Disney is starting to shed streaming subscribers

Paid subscriptions for Disney+ fell 1% from the previous quarter to 124.6 million subscribers

Paid subscriptions for Disney+ fell 1% from the previous quarter to 124.6 million subscribers

Disney’s (DIS) streaming business once again turned a profit last quarter. But its flagship platform is starting to lose subscribers.

The House of Mouse on Wednesday released its fiscal first-quarter results, with growth being driven primarily by the company’s box office dominance and profit gains in its streaming business.Disney stock rose about 1% during pre-market trading Wednesday.

“Overall, this quarter proved to be a strong start to the fiscal year,and we remain confident in our strategy for continued growth,” Disney CEO Bob Iger said in a statement. He noted that the company had the top three movies last year: Inside Out 2, Deadpool & Wolverine, and Moana 2.

But on the streaming side, paid subscriptions for Disney+ fell 1% from the previous quarter, to 124.6 million subscribers. The company also said it expects another “modest decline” in the second quarter.

Despite this, Disney reported that its overall streaming business, which includes Hulu and ESPN+, turned a profit, with operating income rising more 100% to $293 million in the three months ending Dec. 31. That compared with a loss of $138 million during same period in 2023.

Disney may have been late to the streaming game — Disney+ launched in 2019, more than a decade after Netflix (NFLX) — but it seems to have finally hit its stride, as long as it can stop or minimize shedding subscribers. After five years, the company’s streaming division finally urned a profit for the first time last year. And more recently, Disney expanded its portfolio by acquiring the sports-centric FuboTV. Disney has also raised its prices.

Overall, Disney’s profit rose 38% in in the three months ending Dec. 31 to $2.6 billion, from $1.9 billion in the same period the prior year. The company’s revenue was up 5% year-over-year to $24.7 billion in its fourth quarter, from $23.5 billion.. Its earnings per share came to $1.76, outperforming Wall Street expectations of $1.45, according to a consensus estimate from analysts surveyed by FactSet (FDS)

Amid all this, Disney continues to struggle with its traditional television assets, which include the broadcast network ABC and its cable channels National Geographic, FX, and others. The company reported that its operating income from the linear networks fell 11% to $1 billion million in its fourth fiscal quarter, from $1.2 billion in the same quarter in 2023.

Unlike some of its competitors, the company remains committed to its broadcast and cable networks — for now.

After a five-year pause, missed payments are once again being reported to credit bureaus, with some borrowers seeing scores fall by more than 150 points

