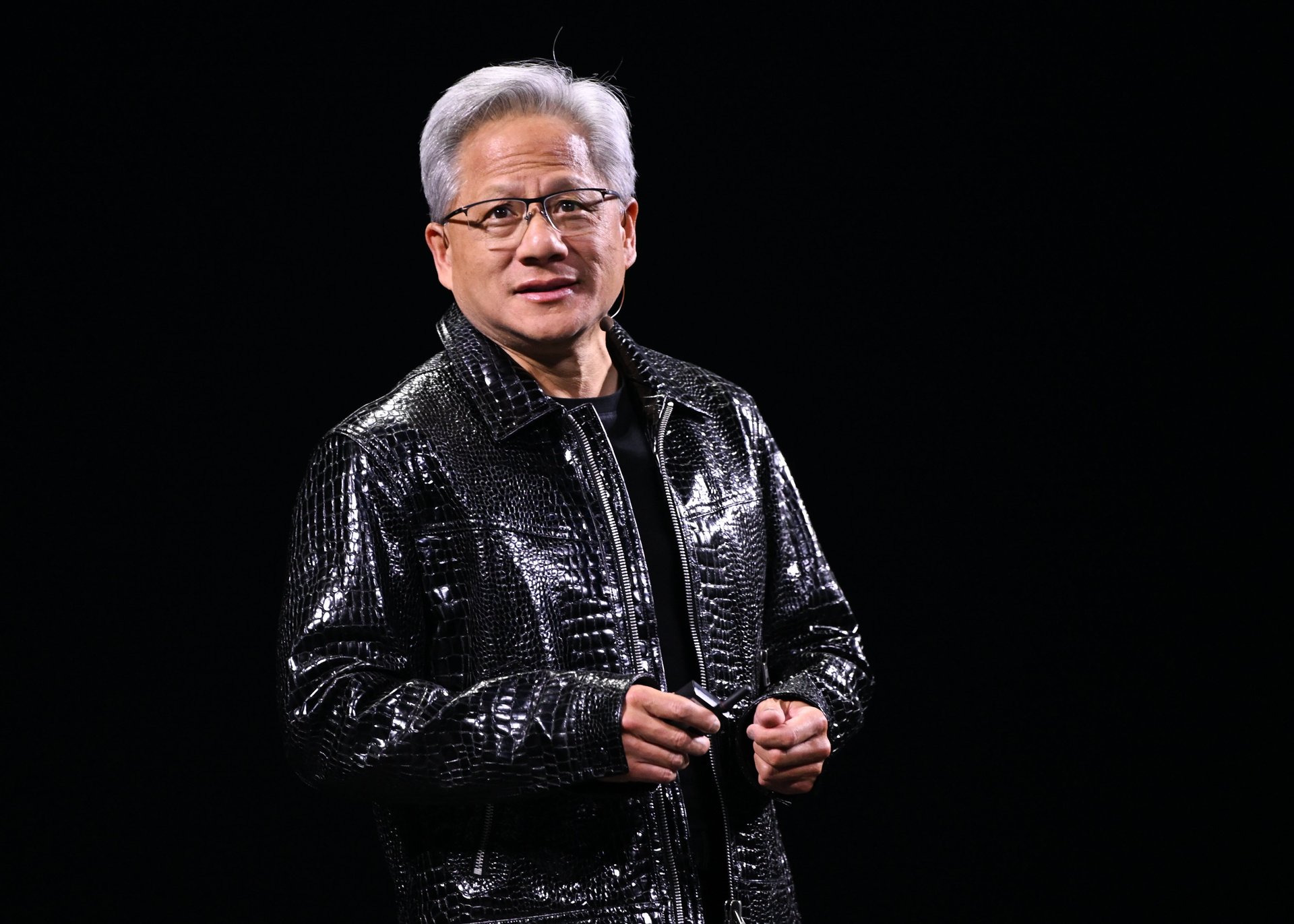

The Nvidia stock rout sent CEO Jensen Huang's net worth plummeting $18 billion

Huang's net worth fell almost 15% as the AI chipmaker's stock shed hundreds of billions in market value

Nvidia (NVDA) CEO Jensen Huang’s net worth plunged $18 billion Monday as the chipmaker’s stock continues to free fall.

Suggested Reading

Huang was worth $106.3 billion as of Monday morning, down nearly 15%, according to Forbes Real-Time Billionaires list. Huang has an approximately 3% stake in Nvidia.

Related Content

Shares of Nvidia were down nearly 16% to around $120 apiece just before mid-day. The rout caused the semiconductor giant’s market capitalization to fall by more than $465 billion to $2.97 trillion — the biggest single-day decline in market value for a company, beating its own previous record set last September.

That drop puts it below Apple (AAPL) and Microsoft (MSFT) as the third-most valuable company in the world. Just last week, Nvidia surpassed Apple to become the world’s most valuable company.

Global technology stocks suffered a widespread sell-off Monday that sent all three major U.S. indices tumbling, after investors grew concerned over a perceived threat from Chinese artificial intelligence startup DeepSeek.

Other major chip stocks also sank, including ASML (ASML), Broadcom (AVGO), Super Micro Computer (SMCI), Micron (MU), and Taiwan Semiconductor Manufacturing Co. (TSM).

The tech-heavy Nasdaq plunged more than 600 points, or roughly 3%. The Dow Jones Industrial Average, an index of 30 of the largest U.S. companies including Nvidia, were also down more than 70 points, and the S&P 500 tumbled almost 2%.

The sell-off was prompted by DeepSeek’s announcement last week that it launched a model rivaling OpenAI’s ChatGPT and Meta’s (META) Llama 3.1 built using lower capability chips from Nvidia, which could put pressure on the semiconductor darling if other firms move away from its premium offerings.

In December, the private company launched a free, open source large language model (LLM), which it claimed it had developed in just two months for less than $6 million.

Analysts at Wedbush said in a research note Monday that “tech stocks are under massive pressure led by Nvidia as the Street will view DeepSeek as a major perceived threat to U.S. tech dominance and owning this AI Revolution.”

However, they noted that the DeepSeek threat isn’t yet cause for concern, as U.S. companies remain ahead of the curve to achieving the next frontier of AI development: artificial general intelligence, or AGI.