For Quartz members—AMC Theaters’ dramatic cliffhanger

Hi [%first_name | Quartz member%],

Hi [%first_name | Quartz member%],

Remember movie theaters? We don’t either. But AMC Entertainment certainly hasn’t forgotten that 15% of its movie theaters around the world are still shuttered—and the ones that are open have few customers. How the next few months play out for AMC will have a colossal impact on the future of the theatrical experience.

But first, a recap: Thailand and Hong Kong are brewing a #MilkTeaAlliance, China is rapidly producing new billionaires, and Netflix’s pandemic bump is over. Restaurants are shelling out for ventilation upgrades, while the moon is getting upgraded to 4G. Why is it so hard to redesign America’s election ballot? We looked into it.

Your most-read story this week is also the most relatable: How to get through another Covid-19 lockdown. It’s no cure-all, but make sure you’re signed up for Need to Know: Coronavirus, our weekly newsletter providing cool, calm, and collected Covid updates—plus advice from us and each other on how to keep it together.

Okay, butter your popcorn and silence your cell phone. We’re raising the curtain on AMC Entertainment.

Let’s all not go to the movies

The world’s movie theaters are—for real this time—facing an existential crisis. Every few years we hear about the looming “death” of theaters due to a variety of factors, including rising ticket prices and the proliferation of alternate forms of entertainment like streaming. But this is different. The pandemic has taken an industry that was already fending off threats on all sides and nudged it toward oblivion.

No company exemplifies this more than AMC Entertainment, the 100-year-old owner of the biggest theater chain in the world, AMC Theatres. With no new movies to put in cinemas and would-be moviegoers reluctant to go see the few that are screening, AMC is quite literally running out of cash. Happy centennial! Your award is bankruptcy.

AMC admitted in a filing (pdf) to the US Securities and Exchange Commission that “substantial doubt exists about the Company’s ability to continue as a going concern for a reasonable period of time.” If it doesn’t find new sources of liquidity (and fast), it will declare bankruptcy. AMC generated $1 billion in revenue as recently as the first quarter.

If AMC goes under, we all lose. That would mean 1,000 theaters, across 15 countries, just disappear—leaving fewer spots for movies to be seen, fewer options for consumers, and less leverage for the theater chains that do survive to negotiate with Hollywood studios over the terms of distribution. It would be a crushing blow to the theater industry and anyone who has ever enjoyed a trip to the movies.

It’s possible AMC survives these next few months, a vaccine is found and widely distributed in 2021, studios start releasing lots of big movies again, and the theater industry lives to fight another day (though that won’t solve the ongoing problem of streaming). But the prospect of a theaterless world has never been more real than it is right now. Videos like this one could seem like an ancient relic to future generations, no less incomprehensible to them than dinosaur fossils are to us.