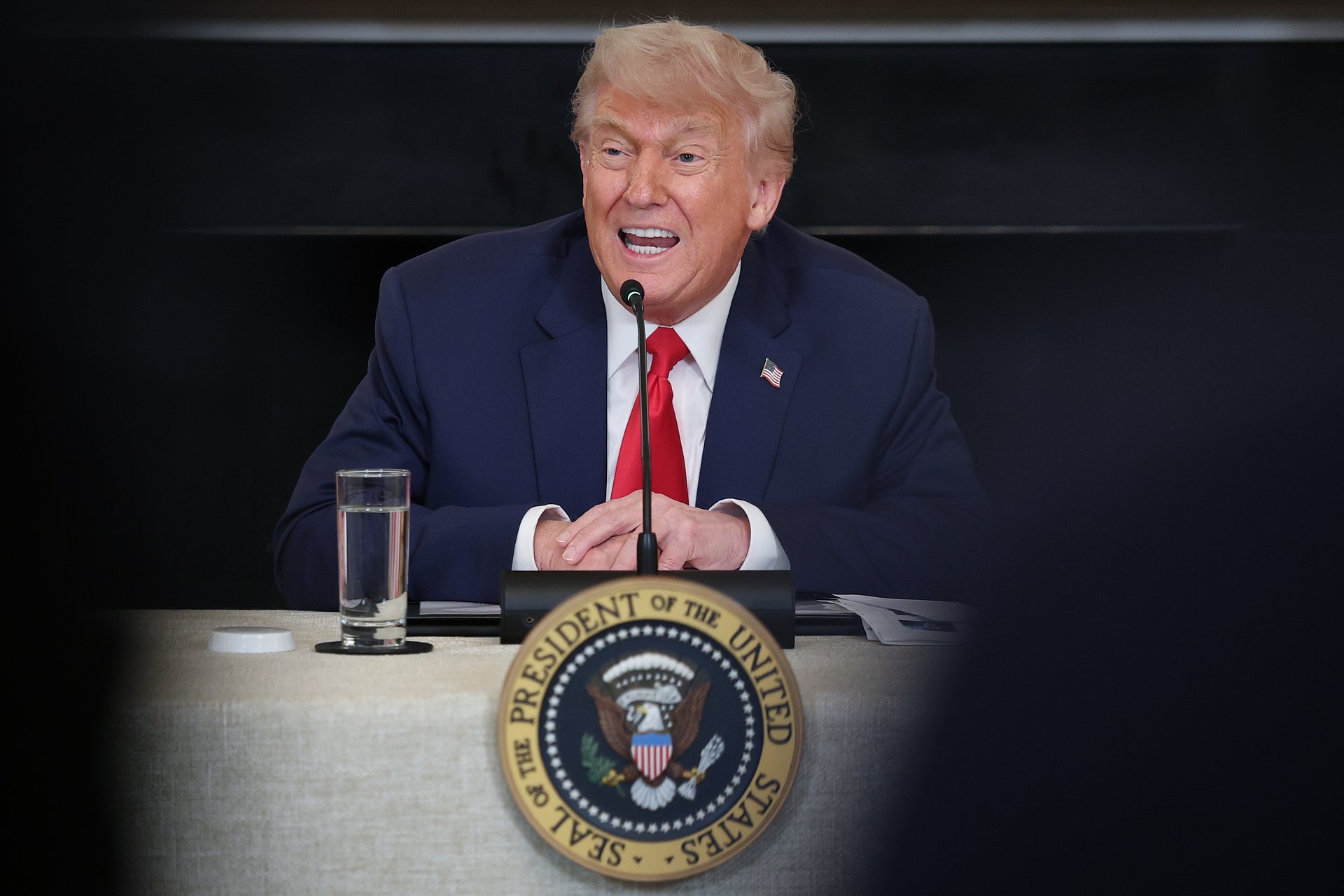

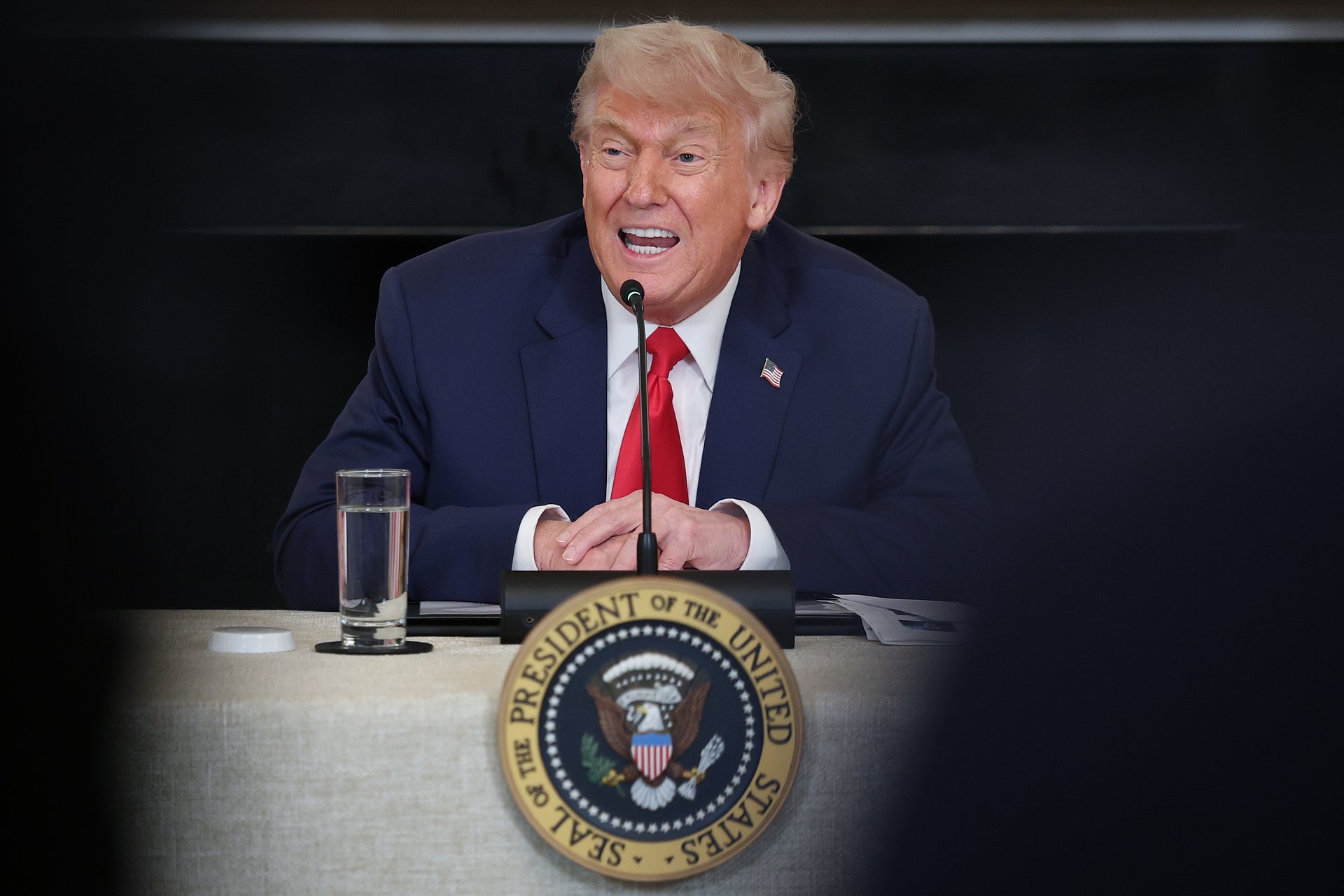

Millions of student loan borrowers are watching their credit scores plummet in real time as the Trump administration resumes federal debt collections.

After a five-year pause on collections, missed payments are once again being reported to credit bureaus, with some borrowers seeing their scores fall by more than 150 points — which has the potential to jeopardize their ability to rent apartments, obtain loans, or access reasonably priced credit. The Federal Reserve Bank of New York estimates that more than two million borrowers have so far experienced score declines of at least 100 points, as of the first quarter of 2025.

More than 5 million borrowers are currently in default, and that number is expected to rise, with the New York Fed projecting significant credit score drops for over 9 million borrowers.

In addition to the hit to their credit scores, those in default also face wage garnishment and the seizure of tax refunds through the Treasury Offset Program. Social Security garnishment remains paused as of June.

The timing is especially challenging for younger borrowers. Unemployment among college graduates ages 20 to 24 has risen to 6.6%, the highest level in a decade outside of the pandemic. New graduates face stiff competitions for jobs, with many entry-level jobs now requiring years of experience. Even retail and restaurant jobs can be hard to come by.

Combined with proposed cuts to federal student aid in President Donald Trump’s broader budget plan, the resumption of collections signals a new era of aggressive enforcement — and growing financial strain for borrowers across the country.

“Borrowing money and failing to pay it back isn’t a victimless offense,” Education Secretary Linda McMahon wrote in a recent Wall Street Journal op-ed defending the Trump administration’s resumption of collections. “Debt doesn’t go away; it gets transferred to others.”

