Good morning, Quartz members!

Every financial institution with an acronym has its hands full with crypto.

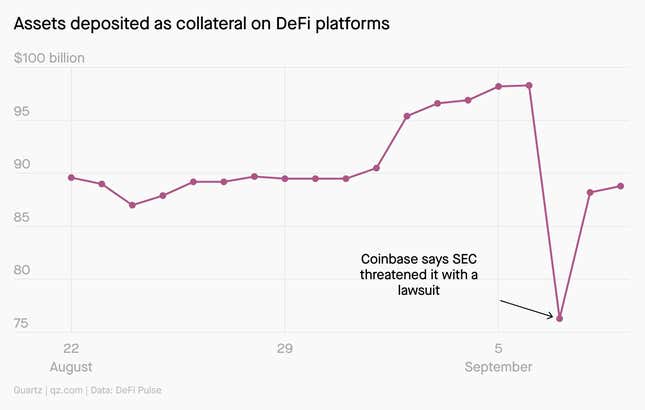

In the US, the Securities and Exchange Commission (SEC) has put DeFi, or decentralized finance, in its sights, and is threatening to sue Coinbase, the country’s largest crypto exchange. Further south, the International Monetary Fund (IMF) warned that El Salvador’s let’s-make-bitcoin-legal-tender experiment could damage economic stability. Meanwhile, a top official at the Bank for International Settlements says central banks have to speed up their own work on digital currencies, because crypto alternatives are sprinting ahead.

These episodes underscore crypto’s status as a $2 trillion gorilla: too big for regulators to ignore, but not so easy to tame. Take Coinbase’s Lend product, which is meant to offer a 4% annual yield to customers who allow the company to lend out a crypto token pegged to the US dollar. Legal experts disagree on the SEC’s objection to Lend—is it a security? A bank account?—but they do agree on two things:

- Regulators aren’t going to allow a parallel financial system to rise up that’s outside their purview.

- Crypto moves quickly but rules get made slowly; that means watchdogs will always be playing catch-up.

Regulators are expected to ensure financial stability and protect investors, but also—as we contemplate the years since 9/11—to keep the banking and money systems from being used by criminals and terrorists.

The hard part is coming up with laws that protect the public without stifling new ideas or penalizing companies that want to follow the rules, explains Carol Goforth, a law professor and crypto specialist at the University of Arkansas. She says there’s a risk of “the criminal element utilizing these assets, these products, to seriously harm the public [and] the existing financial infrastructure.”

The backstory

- Crypto startups “want” regulation. For almost a decade, plenty of cryptocurrency proponents have argued that regulatory uncertainty is holding the ecosystem back.

- Gary Gensler is the new crypto sheriff. The SEC chair is skeptical about stock picking, taught a class at MIT about blockchain, is a Goldman Sachs alum who antagonized Wall Street as a watchdog, and happens to be a very good dancer.

- Central banks are going digital, too. Policy makers from Washington to Beijing are developing digital forms of cash as online payments and crypto assets proliferate.

And Howey!

“We are forcing this new thing into existing regulations, hopefully, while we wait for better-fitting rules to come along and be enacted.” —Crypto specialist Carol Goforth

In the US, much of the SEC’s decision making—including potentially on Coinbase’s Lend—comes down to Supreme Court cases in 1946 (the Howey test) and 1990, which decided what constitutes a security and therefore what falls under the SEC’s purview.

Experts are divided on where Lend fits in. Duke University law professor James Cox says Lend smells like a security in most respects, and probably is one under the catchall of an “investment contract.” Goforth says Lend looks more like a lending product, such as a bank’s high-yield savings account, and shouldn’t be considered a security.

What to watch for next

- Unimpressed bond investors. Even if politicians like El Salvador’s Nayib Bukele won’t listen to their citizens (or the IMF), eventually they’ll have to listen to the bond vigilantes: The country’s borrowing costs have shot up since its bitcoin maneuver was announced.

