Hi Quartz members,

Before the war in Ukraine, Europe had zero new liquified natural gas import terminals planned. Now it has 12. Yikes.

Gas must be liquified to reach from production fields in places like the US, Qatar, and Australia to customers in Asia and Europe. Although LNG has plenty of its own emissions, it can be an improvement, climate-wise, over coal-fired electricity. Even before the war, LNG prices were rising globally as demand in Japan, South Korea, and other coal-reliant Asian countries surged, creating competition for a relatively limited supply.

But Europe was never supposed to see an explosion in LNG demand; its gas needs were met by existing pipelines and terminals, and it was the world’s most advanced market for renewables. In the past, some European countries had actually rejected US LNG shipments on the grounds that they were too emissions-heavy. Now, the need to quickly drop Russian gas has changed the story, and made Europe the hottest new market for LNG exporters.

If LNG could perfectly offset Russian gas that would stay in the ground without European customers, this might not be a big deal. But LNG is more carbon-intensive than pipeline gas. And the bigger problem is the timeline: Building a fleet of new, multibillion-dollar LNG terminals with a return-on-investment horizon of decades means either locking in gas reliance at a time when the shift to renewables has never been cheaper or more urgent, or leaving investors on the hook for stranded assets.

That risk was made especially clear this week in the latest report from the Intergovernmental Panel on Climate Change, which explained that existing fossil fuel infrastructure already blows past the Paris Agreement warming target. “The truly dangerous radicals,” UN secretary-general António Guterres said, “are the countries that are increasing the production of fossil fuels.”

The backstory

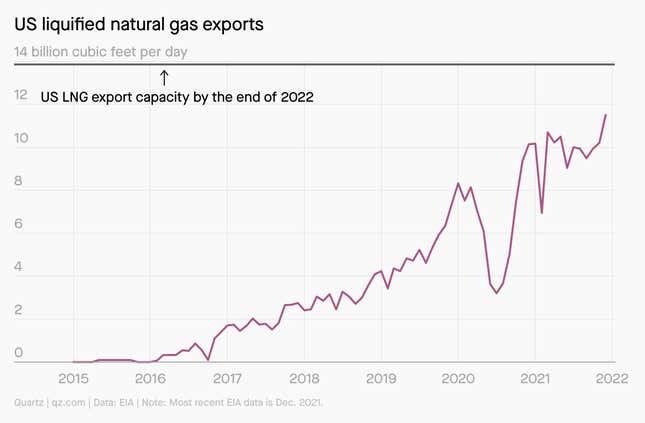

- LNG demand was surging before Ukraine. Countries everywhere—and particularly in Asia—are trying to lower their reliance on coal. The US has been racing to bring more shipping terminals online for the past few years, and in December 2021 finally surpassed Qatar and Australia as the world’s top LNG exporter.

- America doesn’t exactly have gas to spare. The US has already contracted to sell almost all the LNG it can pump, and building the infrastructure to produce and export more will take years. So it’s not exactly clear how the US will accommodate European demand, other than by convincing Asian customers like China and Japan to resell some of their American LNG to Europe. Longer-term, European buyers are signing advance contracts for US LNG that won’t be delivered until 2025 or later.

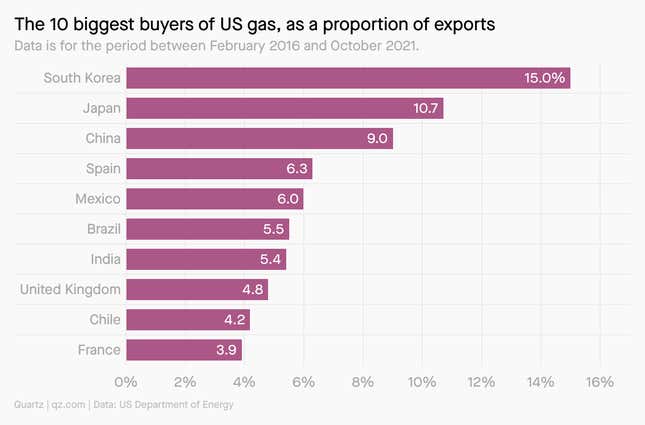

- Europe’s demand could shock energy prices in Asia. Already last year, countries like Japan and South Korea were hit by surging power prices in the face of a squeeze in the gas supply. Poorer countries—like India, which is among the top 10 purchasers of US LNG exports—are far more sensitive to price. If LNG prices stay high for years, governments and citizens may well wonder about their ability to pay for the transition to cleaner fuel.