And she would know. Despite the Trump administration’s hardline stance on student loan repayment, both Trump and McMahon have personally benefited from the kinds of financial forgiveness now being denied to millions of borrowers.

Trump’s businesses have filed for bankruptcy six times, allowing him to walk away from or restructure hundreds of millions of dollars in unpaid loans. In one prominent case, lenders forgave more than $270 million in debt tied to Trump Tower Chicago. While Trump has insisted these were strategic moves, they underscore how bankruptcy laws have long offered protections to business owners that student borrowers are explicitly denied.

McMahon also has a history of seeking debt relief. In 1976, she and her husband, Vince McMahon, filed for personal bankruptcy after an early business failure left them unable to pay creditors. Years later, their professional wrestling company, Titan Sports (the predecessor to WWE), also declared bankruptcy as part of a broader corporate restructuring. McMahon, in the 2010s, seeking to begin a political career amid media scrutiny that brought her history of bankruptcy to light, repaid some of those debts after a lapse of nearly 40 years.

In other words, both Trump and McMahon relied on financial resets and breaks that her Education Department now refuses to extend to borrowers struggling under the weight of — ironically or not — far more modest debts.

GOP senators are still ironing out the final details of their version of the sweeping legislation. Taxes will be in the spotlight

Republicans are projecting confidence that they'll be able to wrap up work within the next three weeks on sweeping legislation containing most of President Donald Trump's domestic policy agenda

"It will get done. We need to get it done," Senate Majority Leader John Thune said in a Fox News Sunday interview. "We will roll into the Fourth of July recess, if necessary, in order to get this on the president's desk."

The sentiment was echoed by Sen. John Barrasso of Wyoming, the second-ranking Senate Republican, in an interview on Sunday Morning Futures on Fox Business.

"The idea is to get this done by the Fourth of July," Barrasso said.

