Dozens of states want to block 23andMe from selling DNA info

A new lawsuit came after Regeneron Pharmaceuticals said it would buy the failing genetic testing company for $256 million

A new lawsuit came after Regeneron Pharmaceuticals said it would buy the failing genetic testing company for $256 million

Twenty-seven states and Washington, D.C. are suing to stop 23andMe (ME) from selling customers’ personal information without their consent.

The lawsuit filed in a Missouri bankruptcy court Monday was brought by a bipartisan coalition of attorneys general who fear that the genetic testing company will auction off people’s private information to the highest bidder without regard for their privacy.

“This isn’t just data – it’s your DNA. It’s personal, permanent, and deeply private,” Oregon Attorney General Dan Rayfield said in a statement. “People did not submit their personal data to 23andMe thinking their genetic blueprint would later be sold off... We’re standing up in court to make sure Oregonians – and millions of others – keep the right to control their own genetic information.”

The suit comes after 23andMe, which had a $6 billion valuation at the time of its 2021 IPO, declared bankruptcy in late March. The company then announced in May that it was being purchased by Regeneron Pharmaceuticals for $256 million, in a deal expected to finalized in the third quarter of 2025.

After 23andMe declared bankruptcy, there were myriad concerns about users’ privacy, especially after a 2023 data breach affecting 6.9 million people. Its stock tumbled by 98% from 2021 to November 2024. It then halted work on new therapies, laid off hundreds of employees and agreed to a $30 million settlement related to the breach. This April, the company was subjected to a Congressional investigation into the fate of its users’ sensitive information.

The coalition of states suing to stop the sale of information say that should be able to control the fate of their own genetic data, which Rayfield said “cannot be sold like ordinary property.” In their complaint, the states say the information is too personal and sensitive to be auctioned off.

In the meantime, the attorneys general are encouraging those who used the service to delete their genetic information.

A spokesperson for 23andMe told Quartz in a statement that it believes the suit is “without merit” and it will address the allegations at its sale hearing. “We required any bidder to adopt our policies and comply with applicable law as a condition to participating in our sales process,” the company said. “Customers will continue to have the same rights and protections in the hands of the winning bidder.”

—Michael Barclay contributed to this article.

Bryan Bedford also says he was shocked by lack of leadership and ambition at the agency in wake of safety concerns

President Donald Trump's nominee to lead the FAA said Wednesday that he would hold Boeing "accountable to deliver a high-quality product safely,” as the plane maker continues to face the fallout from a string of sometimes deadly safety issues with its 737 Max jets.

Republic Airways CEO Bryan Bedford, who Trump has tapped to lead the Federal Aviation Administration, said during a Senate confirmation hearing that he would work with Boeing instead of just scolding it. Bedford said the FAA could tell Boeing “where the failures are” and “move the process along a little quicker.”

Boeing has been throttled by ongoing safety failures with planes, including accidents that killed 346 people in 2018 and 2019.

In May, Boeing said its new safety processes had streamlined to the point where they were consistently building 38 planes per month, as per an FAA-imposed cap after the Alaskan Airways incident of 2024, in which an emergency door blew open. Boeing had hoped to up that to 48 planes a month in a year’s time, but last week acting FAA administrator Chris Rocheleau said that was not going to happen any time soon. He did note, however, that Boeing had made improvements.

In advance of Bedford’s confirmation hearing, Reuters reported that he cited a “lack of steady and qualified leadership” at the FAA, which led to a “lack of any coherent strategy or vision.” Bedford argued that, "A malaise has set in whereby managers believe the agency is helpless to make the necessary changes, and furthermore, they rationalize it isn’t really their fault."

At the hearing itself, Bedford said that he had asked FAA employees what their goals were and said he was shocked to hear them answer that “they don’t have any."

The FAA’s biggest current challenge is the crisis in air traffic control, leading to incidents like the January collision near Washington Reagan Airport or the recent outages at Newark Liberty International Airport.

Rocheleau said the entire system needs an overhaul, citing the fact that many facilities—some of which are more than 50 years old—still use floppy disks and paper strips. Bedford says that when he asked FAA employees how the system could change, they merely answered that they would work harder. "That's just not the kind of leadership that we're going to need in order to get the job done," he told the hearing.

Beijing is holding on to a valuable bargaining chip, despite reaching an agreement on US-China trade.

