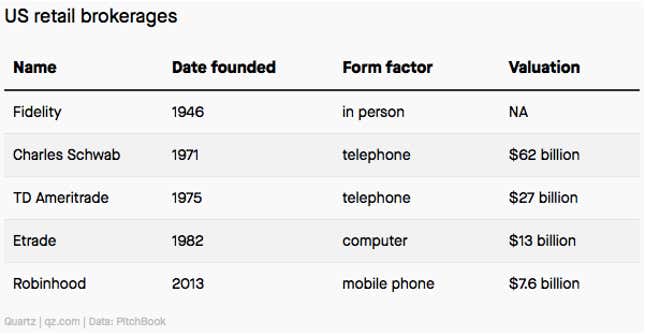

The US stock brokerage business has had a nice symmetry over the decades. As Quartz’s field guide to fintech puts it, each generation has gotten a new dominant brokerage that’s native to their preferred mode of communication: Charles Schwab pioneered telephone brokerage, while Etrade rolled out online trading. Robinhood is native to the smartphone.

Now Morgan Stanley, the 89-year-old investment bank that was built in a time of communication via whiskey and cigars, has spoiled that elegance by buying Etrade, the dot-com era stock brokerage. Arguably, venture capital-funded Robinhood gets the blame because it cut commission rates (it makes money in other ways). That sparked something of a price war, which likely set off Charles Schwab’s acquisition of TD Ameritrade.

As profits get squeezed, Robert Le, senior analyst of emerging technology at PitchBook, thinks more M&A could be on the way: “We believe that Robinhood could be an acquisition target if it fails to find growth with new products such as cash management.”

This week’s top stories

1️⃣ Main Street is becoming Wall Street’s favorite client. The “crown jewel” (paywall) of the Morgan Stanley’s latest acquisition is the low profile business of managing stock that employees receive as part of their compensation, according to the Wall Street Journal. CNBC reports that rival Goldman Sachs took a pass on the opportunity.

2️⃣ German savers are investing in peer-to-peer loans via Baltic fintechs, Bloomberg reports. A Lithuanian central banker brags that “it’s always easier to develop a business when there’s no state involvement, no inspection behind your back supervising or demanding permits.” (Ahem.)

3️⃣ Sweden’s central bank is testing an e-krona digital currency. The Riksbank hasn’t decided whether it will issue digital cash; the pilot is scheduled to run until February 2021.

4️⃣ Some UK brokers don’t make money through commissions—they make money through contracts for difference (paywall). CFDs, as the Financial Times writes, are so risky that regulators require brokers to warn their customers about them.

5️⃣ Fidelity’s parent company is spinning out Akoya (paywall), an app for sharing financial account data. The company hopes the spinout will encourage other institutional heavyweights to connect to it.

The future of finance on Quartz

Investors and analysts seem to think LendingClub’s purchase of Radius Bank is a good move. But not everyone is convinced it’s a game changer for the marketplace lender.

Americans are feeling more optimistic about their finances than in generations. A record 73% of respondents in a Gallup poll said they expect they expect their finances to be better a year from now.

Microsoft stock has received the most investment inflows from environmental and socially responsible funds, according to EPFR data. Alphabet and Disney came in at No. 2 and 3.

Elsewhere on Quartz

B Corps are meant to exemplify one idea: That we need to transform the way capitalism works in order to save the world. A growing number of corporations are signing on, from Patagonia to Danone. Quartz’s Cassie Werber reports on why B Corps are gaining momentum—and the limitations that make them imperfect vehicles for social change.

Always be closing

- Franklin Resources is buying Legg Mason for $4.5 billion, creating an asset manager overseeing $1.5 trillion.

- Japan biggest bank, Mitsubishi UFJ Financial, is investing $700 million in Singapore’s Grab ride-hailing and fintech company, Bloomberg reports.

- Behavox is close to raising $100 million from SoftBank. The UK company makes software for monitoring employee behavior at financial companies.

- Concirrus, a startup in London for marine and automotive insurance, got $20 million in funding.

- Self received $20 million in investment. The credit-builder company is based in the US.

I hope your week has been a profitable one (pick your own metric). Please send tips, food delivery suggestions, and other ideas to jd@qz.com.