GOP senators still must clear several procedural maneuvers, including a marathon amendment session, before passing it in the Senate. Conservative House Republicans may still balk if spending cuts are diminished in the upper chamber.

In the next few days, the Trump-backed package faces a major test. The Republican-led Senate Finance Committee is expected to release its portion of the megabill focused on taxation as early as Monday. It is poised to include extensions of several business-friendly deductions, a child tax credit expansion, no taxes on tips, no taxes on overtime pay, and more.

Republican senators have signaled they intend to restore several business-provisions and make them permanent. That includes immediate expensing for research and development spending and 100% bonus depreciation, which is a write-off for certain short-lived investment spending. The current House-approved bill only set up a shelf-life of five years for those tax measures.

Meanwhile, Trump traveled late Sunday to the G-7 summit of world leaders. The White House is pushing to discuss trade, stepping up American energy exports, and AI development with the assorted heads of state, Bloomberg reported.

Good morning, Quartz readers!

What the markets have in store: a high-stakes policy decision and economic projections from the Fed, plus earnings from Accenture, CarMax, Kroger, and Darden Restaurants.

Feeling spendy? According to the most recent consumer survey, buyers are feeling better about the U.S. economy — in the short term, at least, as some economic concerns loom large.

Processing a rivalry. AMD wants to take Nvidia’s throne (and market share) and thinks its latest chips and strategic partnerships will help the company do just that.

Apple shifts its core. It’s now getting 97% of its U.S.-sold iPhones from India as it continues to navigate its supply chain away from dependence on China amid trade war concerns.

Model X-tra. Tesla unveiled upgraded versions (with new features, namely: soundproofing) of its popular S and X models — which come with a $5,000 hike to their prices.

Bangtanomics: K-pop group BTS’ long-awaited return — after the members completed military service — will have an outsized impact on South Korea’s GDP and the global economy.

If you’ve never heard of dysprosium, don’t worry — you’re not alone. But your EV, your iPhone, and the F-35 jet buzzing overhead are well acquainted. Dysprosium is one of the obscure but essential “rare-earth elements” (REEs) that power everything from magnets in Teslas to missile guidance systems — and right now, they’re one of the quietest frontlines in the U.S.-China trade war.

The minerals aren’t actually rare, but the ability to process them is — and China has that part on lock. As of this year, Beijing refines nearly all of the world’s heavy REEs and 90% of the light ones. That control just got sharper: After adding key REEs to its dual-use export control list and throttling magnet exports, China has left U.S. automakers and defense contractors scrambling. Tesla reportedly saw delays; some suppliers are reportedly in “full panic.”

Washington’s response? Rumors of $400-plus million in Defense Production Act funds, a growing rare-earth mine in California, and whispers of a Strategic Rare Earth Reserve. But analysts say it’ll take years before the U.S. can compete — and in the meantime, China’s playing geopolitical chess with a six-month export permit timer.

The next big trade war may be fought not over oil or chips — but over minerals you’ve never heard of and still can’t pronounce. Quartz’s Shannon Carroll has more on the minerals silently running your phone, car, and democracy.

The Trump administration is turning up the heat — and the tariffs — on your next household appliances.

In a fresh twist on an old trade war, the White House announced that tariffs will be slapped on imported appliances made with steel, including washer-dryers, fridge-freezers, dishwashers, and cooking stoves. The levies, dubbed “steel-derivative product” tariffs by the Commerce Department, go into effect June 23. If it sounds like déjà vu, you’re not wrong — this is basically “Trump Trade War: Home Edition.”

The announcement follows last week’s doubling of steel and aluminum tariffs to 50%. President Donald Trump hinted that auto tariffs may be next: “The higher you go, the more likely it is they build a plant here [in the U.S.],” he said, presumably referring to car manufacturers and not Whirlpool.

Economists, meanwhile, are shaking their heads — again. Tariffs tend to function as taxes on consumers, with price hikes arriving not immediately, but eventually, like a slow-motion punch from a heavyweight boxer. Though May’s Consumer Price Index clocked in at a manageable 2.4% year-over-year, analysts expect a summer surge as inventories dwindle and tariff costs ripple through the supply chain.

This isn’t Trump’s first load of appliance-related tariffs. Back in 2018, he imposed similar duties on imported washing machines. It did spark some domestic hiring, but at a sudsy cost: One analysis found each job created came out to $817,000 — paid for by American shoppers.

If history repeats, your next trip to Best Buy might come with sticker shock. Quartz’s Joseph Zeballos-Roig has more on why Trump’s tariffs are coming home to roost.

