On July 16, food delivery company Zomato went public on India’s two major stock exchanges. By pretty much any metric, it went spectacularly well—the $1.1 billion IPO received 38 times as many applications as the number of shares on offer. Info Edge, Zomato’s earliest investor, saw the value of its investment increase more than 1,000 times. The IPO catapulted the Indian food-delivery firm’s valuation from $5.4 billion to $12 billion. Not bad for a 12-year-old company from Gurugram, a city south of New Delhi.

What’s remarkable is not the company’s post-IPO valuation (it’s chump change compared to Uber’s historic $82.4 billion post-IPO valuation). It’s where it’s from: Zomato is among the first multibillion-dollar tech startups to list in India, where startups are notorious for not providing exits at all. That’s got investors hoping Zomato’s IPO won’t be the last—fintech players Mobikwik and Paytm have both filed their pre-IPO documents, while others are eyeing startups including beauty e-tailer Nykaa, online insurance aggregator PolicyBazaar, e-commerce logistics firm Delhivery, eyewear retailer Lenskart, and e-grocery platform Grofers.

For Zomato, though, good news comes with a caveat. Until now, Zomato’s been able to operate in several countries, execute a handful of acquisitions, and experiment with new parts of its business away from the limelight. But it hasn’t had a perfect track record, and it continues to operate at a loss. Its co-founder quit just two months after the IPO. As a public company, it’s bound to come under increased scrutiny.

What goes up…

Zomato, founded as Foodiebay, was established in July 2008 by two IIT Delhi alumni, Deepinder Goyal and Pankaj Chaddah. What started off as a restaurant listing and delivery platform quickly became India’s answer to DoorDash, with a fleet of 150,000 delivery workers. Today, the majority of the company’s revenue comes from commissions on delivery orders and subscription fees for its loyalty programs that offer exclusive discounts.

In the last 12 years, the firm has raised over $2.1 billion across 21 funding rounds from marquee investors including New York-headquartered Tiger Global, Chinese e-commerce giant’s affiliate Ant Group, and South African multinational Naspers. It used a lot of the cash to acquire over a dozen companies, including UberEats’ India business in January 2020. The company has also made significant investments in artificial intelligence, machine learning, and deep data science.

Its revenue has only grown. Zomato captured nearly half of India’s online food delivery market share as of February 2021.

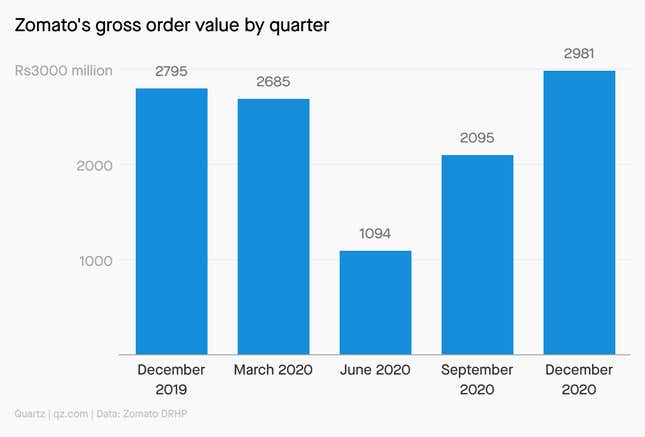

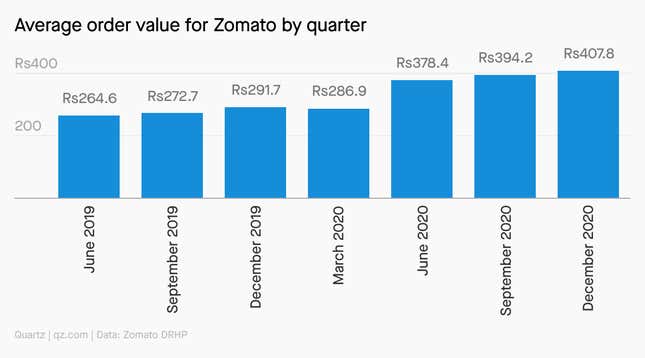

Covid-19 especially gave the food delivery business a big push. With more people staying home—many of whom have moved back in with families—the average order size has been growing across the country.