China is subjecting U.S. automakers and manufacturers to a six-month limit on rare-earth export licenses, sources familiar with the matter told The Wall Street Journal on Wednesday.

The aim is to give Beijing leverage should its trade war with Washington escalate again, while amplifying uncertainty for American businesses, sources say.

Beijing had agreed to temporarily restore the licenses during trade talks with the U.S. negotiators in London this week, which was deemed to be a major breakthrough of the meeting. Yet, the six-month limit suggests that there's still a desire to keep hold of bargaining chips. Beijing knows its grip on the supply of critical minerals is a valuable weapon for future negotiations, sources said.

In return for reinstating the licenses, the U.S. has agreed to ease some restrictions on exports to China, sources said. These include jet engines and related parts, and ethane, a chemical used for manufacturing plastics. China has agreed to start approving U.S. companies’ license applications imminently, contingent on President Donald Trump and Chinese leader Xi Jinping’s approval of the trade framework, sources said. At that point, the U.S. will also begin to drop the export controls on the jet engines and ethane, they added.

The White House could not be immediately reached for comment.

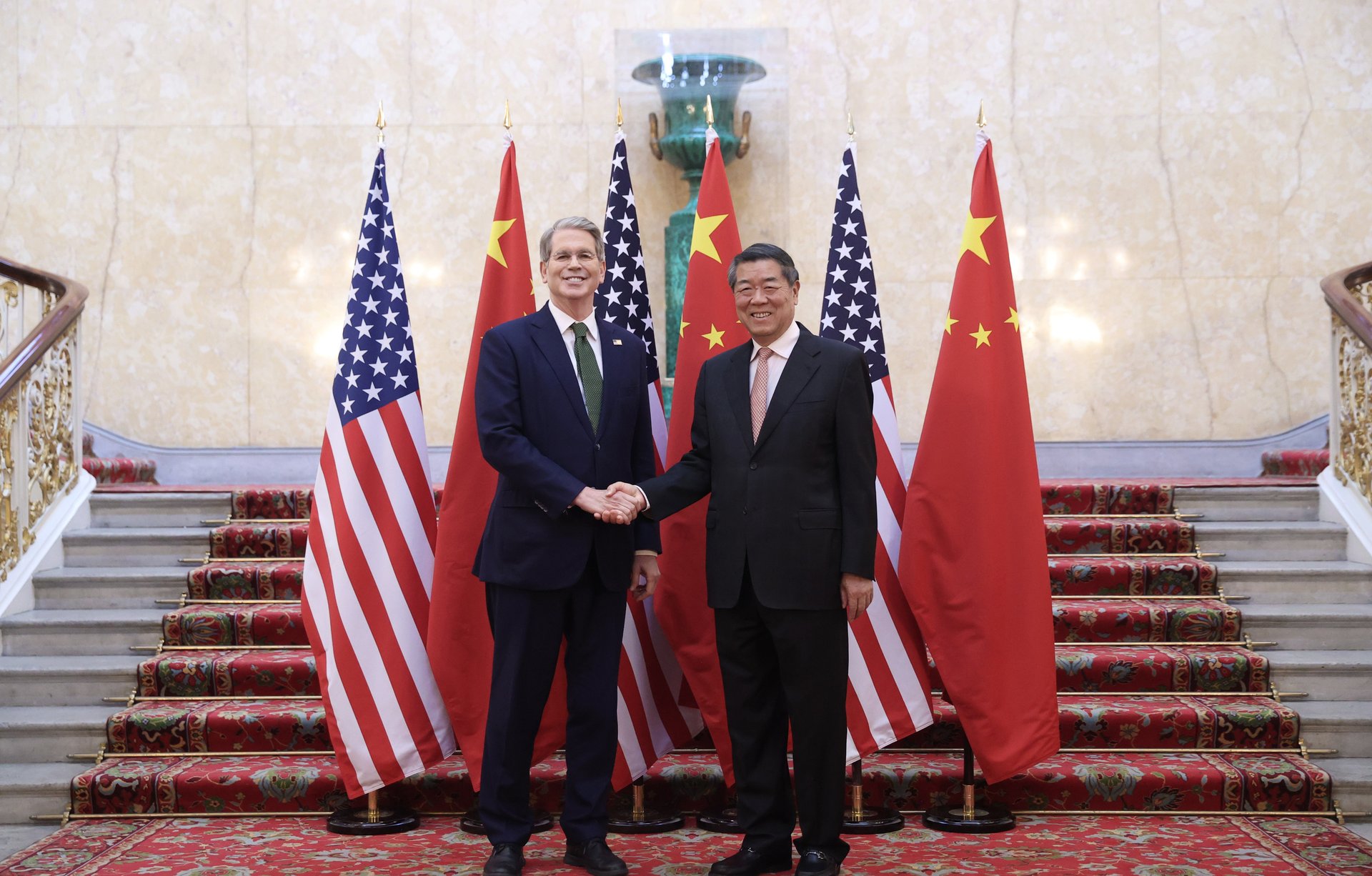

The London talks have finalized a trade framework which was only agreed "in principal" during the US-China trade talks in Geneva, Switzerland, on May 11 and 12. Trump said in a Truth Social post on Wednesday: “Our deal with China is done." Treasury Secretary Scott Bessent led the American delegation in the talks with Chinese Vice Premier He Lifeng.

The Geneva meeting took place with the aim of defusing tensions and easing export restrictions that threaten global manufacturing.

The Trump administration official thinks people will learn to work with AI — and trying to stem its rise is "like telling the tides to stop"

One top Trump administration official thinks that the losers in the AI arms race may not be the ones replaced by machines — but the ones outpaced by colleagues who know how to use the machines better.

David Sacks, the tech investor tapped by President Donald Trump to shape AI policy, says Americans are focusing on the wrong threat. Sacks downplayed predictions of mass job loss in favor of a more optimistic — if demanding — future of work. Speaking publicly on Tuesday, Sacks said he doesn’t believe AI will trigger widespread unemployment. Instead, he framed the technology as a multiplier for human productivity, echoing historic shifts in labor.

“You’re not going to lose your job to AI,” he said at a recent AWS Summit in Washington. “You’re going to lose your job to someone who knows how to do AI better.”