🚗 The White House wants to streamline safety exemptions for self-driving cars

🌽 The Trump administration might soon allow more corn in cars’ gas tanks

🤖 Your Meta AI requests might not be as private as you think

💸 Amazon and Walmart are the latest to consider offering their own crypto

Our best wishes on a safe start to the day. Send any news, comments, and more to [email protected].

Private, intimate and embarrassing information is easily viewable on "discover" feed unless users adjust their settings

Meta has another privacy scandal on its hands, but this time with its AI chatbot equivalent to ChatGPT.

Some Meta AI user questions or prompts can be seen publicly, including links to their Instagram or Facebook accounts, phone numbers and email addresses, or even private or embarrassing information. The outlet Tech Crunch found people asking for information on tax evasion, liability in white-collar crimes, scantily clad animated characters, and other examples.

The company promises that “As always, you’re in control: nothing is shared to your feed unless you choose to post it,” and a user must select “share” and “post” before their requests become visible. Judging by some of the things made viewable, it’s perhaps unclear to many users that they’re broadcasting to the world. And if you open Meta AI via your public Instagram account without updating your privacy settings, your searches become visible also.

When Meta AI was launched on April 29, as a competitor to ChatGPT, the corporate blog said the “discover” feed feature would be “a place to share and explore how others are using AI. You can see the best prompts people are sharing, or remix them to make them your own.”

Within a week, alarm bells were going off. Fast Company wrote a story with the headline, “Meta AI’s social feed is a privacy disaster waiting to happen.” Business Insider called the “discover” function “the saddest place on the Internet,” populated by “people sharing intimate information about themselves — things like thoughts on grief, or child custody, or financial distress.”

Wired magazine asked the Meta AI chatbot about these concerns. It responded, “Some users might unintentionally share sensitive info due to misunderstandings about platform defaults or changes in settings over time. Meta provides tools and resources to help users manage their privacy, but it’s an ongoing challenge.”

To turn off public settings in the app requires a user to select the “data privacy” tab under a profile photo where another tab encourages the user to “suggest your prompts on other apps”— it should be toggled off. The user must then return to the “data privacy” tab and select “apply all” to “make all your public prompts visible only to you.”

None of that might be that obvious to the average user.

While the Meta AI app has been downloaded only 6.5 million times since its launch, CEO Mark Zuckerberg said in late May that the company’s AI assistant has one billion monthly active users across all of Meta's platforms.

The measure from the Environmental Protection Agency would compel refiners to blend biofuels into diesel or gasoline

The Trump administration may soon allow more corn in Americans' gas tanks.

The measure from the Environmental Protection Agency would compel refiners to blend biofuels into diesel or gasoline. Those refiners would have to mix about 24.02 million gallons in 2026, a new record. It's a step to discourage foreign imports from reaching the sector.

“We are creating a new system that benefits American farmers,” EPA Administrator Lee Zeldin said in a release. “We can no longer afford to continue with the same system where Americans pay for foreign competitors.”

Soybean oil prices jumped after the announcement. It leapt 6.3% during Friday's market trading.

Still, other aspects remained unclear, such as whether small refineries would be exempt from the quotas, given the sheer blending capacity that's necessary to meet the Trump-backed standard. The measure falls under the Renewable Fuel Standard program, which was set up by Congress two decades ago to help boost rural communities.

President Donald Trump's megabill that's currently in the Senate includes a four-year extension of a biofuel tax credit, known as 45Z. But it undoes most other green energy tax credits that were unilaterally approved by Democrats in 2022 under their Inflation Reduction Act.

Panic over tariffs has calmed somewhat as the feared effects haven't taken hold — yet

Consumer sentiment is improving for the first time in six months.

The University of Michigan’s Survey of Consumers says buyers are feeling somewhat better about the U.S. economy — in the short term, at least. “Consumers still perceive wide-ranging downside risks to the economy,” it reads.

Consumer sentiment in May rose 16% from April’s numbers, although it remains 20% below December 2024, in what was a post-election bump before Donald Trump took office.

In the six months yet, as Trump declared a trade war, consumers were feeling much more hesitant amidst all the uncertainty. “Consumers appear to have settled somewhat from the shock of the extremely high tariffs announced in April and the policy volatility seen in the weeks that followed,” reads the report. “These trends were unanimous across the distributions of age, income, wealth, political party, and geographic region.”

The Survey of Consumers is a national poll conducted for the last 79 years, focusing on three areas: consumers’ own financial situation, and their short-term and long-term views on the economy’s overall prospects.

