Hi Quartz members!

Over the past year, there has been a lot of buzz in China around the notion of “high-quality” economic growth. The country’s 14th Five Year Plan, which was issued last year and maps out big economic and political priorities through 2025, made clear that “high-quality” growth under a “new development pattern” is a key priority. But what exactly does “high quality” mean?

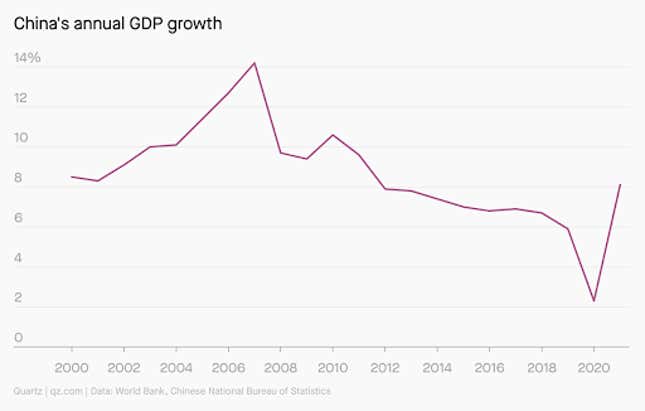

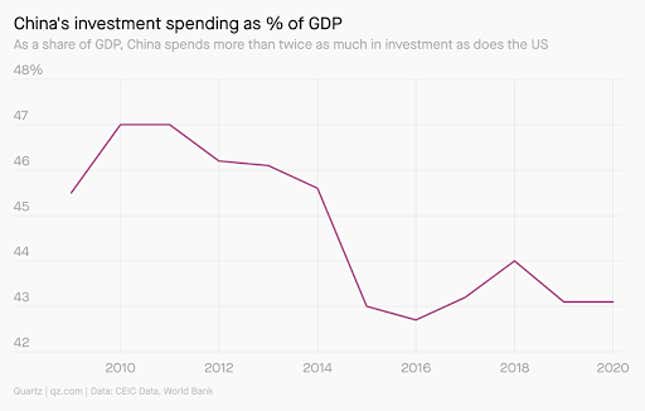

Historically, the activities that have boosted China’s GDP growth rates include high investment spending—primarily in infrastructure and real estate, which together make up about 25% to 30% of China’s GDP. But there are only so many apartment buildings and bridges that need to be built before those investments become unproductive. And in recent years, as “ghost towns” proliferated and real estate developers accumulated debt, Beijing came to the realization that the breakneck speed of GDP growth in decades past is no longer possible nor sustainable. China’s Evergrande, the world’s most indebted developer, is the errant poster child for what Xi has criticized as “inflated” or “fictional” growth, as opposed to “genuine.”

Thus the emphasis on “high-quality” growth is in fact a signal of an important pivot, Travis Lundy, a Hong Kong-based independent analyst, said on a recent episode of Bloomberg’s Odd Lots podcast. “That means that they were telling you very clearly, the stuff that we did before to get a very high growth rate, we’re not going to do it anymore,” Lundy said. “That’s a policy decision.”

For an authoritarian government whose legitimacy is heavily dependent on delivering sustained economic growth and improving the livelihoods of its populace, the shift in focus towards quality of growth is also a way of managing expectations and also diverting attention away from the many structural headwinds that China’s economy is facing, including an aging population and lagging productivity, said Alicia García-Herrero, chief economist for Asia Pacific at Natixis.

“I have a feeling that the official wording is evolving for a crucial reason because [China is] in the midst of both structural deceleration and also cyclical deceleration,” said García-Herrero. “So it’s very hard to find the right words to tell the world, ‘We’re decelerating.’”

The backstory

- “High-quality” growth is so hot right now. It’s a key focus of China’s latest five-year plan. Chinese leader Xi Jinping has stressed its significance. And prominent Chinese economists argue it’s key to China’s future.

- China’s GDP numbers are… complicated. Many economists argue that China’s GDP numbers do not give an accurate picture of the underlying economy and are not comparable with those of other major economies, like the US. As Michael Pettis, finance professor at Peking University’s school of management, explains, this is because much of the Chinese economy operates under soft budget constraints. A hard budget constraint means “you’ve got to have the money to spend it,” whereas a soft budget constraint means there’s no limit to one’s spending and losses can in principle be rolled over indefinitely. Local governments in China operate under soft budget constraints, in contrast to the hard budget constraints of other major Western economies, and because they comprise a large share of economic activity, China’s GDP numbers are fundamentally different in nature and as such, incomparable.