Sacks is betting AI won’t replace whole jobs but will instead automate routine pieces, letting workers get more done and add skills. That’s how past revolutions unfolded, he said: fewer farmers, not more long-term unemployed bodies.

“Personally, I don’t think [AI is] going to lead to a giant wave of unemployment,” he said, pushing back against what he called the “doomer cult” predicting mass job loss.

Sacks’ comments come at a time when prominent voices have warned about widespread disruption. Some studies foresee millions of displaced workers, and calls for universal basic income (UBI) are gaining traction. Anthropic CEO Dario Amodei said recently that AI could wipe out some white-collar jobs and drive unemployment to 20% — adding that tech leaders “have a duty to be honest about what’s coming.”

But Sacks seems to reject that narrative

“I think it’s actually very hard to replace a human job entirely,” he said. “I think it’s easier to replace pieces of it.” Sacks said AI agents will increasingly support workers, not supplant them. “They’re under the guidance of human workers who know how to use them to get more productive,” he said, describing a future where people use AI to extend what they can do.

“I could see AI driving our growth rate to something like 4 or 5%” he said. “I think you’re already seeing the beginning of an AI boom. I mean, I’m very optimistic that this will be a huge economic tailwind for us.”

The Trump administration official said resisting the technology is futile.

“It’s kind of like telling the tides to stop — it’s just not going to happen,” he said, urging policymakers and educators to embrace the shift rather than attempt to block it. He pointed to a recent example of a teacher who adapted her curriculum by allowing students to complete certain assignments using AI tools while reserving other tasks for traditional, tech-free evaluation.

That kind of hybrid approach, Sacks suggested, is the right way forward — an acknowledgment that AI is here to stay, and students need to be fluent in it without becoming dependent on it.

“I don’t think that the right thing to do here is to throw up a wall and just be so afraid of AI that we try to resist it,” he said. “We have to embrace that opportunity. We have to have our workers know how to use AI — be creative with it.”

Elon Musk and his X CEO threatened advertisers with lawsuits amid a 44% decline in ad revenue

X, the social media platform formerly known as Twitter, is leaning into a coercive new advertising strategy under Elon Musk and CEO Linda Yaccarino: pressure, threats, and lawsuits.

That’s the picture painted in a bombshell Wall Street Journal report published Wednesday. The report describes how Musk and Yaccarino led an aggressive campaign to rescue X’s declining ad business by threatening to sue companies that refused to spend money on the platform.