A June 9 report from Chief Executive revealed that consumer demand is the same or higher than last year, which in turn supports a report from the Conference Board at the end of May. The Chief Executive report rates CEOs’ confidence in the U.S. economy on a scale of 1 to 10: last month it nudged up from 5.0 to 5.3. Rodon Group CEO Michael Araten thinks “business conditions are likely to improve as trade war calms down and interest rates are reduced.” Federal Reserve Chair Jerome Powell has held interest rates steady, to the public chagrin of Trump.

Trump declared April 2 to be “Liberation Day” with a series of tariffs on every U.S. trading partner. One week later, he backed down, enacting a 90-day pause and claiming that his team could negotiate 90 trade deals in the next 90 days. They only have one: with the U.K. A “framework” with China was announced on June 12, but details are scarce. The 90-day pause ends on July 1.

Tariffs have yet to fully impact American consumers. That will start to change soon, particularly on home appliances starting June 23.

The Department of Transportation is making it easier for autonomous vehicles without standard features like steering wheels to hit U.S. roads

The Trump administration wants to make it easier for automakers to release self-driving cars that don’t have standard controls like steering wheels or brake pedals.

The National Highway Traffic Safety Administration in a letter to stakeholders Friday said it was simplifying the process for auto companies seeking to be exempt from safety regulations compelling mirrors, brakes, and other traditional controls to be in vehicles.

The NHTSA has the authority to grant exemptions up to 2,500 vehicles per manufacturer. But the process has proved time-consuming and frustrating for automakers hoping to secure a federal reprieve from safety guidelines. Many requests gather dust for years without the NHTSA taking action on the application.

“We’ve streamlined this process to remove another barrier to transportation innovation in the United States, ensure American AV companies can out-compete international rivals, and maintain safety,” said Transportation Secretary Sean Duffy in a statement. He added the current process “ensnares companies with unnecessary red tape that makes it impossible to keep pace with the latest technology.”

The Biden administration set up an identical, slimmed-down exemption process for auto and tech companies last year with self-driving cars. But they obligated those firms to share data with the government to cultivate more transparency.

Tesla is about to release a highly-anticipated “robotaxi, set for June 22 as more self-driving cars hit the road. Waymo, another autonomous driving firm, already has fully driverless cars operating in Phoenix, San Francisco, and parts of Los Angeles and Austin.

—Shannon Carroll contributed to this article.

BTS is much more than just a musical group — it's a global financial power and a "strategic national asset"

After almost three years on hiatus, BTS is about to make noise — not just on the charts, but in the global markets. By the time all seven members of the K-pop group complete their mandatory military service this month, they won’t just be lacing up for a comeback — they’ll be rebooting one of South Korea’s most potent economic powerhouses.

Six members — Jin, j-Hope, RM, V, Jimin, and Jungkook — have finished their time in the army (not to be confused with their fandom, which is called ARMY) with the seventh, Suga, set to rejoin civilian life within days. And as much as fans are thrilled for all seven to be back in the recording studio, there’s another group that's equally hyped for the reunion: investors, economists, and South Korean officials who know exactly what the phrase “BTS comeback” means for the country’s GDP.

Because BTS isn’t just a group. It’s a global emotional support system, a cultural juggernaut, a fashion tour de force, a soft power flex, and — yes — a multibillion-dollar economic ecosystem. Its reunion is expected to ripple far beyond fans and music charts and straight into the Korean economy — and beyond.

It won't be the first time BTS has had an outsized financial impact.

In 2019, a report from the Hyundai Research Institute estimated that BTS brought in over $4.65 billion annually to South Korea’s economy — on par with the contribution of nearly half a million average Korean workers. That figure doesn’t just include album sales or ticket revenue but also tourism, consumer products, language learning, streaming traffic, and even spinoff exports such as cosmetics and fashion.

When BTS played a one-off, free concert in Busan in 2022, in support of the city’s World Expo bid, the event attracted over 50,000 visitors and was estimated to contribute more than $500 million in economic value. A post-hiatus world tour could easily multiply that impact several times over.

But beyond the hard numbers, BTS represents a kind of cultural capital that few other entities — not even K-pop as a whole — can replicate. The group is arguably the single most influential driver of the so-called “Korean Wave,” or “hallyu,” which has reshaped global pop culture over the past decade. Its influence has helped make Korean fashion, food, and entertainment (think: K-dramas) aspirational worldwide, fueling growth for everything from Netflix subscriptions to LVMH investments in Korean brands. (The members all have brand deals with top fashion companies.) In recent years, Korean has become one of the fastest-growing languages studied on apps such as Duolingo.

