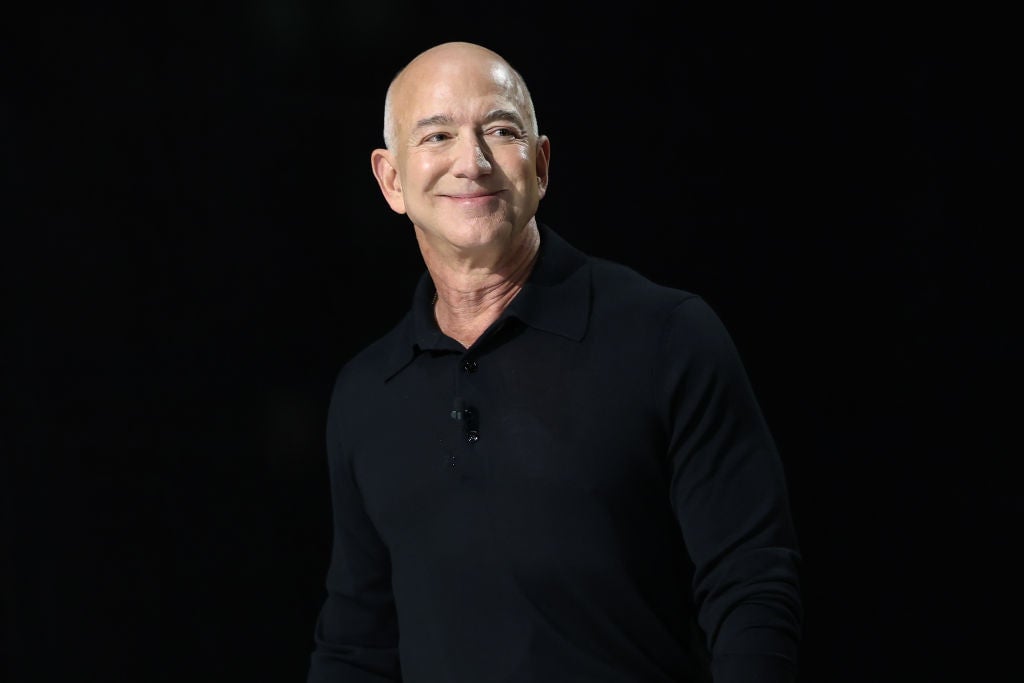

Jeff Bezos is planning to sell billions worth of Amazon stock

The Amazon founder will sell up to 25 million shares over the next year, according to an SEC filing

Amazon (AMZN) founder Jeff Bezos will sell billions of dollars in Amazon stock over the next year, according to a regulatory filing.

Suggested Reading

The former Amazon CEO and current executive chair will sell up to 25 million shares between now and May 2026, according to the SEC disclosure, which was made publicly available Friday. The value of those transactions would amount to about $4.8 billion at Amazon’s current stock price. The filing says Bezos adopted the plan in March.

Related Content

The disclosure comes a day after Amazon reported its first-quarter earnings. Net sales rose 9% to $155.7 billion, while net income reached $17.1 billion, or $1.59 per share, easily topping Wall Street’s forecast of $1.37 earnings per share.

Amazon’s North American sales came in at $92.9 billion and international sales hit $33.5 billion, climbing 8% and 5% over last year, respectively. AWS posted $29.3 billion in revenue, with segment operating income climbing to $11.5 billion — suggesting that demand for cloud and AI workloads remains strong. Ad sales also surpassed estimates, rising 19% year-over-year.

Still, Amazon shares were up only 0.2%, to 190.62, on Friday afternoon. The stock is down 13.5% since the start of the year.

Bezos unloaded about $13.5 billion worth of Amazon stock last year, the first time he’d sold his shares since 2021. That included 50 million shares in the span of nine trading days in February 2024 and another 25 million shares in July, when the stock was near its all-time high.

The timing of those sales coincided with Bezos’ full-time move from the Seattle area, where Amazon is headquartered, to Florida. If he still lived in Washington state, where a 7% capital gains tax was enacted in 2022, those transactions would have cost Bezos nearly $945 million.

Bezos didn’t mention Washington state’s new capital gains tax as a reason for his move. But while living there, the billionaire didn’t sell any Amazon stock in 2022 or 2023 after the tax was enacted, Fortune reported.

—Catherine Baab and Bruce Gil contributed to this article.