America's wealthiest are dodging $150 billion in taxes each year, according to the IRS Commissioner

The U.S.'s billionaires and millionaires make up a large chunk of the country's $600 billion 'tax gap'

America’s wealthiest — the billionaires and millionaires — are dodging about $150 billion in taxes each year and creating a “tax gap” in the U.S., according to the IRS.

Suggested Reading

The IRS — starved for cash after years of reduced funding from Congress — has had increasing difficulty putting resources aside to fund its audit divisions. As a result, the audit rate on millionaires fell by more than 70% from 2010 to 2019, according to the U.S. Treasury Department. Likewise, the audit rate on large corporations fell by more than 50% over that same period.

Related Content

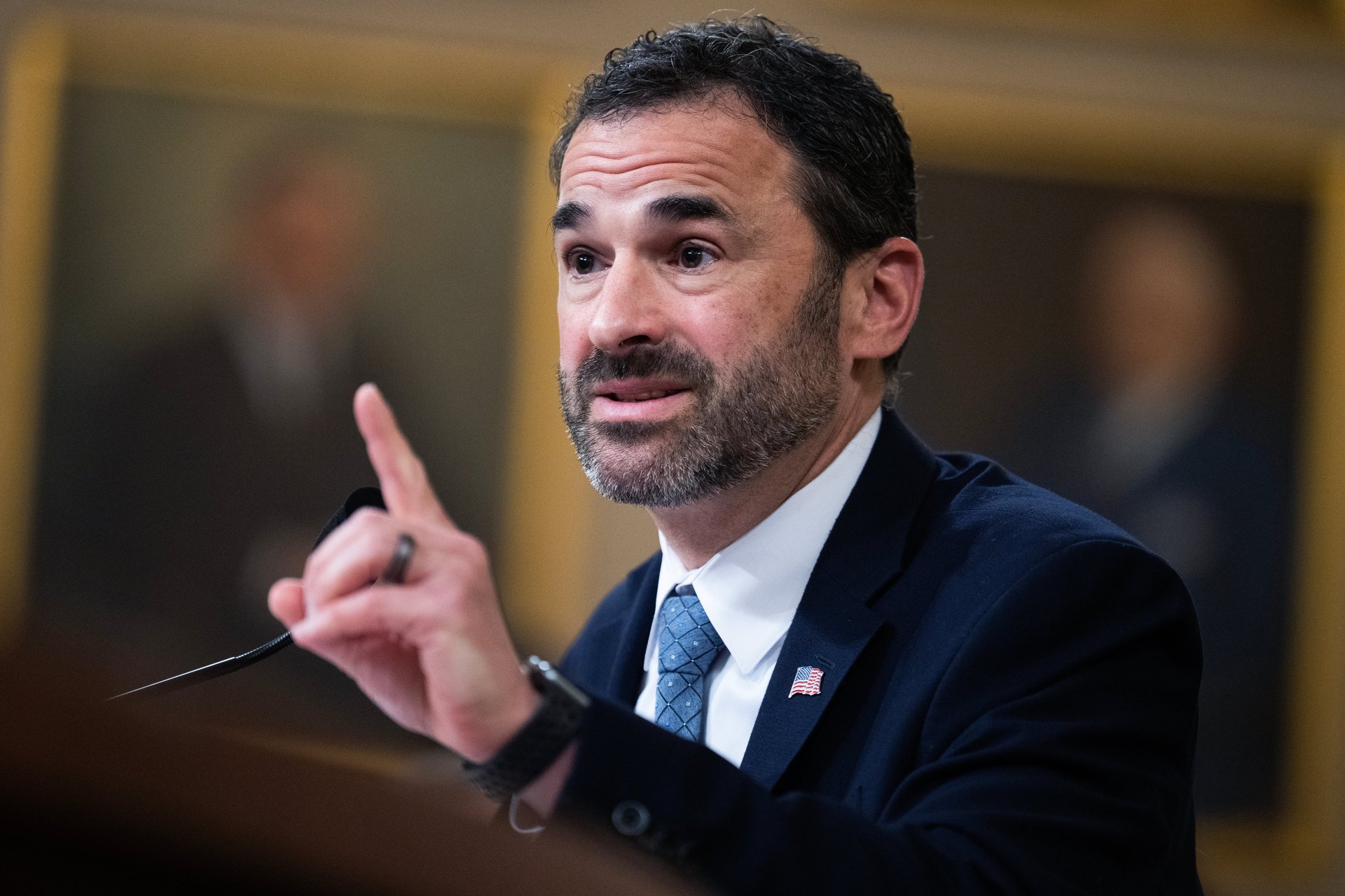

The resulting tax gap, or the difference between taxes owed and taxes paid, ballooned to over $600 billion, according to the Treasury Department. A large chunk of that is directly attributable to millionaires and billionaires, IRS Commissioner Danny Werfel told CNBC.

“When I look at what we call our tax gap, which is the amount of money owed versus what is paid for, millionaires and billionaires that either don’t file or [are] under reporting their income, that’s $150 billion of our tax gap,” Werfel said. “There is plenty of work to be done.”

The IRS — backed by tens of billions of dollars in funding to be delivered over the next several years by 2022's Inflation Reduction Act — has begun bulking up its divisions that audit millionaires, billionaires, and large corporations. That increased enforcement is expected to generate as much as $561 billion between 2024 and 2034.

Last month, the agency said it had collected around $360 million in overdue taxes from delinquent millionaires in addition to the $122 million it collected last October. The IRS has identified 1,600 millionaire taxpayers who have failed to pay at least $250,000 in assessed taxes.

As part of its enhanced efforts, the IRS on Wednesday announced a new program to audit companies that own private jets. There are more than 10,000 corporate jets in the U.S. valued at tens of millions of dollars each, according to the agency, and many can be fully deducted.

“These aircraft audits will help ensure high-income groups aren’t flying under the radar with their tax responsibilities,” Werfel told reporters last week.

The IRS is also looking into limited partnerships, with Werfel telling CNBC that many wealthy individuals have been shifting their income to businesses to avoid paying income tax.

Notably, one individual last September was ordered to pay $15 million in restitution after they were discovered to have falsified millions of dollars of personal expenses as deductible business expenses. Among their expenses were costs related to the construction of a 51,000 square-foot mansion, an outdoor pool and pool house; and tennis, basketball, and bocce courts.