South Korea’s tourism board has repeatedly credited BTS with helping drive inbound travel, and in pre-pandemic years, nearly 8% of tourists cited BTS as one of their reasons for visiting. And now, BTS has reasserted its market power: Shares in HYBE, the group’s agency, surged 7% in a single day in early June, hitting a 38-month high after news that RM, V, Jimin, and Jungkook had officially completed their service. Analysts see the group’s return as a bullish signal for HYBE (which has expanded into the U.S) and for the broader entertainment and media complex built around K-pop’s global reach.

The group’s post-military plans are still under wraps, but expectations are high for new music by the end of 2025, followed by a global tour that could easily become one of the most lucrative in history. BTS’s last full-scale tour, “Love Yourself: Speak Yourself,” grossed over $200 million — without even covering the globe. A four-night run of performances for a “Permission to Dance on Stage” in late 2021 likely injected more than $100 million into the Los Angeles economy via tourism, hospitality, and related spending; and the four-night Las Vegas leg generated over $160 million in tourism and associated economic activity.

A post-pandemic, post-hiatus version could easily knock those numbers out of the park, with knock-on effects in every city the group plays. Flights, hotels, restaurants, and local retail often see major surges in BTS-connected cities, especially given the group’s unusually mobile — and highly dedicated — international fanbase.

That level of fandom has made BTS not just a cultural product but an economic ecosystem. HYBE has built a digital platform — Weverse — that has become a key monetization engine for fandoms: a $100 million revenue stream—high-margin, digitally savvy, and ready to monetize fandoms like never before. Through livestreams, merchandise, and artist-to-fan interactions, HYBE has been able to drive recurring revenue even without new BTS music.

But perhaps the most valuable impact is the hardest to quantify. BTS’s success has reframed how South Korea is seen on the global stage — transforming the country’s image from tech-forward but culturally niche to trend-setting and culturally magnetic. BTS is mentioned alongside Oscar-winning director Bong Joon-ho, soccer star Son Heung-min (who called BTS “national heroes”) as the country’s biggest exports. BTS has been invited to speak at the UN, partnered with UNICEF, and collaborated with South Korea’s Ministry of Culture to promote tourism.

As a soft power asset, BTS arguably rivals the likes of the Olympics or a global sporting franchise. The difference is: BTS is still running. And now, the group is entering a new era. And to say its fans are excited is an understatement (just ask this author). Analysts at Hana Financial have called BTS “a strategic national asset,” and government officials have quietly echoed the sentiment.

Few other music groups could be credited with moving national GDP — but then again, few other music groups could ever be BTS.

As the U.S. and China try to resolve tensions, the minerals that power EVs and smartphones are increasingly under lock and key. China holds most of the keys

You’ve probably never heard of dysprosium or neodymium, but Tesla vehicles, F-35 fighter jets, and your iPhone rely on them heavily. They’re two of the 17 elements known as rare-earth elements (REEs) — a bit of a misnomer because they’re actually not particularly rare. What is rare, however, is the ability to process them. And that’s a big problem.

Today, China controls nearly all global processing of rare earths, while the U.S. is scrambling to catch up. As demand surges for electric vehicles and high-tech defenses, these somewhat obscure elements sit at the heart of the 21st-century economy — and have increasingly become one of the biggest flashpoints in the escalating U.S.-China trade war.

Here’s what you need to know about rare earths — and why the stakes are suddenly so high.

Despite the futuristic ring of the term “rare earths,” they’re not exotic minerals beamed down from space. Rare earths are found in abundant quantities throughout the Earth’s crust, but they rarely appear in concentrations high enough to be easily extracted and refined — and to make doing so economical.

Instead, these elements are often mixed with radioactive rock — think of a fruit salad of minerals, where the flavors are the REEs and the rest is, well, literally trash.

Rare-earth elements (REEs) fall into two main camps: light and heavy — terms given based on their atomic weights. Light REEs, such as neodymium and praseodymium, are more common and primarily used in industrial applications such as permanent magnets for electric vehicle (EV) motors, wind turbines, and consumer electronics. Heavy rare earths, such as dysprosium and terbium, are far less common and significantly harder to process — and are more heavily restricted. They’re essential for more specialized uses, including high-performance magnets, military hardware, and advanced clean-energy technologies.

A single F-35 fighter jet, for example, contains around 900 pounds of rare-earth materials — an eye-watering amount for elements most people have never heard of. Your iPhone? It may only contain a few grams, but it wouldn’t work without them.