By the numbers

$1.1 billion: AMC’s market capitalization around this time last year

$330 million: AMC’s market cap today

85%: decline in year-to-date AMC theater attendance compared to 2019

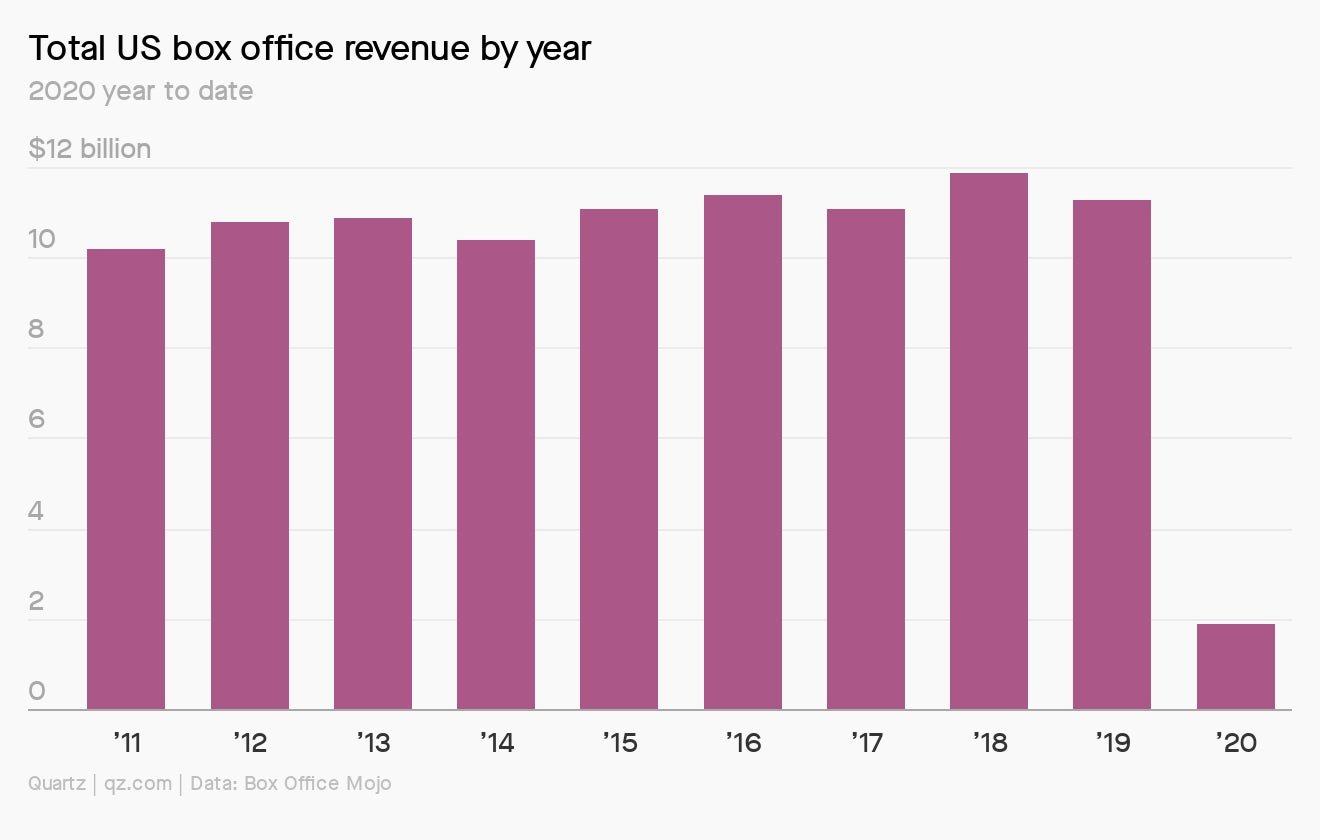

$11.3 billion: Total US box office revenue last year

$1.9 billion: Total US box office revenue so far this year, including January through March

15 million: number of shares of stock AMC has agreed to sell to Goldman Sachs and Citigroup

0: number of AMC theaters open in New York and Los Angeles, its two biggest markets

Checking under the hood

AMC’s outlook isn’t any rosier when you look closely at its core financials. The company lost nearly $2 billion last quarter (before the pandemic, it usually at least broke even). And it was already $5 billion in debt before this crisis, mostly due to efforts to renovate its theaters and give customers a more luxury experience.

As of Oct. 16, AMC resumed operations at 519 of its 598 US theaters, with capacity limited to between 20% and 40%, depending on location. Many of the theaters still closed are in New York and California, which together accounted for nearly 20% of the company’s revenue in 2019. So it’s missing its two most lucrative areas, and the areas that are operational aren’t making any money. (The world’s second biggest chain, Regal Cinemas, just re-closed all of its global theaters, though its financial situation is not quite as precarious as that of AMC.)

AMC’s one and only priority right now is liquidity, and it has done virtually everything in its power to keep enough cash on hand just to function. AMC has renegotiated almost all of its leases globally. It has suspended shareholder cash returns, its stock buy-back program, and future dividend payments. It has raised hundreds of millions of dollars in private debt, furloughed employees, reduced salaries across the board, and canceled annual merit pay raises.

That alone won’t be enough, which is why the company is now looking for additional capital to ride out the rest of the pandemic. Maybe the US government will provide bailout funds—though that may depend on the results of the upcoming election. Dozens of famous filmmakers, from Judd Apatow to Greta Gerwig to Taika Waititi, recently signed a letter urging the US government to bail out theaters before the industry is annihilated. Surely, that’s what will get Mitch McConnell and Nancy Pelosi to act—a passionate letter from the guy who directed The 40-Year-Old Virgin.

Quotable

“This was the most challenging quarter in the 100-year history of AMC.” —Adam Aron, AMC Entertainment president and CEO, during a call with analysts on Aug. 6

Save a theater, rent your own

AMC is so desperate for any additional revenue while its theaters wither that it will now allow you to rent an entire theater for $99 and invite up to 20 of your friends to watch a classic movie like Jurassic Park. It costs a lot more to screen a new movie, like Tenet, the latest action thriller from director Christopher Nolan. But split between 10 or 20 people, it still equates to about a normal trip to the theater (remember those?) per person.

It’s not a terrible idea. While health experts aren’t exactly encouraging consumers to head back to theaters, they do say the cinema may not be as dangerous as you’d think—especially relative to other indoor activities, like restaurants and bars. That’s due to two main factors: Everyone is facing the same direction in a theater, and no one is talking. Both help prevent the spread of droplets transmitting the virus from one person to another.

Other chains like Cinemark and Alamo Drafthouse are offering similar rental packages. So if you’re a fan of movies, have a lot of friends, and are open to the idea of spending two hours indoors with other people (albeit with seats spaced out), consider helping out your local theater in need. Their existence might depend on it.

Keep reading:

- If AMC does survive, it will do so in a new era of moviegoing. The company made a deal with Universal Pictures to drastically shorten the amount of time between when a movie plays in theaters and when it’s allowed to hit digital rental services.

- AMC’s investors have long hoped a deep-pocketed media conglomerate might buy the struggling theater chain. Its stock soared earlier this year off reports Amazon may have been interested. (It wasn’t.)

- While the US box office languishes (in part due to AMC locations still being closed in New York and California), Japan is doing quite well. In fact, its box office is breaking records.

- One part of the US theater industry that’s actually thriving? Drive-in theaters, which have seen a surge in attendance this year, for obvious reasons.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or companies you want to know more about.

Also, thank you to the readers who pointed out an error in last week’s email on Spotify. We wrote that Amazon is valued at $1.72 billion, Google at $1.07 billion, and Tencent at $684 million. Amazon is actually valued at $1.72 trillion, Google at $1.07 trillion, and Tencent at $684 billion. A good reminder that no matter how big you think the tech giants are—they’re bigger. Also that a final final final proofread never hurts.

Best wishes for a cinematic end to your week,