…Must come down

But all that income hasn’t yet brought the company’s budget into the black. The biggest reason: its businesses abroad.

In its early days, Zomato made a big push to go international. The proposition was lucrative: In foreign countries, even if the company’s presence was smaller, the average order value was far bigger than India’s.

But many of those investments haven’t gone according to plan. In fact, the international business has been more of a burden than a boon, contributing to a tenth of the business and 2.5% of assets but accounting for 15% of liabilities and 13% of losses in FY21.

🇦🇪 UAE

Sept. 2012: Zomato expands operations to the UAE, starting with Dubai.

March 2019: Zomato sells the UAE business to Germany’s Delivery Hero Group for around $172 million

🇦🇺 New Zealand

June 2014: Zomato buys MenuMania, a restaurant listing and review platform already popular in New Zealand, for an undisclosed amount

Dec. 2020: Zomato pulls the plug on offering support services in New Zealand, another other countries

🇸🇬 Singapore

May 2012: Zomato sets up its Singapore subsidiary.

Sept. 2021: The company shuts its Singapore business, stating that the business did not have active operations.

🇬🇧 UK

Jan. 2013: Zomato launches in London, its first foray into the UK.

Sept. 2021: The company shuts its UK business after stating that the business was not active.

🇺🇸 US

Jan. 2015: Zomato enters the US by acquiring Seattle-based restaurant reviews site UrbanSpoon for $60 million

April 2015: Zomato buys Yelp competitor Nextable

June 2015: Zomato shuts down UrbanSpoon six months after acquiring it owing to stiff competition from Yelp

June 2021: Zomato divests its stake in Nextable, winding down its US operations entirely

Admittedly, Zomato isn’t the only company of its kind struggling to make ends meet. Most of its foreign counterparts—US-based GrubHub, UK-based Deliveroo and Germany’s DeliveryHero, to name a few—are clocking even bigger losses (only China’s Meituan is an exception). Profitability is a real struggle because the business model is flawed: Customer acquisition costs are high, fee per order is low, and the product is undifferentiated so any one company standing out is near impossible.

Experts don’t think Zomato’s losses are a reason to fret. “Despite losses, Zomato continued to garner investors’ attention,” said Aurojyoti Bose, lead Analyst at GlobalData.

The upside of shedding this dead weight? Zomato can really double down on its India business. The IPO funds will be used for customer and user acquisition, delivery, and tech infrastructure, as well as acquisitions and other strategic initiatives, Zomato said.

By the digits

556: Indian cities and towns Zomato operates in

$1.3 billion: Zomato’s gross merchandise value in the year ended March 31, 2021

32.1 million: Average monthly active users in the year ended March 31, 2021

4,254: Peak orders per minute on Zomato in India on Dec. 31, 2020

390,000: Active restaurant listings on Zomato’s restaurant discovery feature as of March 2021

148,000: Active delivery restaurants on Zomato (the main part of its business) as of March 2021

Spotlight on gig workers

In August 2021, the company’s ads featuring actors Hrithik Roshan and Katrina Kaif drew flak for showing delivery boys didn’t have even a second to spare between deliveries. Critics pointed out these workers were exploited, made to run around come rain or shine.

Zomato’s response not only said the ads were “well-intentioned” and “unfortunately misinterpreted by some.” On Aug. 30, Zomato said “We will also, very soon, publish a blog post explaining why we think our delivery partners are fairly compensated for the work/time that they put in.” So far, none has been published.

Delivery workers disagree. They have repeatedly claimed they are overworked and underpaid. Posts by Twitter handles @SwiggyDEHyd (now disabled) and @DeliveryBhoy began tirelessly unveiling the company’s exploitative practices such as reduced payouts, late payments, accidents, and more.

Keep learning

- Zomato and Swiggy face backlash from restaurants and hotel owners over high commissions

- Amazon could emerge as a credible threat in India’s food-delivery market

- How Paytm piggybacked on the Zomato frenzy to debut new features

- The Zomato IPO wasn’t the greatest opportunity for retail investors…

- …but it could bear good news for India’s jobseekers

Thanks for reading! Don’t hesitate to reach out with comments, questions, or companies you want to know more about.

Best wishes for an educational end to your week,

—Ananya Bhattacharya, Quartz India reporter (loves ordering burgers to be delivered)