Verizon, which hadn’t advertised on X since 2022, pledged at least $10 million this year after receiving a legal threat. Ralph Lauren also agreed to return after being threatened with a lawsuit. In all, at least six companies rejoined the platform after similar pressure tactics, according to the report. Some deals included binding ad-spend commitments, while others included soft or non-binding targets struck under duress.

Behind the scenes, X lawyers reportedly warned advertisers they could be added to an ongoing lawsuit alleging an illegal ad boycott. X first filed that suit last August, targeting the World Federation of Advertisers and several major brands. Unilever, Amazon’s Twitch unit, and Lego were all among them. Some companies, including Unilever, were later dropped from the suit after signing new ad deals.

The campaign marks an extraordinary and punitive effort to revive the platform’s revenue. After Musk’s $44 billion takeover in late 2022, user engagement is reported to have sharply declined. Advertisers fled in droves amid chaos inside the company and loosened content moderation standards. Yaccarino, a former NBCUniversal ad executive, has been attempting to lure those advertisers back with brand-safety tools and new content deals, including NFL and NBA highlights. But the threats suggest serious desperation.

At one point, a lawyer for X demanded that Pinterest commit to its pre-Musk ad spend for two years — or be sued. Pinterest declined, having found that its ads were more effective when run in other venues. X then followed through on its legal threat, naming Pinterest in the complaint.

“Advertisers are understandably concerned about the litigious streak of Musk’s X interpreted by some as ‘invest with us, or else,’” Ruben Schreurs, CEO of ad consultancy Ebiquity, told the Journal.

Musk has made his contempt for advertiser pressure clear in public, too. In a November 2023 interview at the DealBook Summit, when asked about brands leaving the platform, he said, “If somebody’s going to try to blackmail me with advertising, blackmail me with money… go f—k yourself.”

Addressing Disney CEO Bob Iger directly, who was reportedly in the audience, Musk added: “Hey, Bob, go f—k yourself.”

X’s ad sales fell from $4.6 billion in 2022 to $2.6 billion last year, a 44% decrease, even as the larger ad industry grew by double digits over the same period. For their part, Meta, Google, YouTube, and Amazon all saw vast gains in ad spend over that period Pinterest and TikTok also saw ad spending grow significantly.

Even Snap, with its choppy track record, saw ad revenue climb between 2022 and 2025.

Though it’s recently ticked up, X’s ad revenue remains well below pre-Musk levels, per the Journal. Emarketer projects 2025 will bring the first annual ad growth since the takeover, though it’s also expected to remain below pre-Musk-takeover levels.

Meanwhile the backlash may just be getting started. Some ad agencies are now demanding legal immunity from future lawsuits before agreeing to spend on X.

X has refused.

Buoyed by only infinitesimally higher inflation numbers, the White House wants a rate cut

President Donald Trump is always happy to have an excuse to bash the Federal Reserve, and May’s soft inflation numbers from the Consumer Price Index (CPI) provided just such an occasion.

On Tuesday, Trump posted on Truth Social: “CPI JUST OUT. GREAT NUMBERS! FED SHOULD LOWER ONE FULL POINT. WOULD PAY MUCH LESS INTEREST ON DEBT COMING DUE. SO IMPORTANT!!!”

Vice President J.D. Vance agreed in his post on X. “The president has been saying this for a while, but it's even more clear: the refusal by the Fed to cut rates is monetary malpractice," he wrote.

Data from the Bureau of Labor Statistics showed that headline inflation rose 2.4% annually — up slightly from April’s 2.3%, but still below expectations. Month-over-month, prices climbed 0.1%, down from April’s 0.2% pace. Core inflation, a measure that excludes more volatile food and energy prices, also came in softer than expected.

May’s Consumer Price Index report is the first to reflect, at least partially, the shifting landscape following President Donald Trump’s April “Liberation Day” tariff blitz. While many of the most sweeping tariffs were paused for 90 days pending trade negotiations, baseline 10% duties remain in effect for most partners, and some industry-specific tariffs, including those on steel and aluminum, doubled to 50% as of early June.

Trump has been pushing for interest-rate cuts since the start of his second term. In May, he called Federal Reserve Chair Jerome Powell a “fool who doesn’t have a clue,” after an announcement that interest rates would remain steady for the third month in a row—since Trump returned to office. By contrast, the Fed cut rates three times in late 2024. At the May announcement, Powell told reporters, “The economy itself is in solid shape,” before adding with a wink that was surely seen by Trump, “My gut tells me that uncertainty about the path of the economy is extremely elevated.”

