Dear readers,

Welcome to Quartz’s newsletter on the economic possibilities of the extraterrestrial sphere. Please forward widely, and let me know what you think. This week: Billionaires battle for the airwaves, meet some big new rocket engines, and Capstone, can you hear us?

🚀 🚀 🚀

Has Charlie Ergen finally met a rival he can’t intimidate?

The telecom tycoon built his fortune as a satellite television pioneer with Dish. Today, Ergen’s company has made a $30 billion bet by buying up licenses to use the electromagnetic spectrum between 12 and 12.7 gigahertz and asking the Federal Communications Commissions to approve a 5G mobile network there.

Standing in his way? Elon Musk and his biggest fans, the subscribers to SpaceX’s satellite internet network Starlink. Starlink and other satellite operators use that same radio real estate, and SpaceX argues that the two networks cannot coexist. It wants the FCC to say no to Ergen and Michael Dell, another billionaire entrepreneur who also owns licenses for a significant share of these radio waves through a company called RSAccess.

The technical questions are hard to resolve, and the sides have submitted dueling engineering analyses. Dish and RS Access say a proposed 5G network wouldn’t interfere with satellite transmissions from companies like SpaceX and OneWeb. SpaceX says that finding is the result of “laughably false” assumptions, and that a more accurate assessment predicts outages for three-quarters of SpaceX customers in Las Vegas, a city used for the study because both sides have deployed networks there.

“This band [of radio frequencies] works like a library. Everyone has to come in and whisper so that everyone can use the library,” said a SpaceX executive who did not want to be identified discussing regulatory proceedings. “Dish and RSAccess are asking to start walking around and playing a trumpet.”

The FCC has said that it could approve Dish and RS Access’s plans if there is a specific technology to protect existing users of the band. An increase in lobbying from both sides has FCC observers expecting some kind of decision in the months ahead. SpaceX called on its subscribers to weigh in with the telecom regulator and tens of thousands of Elon Musk’s fans have filed public comments in favor of Starlink.

Customer pile-ons have been a winning strategy for Musk—but also for Ergen, who likes to unleash his subscribers on counter-parties that won’t give him a good deal. Just last year, Dish accused Sinclair Broadcasting of “using millions of Americans as pawns in its negotiations” and proclaimed that another broadcaster, Tegna, “Prioritizes Greed above Consumers” while negotiating television rights deals.

“Of all the satellite operators in the world, I’ve never seen any go on the offensive so many times against such a wide range of companies,” Quilty satellite business analyst Caleb Henry says of Dish. “Why SpaceX took that [aggressive] approach is a mystery to me. Maybe it was to beat Dish to the punch. Normally these kinds of spectrum disputes are handled out of the spotlight.”

Just last week, the FCC approved Starlink users to access the disputed frequencies while on the move, which will allow the company to offer mobile connectivity to vehicles besides access for homes and other buildings. While the FCC said the approval doesn’t prejudge its decision about Dish and RS Access, both companies had argued against the decision. Independent experts at NGOs Public Knowledge and New America warned the FCC that SpaceX is trying to build out its customer base using these frequencies to get ahead of the agency’s decision.

The bigger question at stake is how the US government allocates publicly owned airwaves. The principle is to encourage private investment in communication networks; spectrum auctions are designed to allocate scarce public resources to those who will do the most good with them.

SpaceX argues that Dish and RS Access have been hoarding spectrum since they acquired these licenses years ago and have only built out limited services. To be fair, FCC rules currently don’t allow them to build out a particularly useful terrestrial network. SpaceX and OneWeb, on the other hand, have spent billions of dollars building out an active communications network with hundreds of thousands of subscribers who stand to lose access if Ergen and Dell get their way.

The FCC is also likely to weigh whether another terrestrial network could create more competition in the concentrated US telecom sector. But if a 5G network is approved in this band, it’s possible that Ergen and Dell will simply sell the much more valuable licenses to other operators, if they can pass an anti-trust review.

Tim Farrar, a satellite industry analyst, said the FCC would typically find a compromise. One potential outcome could be the FCC allowing more terrestrial use in the 12 GHz band, while also approving Starlink’s next generation of satellites, which would likely unlock hundreds of millions in subsidies for rural internet users. SpaceX’s recent detente with OneWeb could be seen as teeing up that kind of deal.

Since then, however, Dish has alleged SpaceX allowed users to illegally test mobile service, and SpaceX has published its engineering analysis and unleashed its fans on Dish.