- The US will approve a bitcoin ETF. Bloomberg analyst (and ETF guru) Eric Balchunas expects the SEC to finally greenlight a bitcoin exchange-traded fund in October, which would make buying and selling crypto as easy as trading a stock.

- More DeFi charges. Decentralized finance—automated software that lets people transact directly with each other—won’t evade the regulatory gaze forever; in August, SEC commissioner Hester Peirce called out projects that are Decentralized in Name Only (DINOs).

- Ethereum will get greener. In the next six months or so, the second-most valuable crypto asset will switch from energy-gobbling “proof-of-work” consensus for transactions to energy-sipping “proof-of-stake.”

- Movie theater chain AMC will start accepting bitcoin. This combines two highly speculative assets (AMC stock and the original crypto token), but it’s not likely to make bitcoin more popular for payments. Payment giant Stripe ended its support for the cryptocurrency years ago.

DeFi-ing gravity

One 🔮 thing

Predicting the development of a new technology is notoriously difficult, but amateur forecasters are giving it their best shot. Online prediction platforms ask users to anticipate the future, and then use those predictions to create “consensus forecasts.” Here are some of the predictions they have for crypto:

25%: Chance Amazon will accept any cryptocurrency by October 2022

40%: Chance Amazon will accept bitcoin before 2024

24%: Chance that another country will classify bitcoin as legal tender by the end of this year

20%: Chance that bitcoin switches from “proof-of-work” by 2035

7 Quartz stories to spark conversation

💱 El Salvador’s bitcoin fixation is like a Reddit meme-stock craze

🤝 Climate cooperation means climate competition to China and the US

📣 Silicon Valley is losing its grip on the US social media market

📈 Opioid overdoses are killing more Black Americans than ever

🌍 The world’s biggest carbon-sucking machine switched on in Iceland

🇮🇳 Reliance Jio’s cheap data turned India’s internet dreams into reality

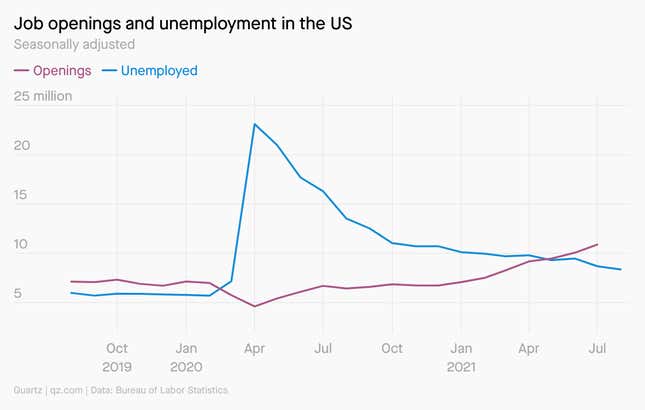

💼 Why the US has a record 10.9 million job openings

5 great stories from elsewhere

🚢 The sinking of the Satoshi. Three crypto fans bought a cruise ship and planned to make it a libertarian utopia. The Guardian digs into what went wrong.

📱 Getting Republicans to give up their iPhones. The New York Times profiles a 22-year-old bitcoin millionaire whose ill-fated Freedom Phone was meant to liberate conservatives from Big Tech.

🙅♀️ The other Afghan women. The New Yorker looks at how how US-Taliban conflict turned women in rural Afghanistan against occupying forces.

🐻 “God, how I love this music.” N+1 waxes poetic about the “tender, nostalgic, and frequently celestial” posts found on Internet Archive’s Grateful Dead collection.

❤️ Are you my mother? For Catapult, Quartz alumnus Thu-Huong Ha writes poignantly about her parents’ retirement, and realizing that even our role models are mutable.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Best wishes for a secure weekend,

John Detrixhe, senior reporter (obsessed with payments)

Kira Bindrim, executive editor (crypto noob)