- The World Bank agrees a shift is in order. As it noted in a December 2021 paper (pdf), in order for China to achieve “high-quality” growth, the country will need to rebalance “from external to domestic demand, from traditional investment and industry to consumption and services, from the state to markets and the private sector, and from a high to a low-carbon economy.”

Charts to watch

Can China change its growth model?

Pettis, the finance professor at Peking University, believes there are five paths—one of which China is currently on—that Beijing can take:

- China continues what it’s doing now, with heavy emphasis on investment in infrastructure and property, and debt continues to rise faster than GDP. However, this is unsustainable, and Beijing has signaled that it doesn’t want to continue this model indefinitely.

- China reduces non-productive investment and replaces it with productive investment, such as in the tech industry. However, it’s difficult to shift such a large part of Chinese investment into an as yet relatively small sector, and Beijing has been trying unsuccessfully to do this for years.

- China reduces non-productive investment and replaces it with consumption. However, this requires that the household share of GDP rise by at least 10-15 percentage points, mainly at the expense of local governments—a politically challenging thing to do.

- China reduces non-productive investment and replaces it with a trade surplus. However, China already has a giant trade surplus and it’s difficult to increase it substantially.

- China reduces non-productive investment and doesn’t replace it, leading to a big drop in GDP growth rates.

“And that’s it,” Pettis says. “There is no other path China can follow. So the question is, which one will they follow? My guess is that [China] will continue on the first path for a bit longer and ultimately will go to the fifth path.” In that case, China would slump into a long period of economic weakness, much like Japan did for decades beginning in the 1990s.

One 🕳️ thing

Pettis illustrates the hard budget/soft budget distinction with two hypothetical, identical Chinas—with the only difference being one has hard budget constraints and the other has soft budget constraints.

1️⃣ In the first China, a construction firm spends $100 digging a hole, then $100 filling it up. “In a hard budget constraint economy or in a normal accounting, you have an expense of $200 and nothing to show for it,” said Pettis.

2️⃣ In the second China, a construction firm similarly spends $100 digging a hole, then $100 filling it up. “But in [this] China, you don’t expense it,” he explained. “You call it an asset. You say, I have now built an asset worth $200.” This, Pettis noted, is how GDP accounting works in the China that we all know. What this means is that China’s official GDP figures as currently reported are inflated a lot relative to actual economic conditions, and are also impossible to compare with the GDP figures of other nations.

Quartz stories to spark conversation

🛰 A small solar storm wrecked SpaceX satellites. What will a big one do?

👶 The US approach to child welfare is based on misleading research

👭 McKinsey says same-gender couples are better at dividing up housework

🌍 Africans are trying to fix Wikipedia’s language problem

📦 Thanks to Amazon, warehouse rents have never been higher

🧐 Can a deepfake company be ethical?

🗣 The crypto craze is spawning a new niche in psychology: therapy for crypto addicts

5 great stories from elsewhere

🌳 CLEÄRCÜT. Romania has been logged to an inch of its life since joining the EU and embracing the trade flows from its uniquely dense forest. The New Republic demonstrates how IKEA, the world’s largest wood consumer, essentially holds Romania’s future in its hands.

🎥 An offer they did refuse. Francis Ford Coppola, 82, is working on his life’s masterpiece, but no one is willing to finance it, and the famed American director can’t really explain the film himself. So Coppola has put $120 million of his own money into the project, he reveals in a rollicking and beautiful GQ profile.

💻 Cool tools. In a tight labor market, even software is negotiable. “I literally told the recruiter: ‘I’m sorry, using Microsoft Teams is not for me,’” one job seeker told Protocol in a piece about the cachet and stigmas attached to workplace productivity tools.

🍞 Open faced. One of the most famous American ad campaigns, “You don’t have to be Jewish to love Levy’s,” featured a Native American biting into a pastrami-on-rye. Identifying that man for the first time, The Forward spins a fascinating yarn about food, advertising, and cultural pluralism.

📺 Screen time. A surprising thing happened on the way to home theaters: Consumers are eschewing set-top boxes like Apple TV and Amazon’s FireTV in favor of the software provided by TV manufacturers. Evan Shapiro, a professor of media and business, explains the implications of that shift in a piece for VideoWeek.

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Best wishes for a high-quality weekend,

—Mary Hui, Quartz reporter in Hong Kong (obsessing over Chinese industrial policies)