Before Trump's re-election, the Harvard Kenndy School suggested that a new Trump administration might bring about the "end of the Federal Reserve as we know it."

-Catherine Baab contribut

Investors are ditching U.S. equities in favor of overseas assets as economic concerns grow

Investors are ditching U.S. equities in favor of overseas assets as concerns grow over fiscal policy, rising debt, and a possible recession.

Exchanged-traded funds (ETFs) and equity mutual funds based in the U.S. saw outflows of $24.7 billion in May, according to LSEG data cited by Reuters. That’s the largest monthly exodus in a year. Meanwhile, last month European funds recorded inflows of $21 billion, taking year-to-date inflows to $82.5 billion, the highest in four years.

Data for 292 emerging market equity ETFs revealed inflows of $3.6 billion last month, bringing this year’s total to $11.1 billion, according to Reuters.

The S&P 500 is up just 3% this year. By comparison, it had risen 14% by this time last year.

President Donald Trump’s reciprocal tariffs on imported goods, and his fiscal policy, have a lot to do with the flight, as it has eroded U.S. assets’ safe-haven reputation.

Since the unveiling of the levies on April 2, the U.S. dollar has shed about 5% of its value against a basket of foreign currencies. Concurrently, in the week or so following "Liberation Day," a U.S. government bond sell-off ensued, sending 10-year Treasury yields soaring more than 12%. Yields remain high, hovering around 4.45%, up from 4.16% the day before the tariff unveiling.

Adding to the bond market’s tariff-related jitters, last week Trump unveiled his “Big Beautiful Bill," which could add $2.4 trillion to the deficit over the next decade, according to the nonpartisan Congressional Budget Office.

Typically, the dollar and yields have moved in step with each other, as higher yields signal to investors that economic growth is to come, thus attracting inflows of foreign capital and strengthening the currency.

That relationship appears to be breaking down, as the correlation reached its lowest level in nearly three years in June, according to the Financial Times' analysis of LSEG data. It's thought that higher borrowing costs could reflect higher risk, as the government takes on more debt while tariffs threaten growth.

As Novo Nordisk faces outside scrutiny, it's making an $812 million bet on the next weight loss frontier

Novo Nordisk is diving deeper into the AI drug discovery race, making a big bet on the future of weight loss drugs — just as investors might be beginning to question who (and what) is steering the ship. On Wednesday, the Danish pharmaceutical giant announced a deal worth up to $812 million with Deep Apple Therapeutics, a U.S.-based biotech startup that uses artificial intelligence to discover drugs.

The goal? To create an oral weight loss and heart health treatment that works differently from today’s blockbuster injections — such as Novo Nordisk’s Ozempic and Wegovy. Instead of targeting the popular GLP-1 pathway — the same mechanism behind Ozempic — Deep Apple’s approach aims at a different biological target, one that might avoid some of the side effects and supply issues that have dogged the current class of drugs.

On its face, the Deep Apple deal is a shot across the bow at Novo Nordisk’s rivals (such as Eli Lilly), which have chipped away at Novo Nordisk’s dominance in the $150 billion weight loss market. But timing is everything — the company is currently without a permanent CEO following the surprise departure of longtime CEO Lars Fruergaard Jørgensen in May.

And Novo Nordisk is dealing with fresh scrutiny from activist hedge fund Parvus Asset Management, which has quietly built a stake in the company and reportedly hopes to influence the CEO succession — a move that briefly lifted Novo Nordisk’s stock on speculation about boardroom shake‑ups.

All of that makes the Deep Apple partnership more than just another research deal or pipeline play. It’s a message to the market: Novo Nordisk wants to show it’s still at the forefront of the next wave of obesity treatments — even as the competition heats up and questions swirl around its direction and footing.

For Novo Nordisk, the deal is largely both a scientific and a strategic bet. Deep Apple’s tech combines AI, structural biology, and massive virtual libraries of potential drug compounds to search for new ways to treat disease — especially through so-called GPCR targets that are tricky but promising. If Deep Apple’s method works, it could help Novo Nordisk move beyond GLP-1 drugs and stay ahead of rivals.

