Call it by its name: a bailout

Silicon Valley Bank was, in fact, bailed out—even if the tech industry argues otherwise

Hi Quartz members!

The b-word has been the subject of a storm this past week. Say it loud: bailout.

When Silicon Valley Bank (SVB) began circling the drain, the US government promised to pay out depositors in full—all of the bank’s the depositors, not just the 2.7% of them who were insured at the $250,000 limit guaranteed by the Federal Deposit Insurance Corp. (FDIC). Top executives were fired, and investors and bondholders zeroed out. But customers of SVB—representing tech startups and founders, but also nonprofits and wineries—were made whole.

The Federal Reserve also announced the availability of emergency loans to all eligible banks, in which their collateral will be valued at par—i.e. more than they’d fetch in the open market. In some ways, this is designed to mitigate the effects of the Fed’s own interest rate hikes, which drove down the value of long-term US bonds held by banks including SVB.

The hectic debate over whether any of this constituted a bailout shows just how charged that term is. Sometimes bailouts are necessary: they limit the panic and damage that can race through a financial system like a virus (*cough* 2008 *cough*). But thanks in part to that financial crisis and its aftermath, bailouts are also widely associated with the use of taxpayer money to rescue reckless bankers and mop up their bad decisions, while also raising the prospect of tighter industry oversight. And what bailout supporter—whether a banker, politician, or desperate depositor—would want to align themselves with all of that?

Cue the arguments. Bill Ackman, the billionaire hedge fund manager, held that the US’s response was “not a bailout in any form” because the government did not protect the banks, their bondholders, or other investors. But plenty disagreed, among them the American economist Paul Krugman, the British economist Dan Davies, and former FDIC chair Sheila Bair.

What is a bailout, exactly? The economist Edward J. Green suggested a particularly inclusive definition (pdf), describing bailouts as “transfers from the government, made to firms…or to their creditors in order to avert insolvency or mitigate its effects, that the recipients are not anticipated to repay.”

Under this definition, the government’s actions surely constitute a bailout. But that shouldn’t be the debate. Rather, the real question is whether the latest bailout action leads to more constructive banking regulations—or whether it becomes a tool to elect people who will further slacken rules meant to curb the worst instincts of banks.