The LNG landscape

In February, US LNG exports hit a record of 13.3 billion cubic feet per day, the first time that all seven US terminals were fully docked by tankers at once.

South Korea, Japan, and India are among the top 10 purchasers of US LNG exports, according to the US Department of Energy. Eight countries in east Asia and the Pacific bought nearly 40% of US exports between 2016 and 2021.

What to watch for next

- Drill, baby, drill. It’s strange to find Democrats in the US Congress—usually reliable supporters of climate change policy—castigating oil executives for not drilling more. But that’s what they did on April 6. The UK, several African countries, and others are also keen to ramp up drilling in response to the war.

- Planning for hydrogen. LNG infrastructure could be repurposed to carry hydrogen, an emerging energy source that can be low-carbon depending on how it’s made. Some European officials have called for any new LNG terminals to be designed with a hydrogen future in mind.

- Shareholder revolts. Energy companies and their financiers are under mounting pressure from investors to explain their fossil fuel plans and how they expect to avoid stranded asset risk. Numerous climate-related resolutions will be up for votes at companies’ annual meetings over the next two months.

How to explain it to your friends

It’s like you have this one ex (LNG) that you keep texting even though he’s kind of toxic because he helps you deal with trauma from an older relationship (coal) that was really bad. So that’s maybe not great, but fine. But then, if you start texting multiple exes this way (building more LNG terminals), your friends will be like: “Whoa, all this texting is keeping you from finding true love” (zero-carbon energy).

Quartz stories to spark conversation

📈 The ruble bounced back. Are sanctions not working?

📺 One thing is keeping streaming TV from taking over

🏠 Great news! US mortgage interest rates just hit 5%

🚀 SpaceX has flown more people to space than China has

🎻 A renowned orchestra shows how boss-free companies thrive

📱 Why Africa’s digital payment landscape is so fragmented

🇮🇹 Italy will offer visas to remote workers seeking la dolce vita

👋 The Great Resignation is not really great, or a resignation

5 great stories from elsewhere

🤑 “I don’t want a yacht.” Sam Bankman-Fried, the 30-year-old founder of crypto exchange FTX, sleeps on a beanbag, drives a Corolla, and plans to give away 99% of his fortune. “You pretty quickly run out of effective ways to make yourself happier by spending money,” Bankman-Fried tells Bloomberg, which describes him as as a “strange sort of capitalist monk.”

💵 The future of the dollar. In Chartbook, Adam Tooze interrogates one strain of what he calls finance fiction, or “Fin-Fi”—geopolitics and the power of the dollar. “My bet is that the current system has huge inertia and is tied down by gigantic network economies,” Tooze writes. “All [the] ‘alternatives’ to the dollar are, in fact, underpinned by dollar swap lines.”

😴 How to do a four-day workweek. The research is in: Working fewer hours is better for workers and their employers. But the typical “four-day workweek” often refers to the same number of hours, just spread out differently. The Washington Post looks at how to make this increasingly popular workplace experiment truly effective.

📦 The Amazon union’s DIY duo. In the wake of the successful unionization vote at a Staten Island Amazon warehouse, this profile by The City of organizers Christian Smalls and Derrick Palmer takes on new meaning. “I know how to stand my ground and that’s part of the reason we’ve been so successful,” Palmer says. “Just staying engaged, because any other person probably would have gotten scared.”

👼 Forgive and let live. What if someone wronged you but still hasn’t apologized? Forgive them anyway! “When you forgive someone, it doesn’t mean you have to have any kind of ongoing relationship with them,” one expert tells Vox for a treatise on forgiveness. “It’s an internal shift, where you’re no longer carrying the wound in the same way.”

Thanks for reading! And don’t hesitate to reach out with comments, questions, or topics you want to know more about.

Best wishes for a non-toxic weekend,

—Tim McDonnell, climate and energy reporter

—Samanth Subramanian, fixing capitalism reporter