Novo Nordisk has been on a partnership spree lately — inking deals with other biotech firms, most recently Septerna but also Omega Therapeutics, and Evotec. But the Deep Apple deal stands out for its size and its future-focused, AI-first approach. For Novo Nordisk investors, the deal with Deep Apple offers: a bet on scientific boldness and a statement that the company refuses to rest on the laurels of its GLP‑1 blockbusters.

The company’s stock is down over 29% in the last six months but is up 17% over the last month and 8% over the past five days.

Whether this deal works or not all comes down to execution. Developing pill-based treatments for obesity and heart-related issues is still risky and tricky. Once Deep Apple finishes the early research, Novo Nordisk will take over — and how fast they move, and whether or not the drugs actually work in early testing, will matter a lot. If all goes well, Novo could avoid problems such as fatigue with current treatments, supply issues, or cheaper copycat drugs.

If it doesn’t, the company risks deepening the doubts swirling around its leadership and long‑term strategy.

In many ways, the Deep Apple tie‑up is a test of faith — in the science and in whoever ends up steering the ship. As Novo moves to appoint a CEO (with some analysts speculating that a U.S. executive could help in the world’s largest weight‑loss market), and as Parvus observes from the wings, the stakes couldn’t be higher.

Despite improving economic data, the JPMorgan Chase CEO is still bracing for a downturn

JPMorgan Chase CEO Jamie Dimon warned Tuesday that the U.S. economy might have a rough rest of the year.

“I think there’s a chance real numbers will deteriorate soon,” the CEO told the crowd at a Morgan Stanley conference.

If the prediction comes true, “employment will come down a little bit. Inflation will go up a little bit. Hopefully, it's just a little bit,” Dimon said.

His latest forecast is better than the recession he said he expected if President Donald Trump stuck with his original tariff plans. But Dimon wasn't too optimistic Tuesday, even though unemployment and job numbers are relatively good.

"Whenever you say consumer sentiment, remember, neither consumers nor businesses ever pick the inflection points. They never have. So, if you're looking for that inflection point, because it really doesn't matter if it's up or down just a little bit, they're not going to tell you that,” he explained.

Still, Dimon wasn’t shy about blaming Trump's tariffs for the potential downturn, saying we are only just seeing their effects.

“Even if the lower numbers are just starting to affect and hit people, you had a lot of people buying stuff ahead of time, both consumers and businesses, for inventory,” he said.

"And maybe in July, August, September, October, you'll start to see, did it have an effect? My guess is it did, hopefully not dramatic. It may just make the soft landing a little bit softer as opposed the ship go down."

Despite the gloomy outlook, Dimon said he isn’t too worried about his predicted “fluctuations” and is more concerned about changes to the global military and economic alliances "that matter to the future of the United States."

The coffee giant says the new AI program will "revolutionize everyday operations"

Starbucks is partnering with Microsoft Azure for AI-powered solutions to one of the greatest creative challenges of the modern workforce: how to make and deliver a cup of coffee.

The new Green Dot Assist program, says Starbucks, promises to “revolutionize everyday operations” by reminding baristas how to do things like make a lavender oat latte and suggest food pairings. It also promises to assist managers with spontaneous staff shortages, reduce the number of important decisions required in their role, and allow them to deflect some in-store staff questions to AI.

A promotional video in the announcement focuses on three tasks: allowing staff to ask specific questions, assisting them in real time, and acting swiftly. Starbucks believes these three elements, which were apparently unheard-of in the previously all-human work environment, amount to “a bold innovation that will unlock new possibilities for the coffeehouse leaders who serve customers around the world.” It's unclear whether the software will help the baristas spell your name correctly on your cup.

The Green Dot Assist program was introduced at a company conference in Las Vegas this week. It will pilot in 35 locations, with a broader launch throughout the U.S. and Canada in the fall.

The coffee giant is coming off a bad second-quarter, the fifth in a row that saw a dip in same-store sales. In April, it announced new technology that promises to reduce wait times from four minutes to two, utilizing something called the Siren Craft System, which mostly appears to be pulling espresso before steaming milk.

Around this time last year, McDonald's abandoned a two-year experiment with IBM AI in its drive-thrus, although didn’t rule out AI assistance in the future. Yum Brands, home to KFC, Taco Bell and Pizza Hut, partnered with Nvidia in March to integrate AI technology.

Starbucks was one of several fast-food chains that set up shop in the Metaverse, in an uncanny-valley twist on its rewards program, but pulled out in March 2024.