“With this study [predicting major interference problems], there is no reason to keep this proceeding open any longer,” the SpaceX executive told Quartz. “As long as its open, Dish and RS Access will attack and oppose everything that we do.”

🌘 🌘 🌘

Imagery interlude

The next generation of rocket engines is coming our way. This week, United Launch Alliance CEO Tory Bruno shared photos of the BE-4 rocket engines that were built for the new Vulcan rocket by Blue Origin. The long-awaited methane-fueled engines will also power Blue’s New Glenn orbital rocket whenever it lifts off.

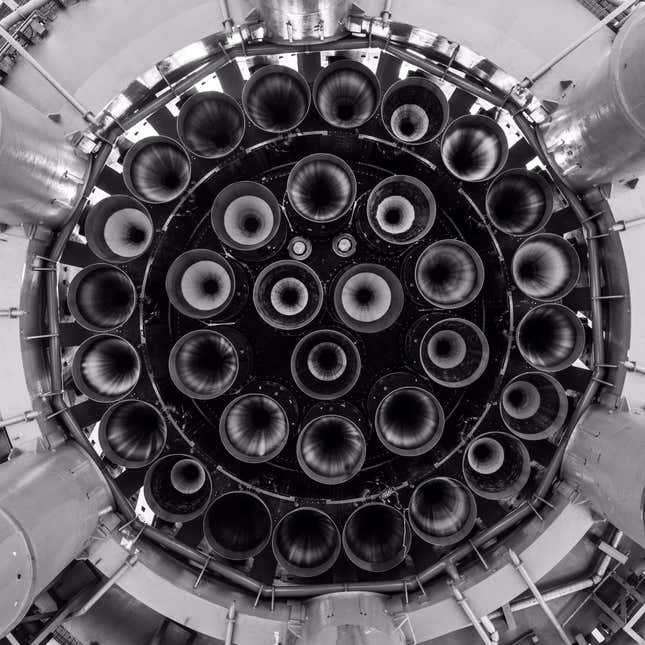

Not to be outdone, SpaceX shared some images of its new methane-fueled engine, the Raptor, which has been demonstrated in a few test flights. Now, the company has packed 33 of these babies into the booster for Starship, the next generation rocket Musk’s team hopes to fly on an orbital test flight sometime this year. That’s a lot of power:

Both engines are designed to generate about 500,000 lbs of thrust, which is just a bit more than generated by a Space Shuttle engine, for example.

🛰🛰🛰

SPACE DEBRIS

Aerojet’s boardroom madness ends. The US rocket and missile-maker resolved a battle between chairman Warren Lichtenstein and CEO Eileen Drake after a shareholder vote backed Drake’s slate of corporate directors. Following a failed acquisition by Lockheed Martin that was scuttled after questions about competitiveness, Aerojet’s management team will focus on the defense contractor’s future as an independent company.

Virgin Galactic to buy Boeing planes. The space tourism company tapped Aurora, a subsidiary of Boeing, to build a new carrier plane that can haul the company’s spacecraft 40,000 ft into the sky before it is released to ignite its rockets and travel to the edge of space. Virgin Galactic is struggling to meet its goals, but this deal at least offers some measure of payback to Boeing, which invested $20 million in Virgin’s IPO, ostensibly to gain access to its advanced aerospace technology.

Rocket Lab takes the lead. After launching its first lunar mission with Capstone last week, the small rocket maker announced two new launches for the US National Reconnaissance Office. The publicly traded space firm is on track to exceed its record of six successful launches in a calendar year, set in 2019 and 2020. That puts it comfortably in front of fellow publicly traded rocket makers Astra (one successful mission) and Virgin Orbit (two successful missions).

The Constellation Class is (finally) real. One frequent pitch in the small rocket world is that these vehicles are perfectly suited to launching spacecraft for the enormous new satellite networks being built by SpaceX, OneWeb, and Amazon. Until this week, it wasn’t clear that any satellite operators saw small rockets in the same way, and indeed several companies have pivoted to build larger vehicles. Now, Relativity Space, which hopes to fly its first mission later this year, has signed a deal to launch OneWeb’s second generation of satellites starting in 2025.

Capstone connection. The tiny satellite trying to prove a funky orbit and kick-start the US return to the Moon lost contact with the Earth, but engineers were able to regain communications with the vehicle.

Your pal,

Tim

This was issue 141 of our newsletter. Hope your week is out of this world! Please send your ideal solutions for the 12 GHz band, predictions for the next rocket to reach orbit for the first time, tips, and informed opinions to tim@qz.com.