China doesn’t just mine rare earths — it refines nearly 100% of the global heavy REE output and the majority of light ones (about 90%). That means even if the U.S., Australia, or other countries dig them up, they typically send them to China for separation, refining, and magnet production.

This choke point gives Beijing formidable economic (and strategic) leverage — one that it has increasingly shown a willingness to use. In late 2023, China required companies to apply for export licenses to ship certain heavy REEs, catching global industries off guard. Officials described the move as a routine regulatory update, but industry experts and national security analysts saw it as a thinly veiled threat: China is ready to weaponize its control of critical minerals. “China could use its dominant position in the rare earth market to gain leverage in trade negotiations,” the U.S. Congressional Research Service noted in a 2023 report.

In 2025, things escalated. This spring, Beijing added seven key rare-earth elements to its dual-use export control list, requiring special licenses for overseas shipments. Soon after, it rolled out a sweeping permit system for high-performance rare-earth magnets. The fallout was immediate. Shipments stalled for weeks, then months, especially for companies with heavy U.S. exposure. While European and Southeast Asian buyers received some preferential treatment, American companies were largely frozen out. Tesla reportedly saw rare-earth–related parts delays that dented production.

Then came the pivot.

Following high-stakes trade talks in London this month, China agreed to ease some restrictions — but only slightly. Magnet export licenses were granted again, with a catch: They now expire after just six months. It’s a classic geopolitical feint — lift pressure long enough to restart negotiations, but keep the threat close. Beijing hasn’t issued a blanket ban. Instead, it’s playing a longer game, using a rolling-export-permit strategy to maintain leverage while staying (technically) within the rules — showing how China can legally “weaponize” critical materials without outright bans.

Of all the industries caught in the crossfire, the automotive sector might be the most vulnerable. Automakers — especially EV-makers — are on the front lines of the rare-earth squeeze. Some are reportedly in a “full panic,” because most electric vehicles use permanent magnet motors made with rare earths (such as neodymium and dysprosium). These magnets are compact, powerful, and crucial for improving EV range and energy efficiency. Even traditional gas-powered cars use rare earths in components such as power steering systems, fuel economy sensors, and braking mechanisms.

In short: No rare earths, no car.

Some automakers, including Tesla, have reportedly begun exploring rare-earth-free motor designs. But these alternatives often come with tradeoffs: larger size, lower performance, and reduced energy efficiency. Most companies aren’t ready to pivot away from REEs anytime soon, especially as demand for EVs continues to soar.

It’s trying, but the road is long — and uphill.

The only active rare-earths mine in the United States is Mountain Pass in California, owned by Nevada-based MP Materials. While it produced a record 1,300 tons of neodymium-praseodymium oxide in 2024, the U.S. still lacks domestic facilities to process heavy rare earths at a commercial scale.

The Department of Defense has committed more than $439 million under the Defense Production Act to jumpstart a domestic supply chain, funding projects from mining and refining to magnet production. The goal: to create a full “mine-to-magnet” infrastructure in the U.S. But analysts warn that even with significant federal support, domestic production won’t be able to meet demand until at least 2026 — and maybe much later.

The Biden administration prioritized rare-earth independence as part of its broader clean energy and national security agenda. But the issue could escalate under the second Trump administration. President Donald Trump has reportedly floated the idea of expanding the use of the Cold War-era Defense Production Act and at hinted at building a “rare earth reserve” modeled after the Strategic Petroleum Reserve to hedge against future shortages.

MP Materials would be a big beneficiary. Bloomberg reported that Deputy Defense Secretary Steve Feinberg is working to line up funding for the company, which has already received millions from the department. Defense Secretary Pete Hegseth said in a recent congressional hearing that MP Materials “is a great example of a place where we can partner with industry,” adding that Feinberg is focused on sourcing REEs.

China, for its part, seems to be continuing to tighten controls. But as the U.S. and its allies ramp up their efforts to diversify sourcing and build parallel supply chains, experts warn that the next few years could see serious disruptions — not just for EV-makers, but for defense contractors, clean-tech companies, and advanced manufacturing more broadly.

In the short term, the U.S. and Europe will likely lean more on stockpiles, subsidies, and partnerships with friendly mining countries such as Australia and Vietnam. But many of those countries still send their ore to China for processing, at least for now.

In the long term, control over rare earths may determine who leads the global economy. Much like oil in the 20th century and semiconductors in the 21st, rare earths are becoming a strategic asset — one that could shape industrial policy, trade negotiations, and military power for decades to come.

They may not be household names yet. But in the shadow war over the future of energy and tech, rare earths are the most essential elements you’ve maybe never heard of.