Adani’s plans for the controversial Carmichael coal mine in Australia have received another blow.

On Dec. 18, the Indian multinational announced that its inability to secure government funding for a part of the project had forced it to cancel its A$2 billion ($1.5 billion) contract with Downer EDI, an Australian’s engineering and infrastructure services provider.

Last week, the Queensland government decided to veto the A$900 million ($689.59 million) potential federal funding for a new rail link required for Australia’s largest coal mine, which would’ve come from the Northern Australia Infrastructure Facility (NAIF).

“Following on from the NAIF veto last week and in line with its vision to achieve the lowest quartile cost of production by ensuring flexibility and efficiencies in the supply chain, Adani has decided to develop and operate the mine on an owner operator basis,” the company said in a statement.

Even though Adani’s Carmichael mine had received support from Australia’s federal and state governments previously, the newly re-elected administration in Queensland shot down the NAIF funding, arguing that the project must be viable without taxpayer funds. The Carmichael mine, including related infrastructure development, is expected to cost more than $15 billion.

Gujarat-based Adani bought the Carmichael mine in northeastern Australia’s Galilee Basin for $500 million in 2010, and should likely have been aware of the project’s infrastructural complexities. The mine requires a 388km railway line to connect it to the Queensland coast, apart from an expansion of the Abbot Point coal terminal, which could pose a risk to the Great Barrier Reef.

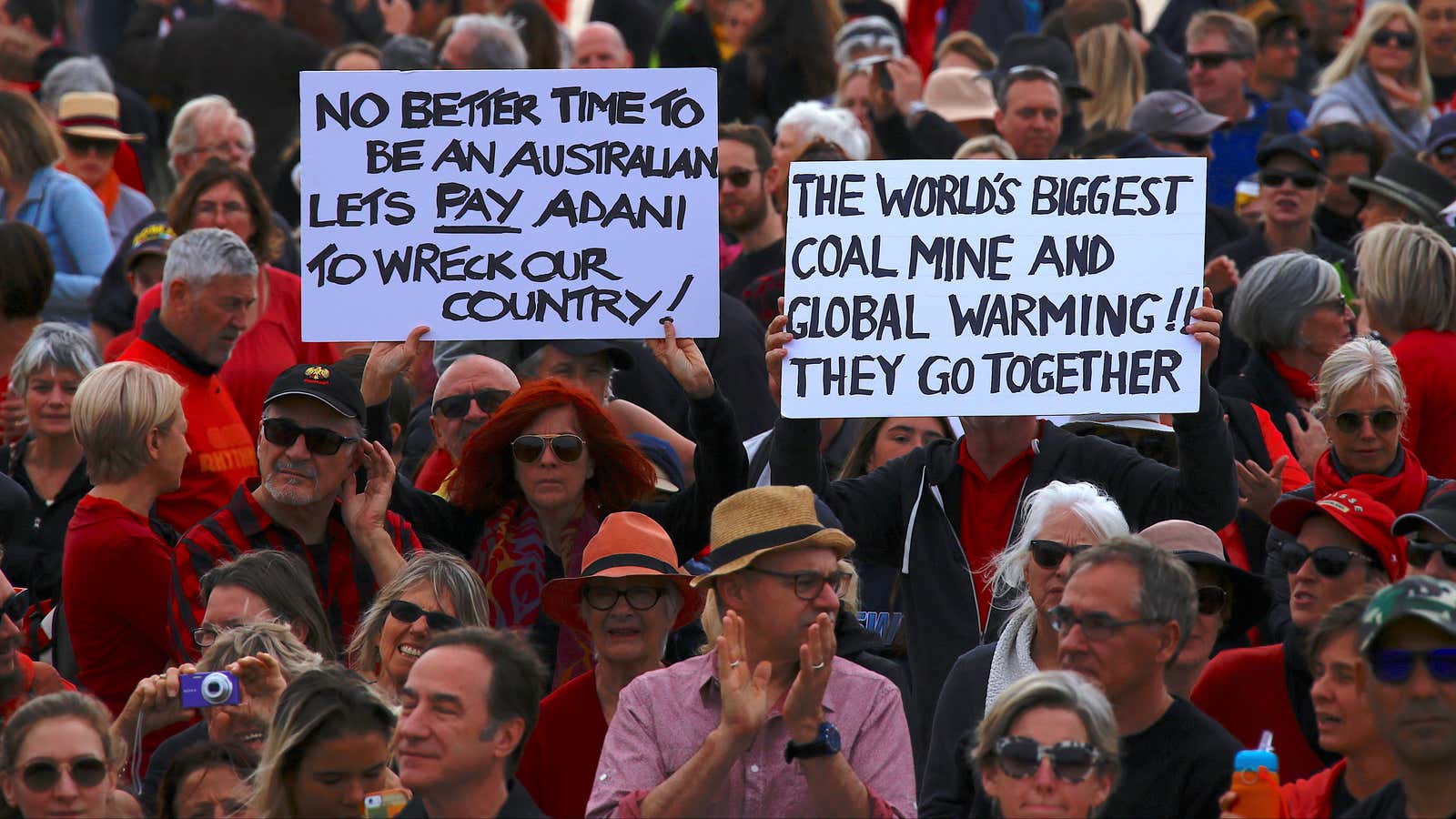

The project has faced consistent opposition within Australia, with activists describing the campaign against the Carmichael mine as “the biggest environmental movement” in the country’s history. From smaller protests in 2014, when a prominent Australian model shed her clothes in opposition to the mine, the momentum against the project has grown in recent months. In early October, for instance, thousands came out across the country in protest against Adani’s plans.

Environmental concerns aside, Adani has had trouble getting its finances in order to build the largest coal mine in Australia. At least 21 banks, both Australian and international, have reportedly declined funding for the project. This includes lenders like Deutsche Bank, Commonwealth Bank of Australia, and other Chinese firms. The company is looking to raise $1.5 billion by March 2018 in order to complete the first stage of its proposed mine.

None of this was entirely unexpected. “The Australian coal projects require large allied infrastructure investment and high leverage, making it challenging to achieve financial closure,” Debasish Mishra, a partner at Deloitte Touche Tohmatsu, told Bloomberg back in 2014. “Some of the Indian players who have invested in Australia may be better off exiting these investment even at a loss.” Moreover, the rise of the renewable energy industry, alongside concerns over large fossil fuel projects, have only added to the momentum against gigantic mines like Carmichael.

Despite these roadblocks, Adani said it remains committed to the Carmichael project and that the jobs of the 800 people it employs in Queensland will not be affected by this move: ”This is simply a change in management structure and ensures that the mine will ultimately be run out of our Adani Australia offices in Townsville.”