USING PROTECTION

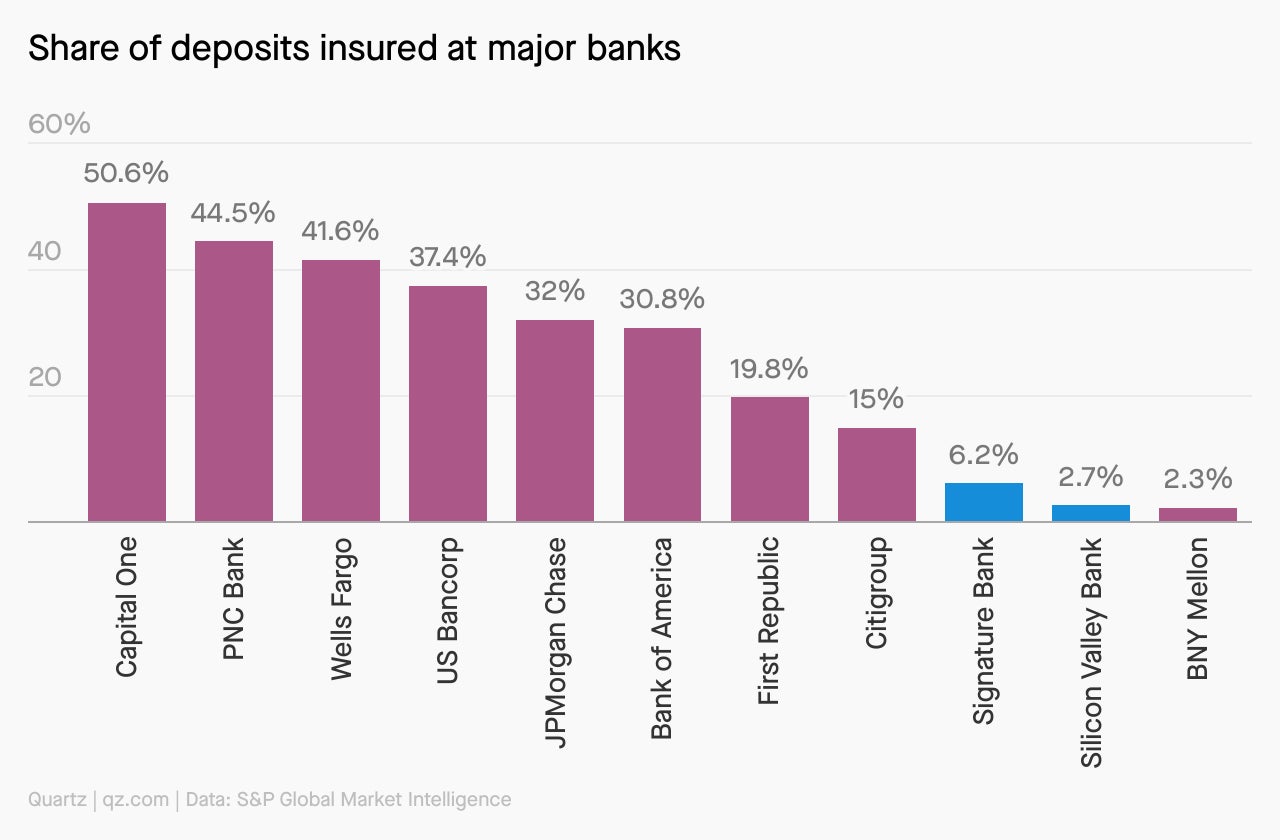

Silicon Valley Bank’s depositors were insured at a shockingly low level. Only 2.7% of accounts at SVB were under $250,000 and thus protected by the FDIC. That may be a symptom of having a highly concentrated clientele of tech companies and venture capital firms. But how does that 2.7% compare with other banks?

HOUSES OF CARDS

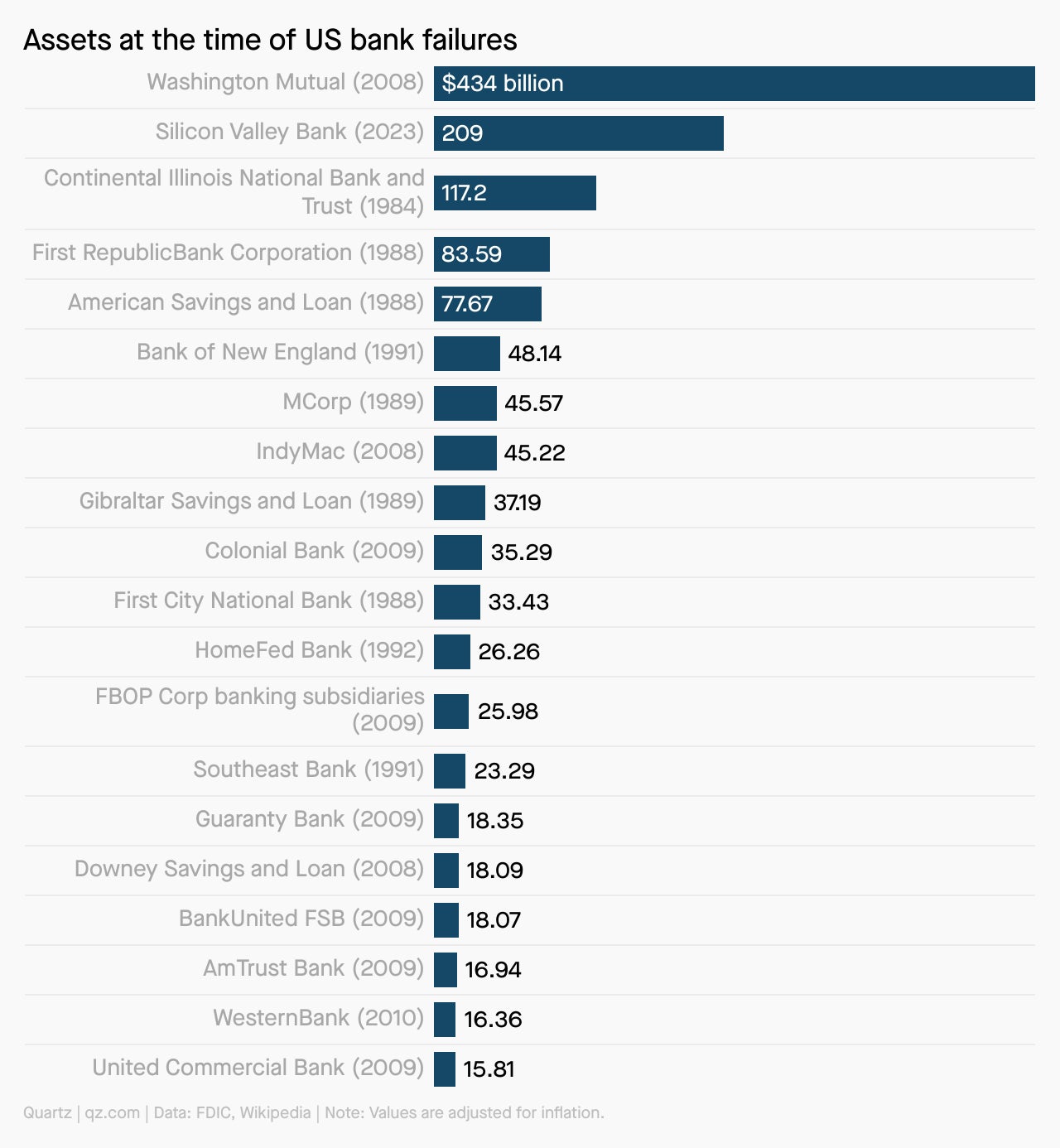

Silicon Valley Bank was the second-largest bank failure in US history. Its $200 billion in assets placed it just below Washington Mutual—$434 billion, adjusted for inflation—at the time of collapse.

ONE 💲 THING

The kind of rescue implied by the word “bailout” can even happen entirely in the private sector, although the government is often pulling strings behind the scenes. In 1988, when the hedge fund Long Term Capital Management was on the precipice, it was bailed out by a cadre of banks, in a rescue orchestrated by the New York Fed.

These kinds of rescues, where a struggling institution is pulled back from the brink, can still be seen today. On March 16, in response to instability at First Republic Bank, 11 large US banks swooped in and put up a $30 billion rescue package. Beyond helping to round up support for the plan, the government was not involved. We can still call it a bailout.

QUARTZ STORIES TO SPARK CONVERSATION

- Even after California’s rain and snow, the state’s drought has not been sated

- More American women over 40 are having babies. Their risk of dying from it keeps rising too

- These creative thinking exercises can disrupt your next team brainstorm

- How does NASA’s new Moon suit compare to the original?

- The strong US job market is helping to give rise to “returnships”

- Microsoft is integrating AI into its office tools and promises mistakes will be made

- Wind can now power a third of US homes

5 GREAT STORIES FROM ELSEWHERE

⏱️ Countdown. Three out of every four H-1B visa holders in the US are from India. During the mass layoffs in Silicon Valley that began in 2022 and have continued this year, many immigrant tech workers found they had a mere 60 days to find a new job; failing to do that would mean packing up their lives and leaving the US. Rest of World describes the tough choices these workers now face. —Shivank Taksali

🦠 Origin story. We should stop blaming bats for coronavirus. Analysis of genetic material collected from Wuhan’s wet animal market suggests that raccoon dogs were carrying and possibly spreading the virus at the end of 2019. While the debate on the origins of SARS-CoV-2 remains to be settled, The Atlantic details the latest breakthrough from researchers that are still doggedly pursuing science-based answers. —Sofia Lotto Persio

👀 Spot the fake. According to one study, nearly 50% of consumers trust online reviews as much as a friend’s recommendation. The problem is, people are not great at discerning liars from truth tellers, even face-to-face. What little insight we have becomes even weaker when sorting through information online. NPR delves into research that examines why we fall so easily for fake reviews, and are often skeptical of positive appraisals. —Julia Malleck

♿ Bad takes on bad guys. The villains in the James Bond novels tended to be disfigured or deformed in some way: facial scars, pincers instead of hands, jaws of steel. The trope of the “crippled” villain has been all too common in literature and film, Jan Grue argues in the Guardian. And it is still alive and well today, as Grue, a wheelchair user, found when he was invited to guest-star in a Norwegian TV show. —Samanth Subramanian

🚗 Double trouble. Thomas Midgley was hailed in his time as a brilliant inventor. And yet, as the New York Times Magazine describes, he bequeathed to the world two of its most toxic scientific legacies: leaded gasoline and chlorofluorocarbons. What can Midgley’s career tell us about scientific advances being made today, and about their potential for unforseen destructiveness? —Samanth Subramanian

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Have a liquid weekend,

— Scott Nover, tech reporter

Additional contributions by Heather Landy, Tim Fernholz, and Samanth Subramanian