Nvidia beats second-quarter expectations boosted by demand for AI chips

The AI chipmaker was expected to more than double its second-quarter revenue to $28.7 billion

Nvidia (NVDA) beat expectations yet again with its highly anticipated second quarter earnings results, reporting a record second-quarter revenue of $30 billion for fiscal year 2025 — up 122% from a year ago.

Suggested Reading

The chipmaker’s revenue for the quarter ending in July is up 15% from last quarter’s revenue of $26 billion, which also surpassed expectations, and was up 262% year-over-year.

Related Content

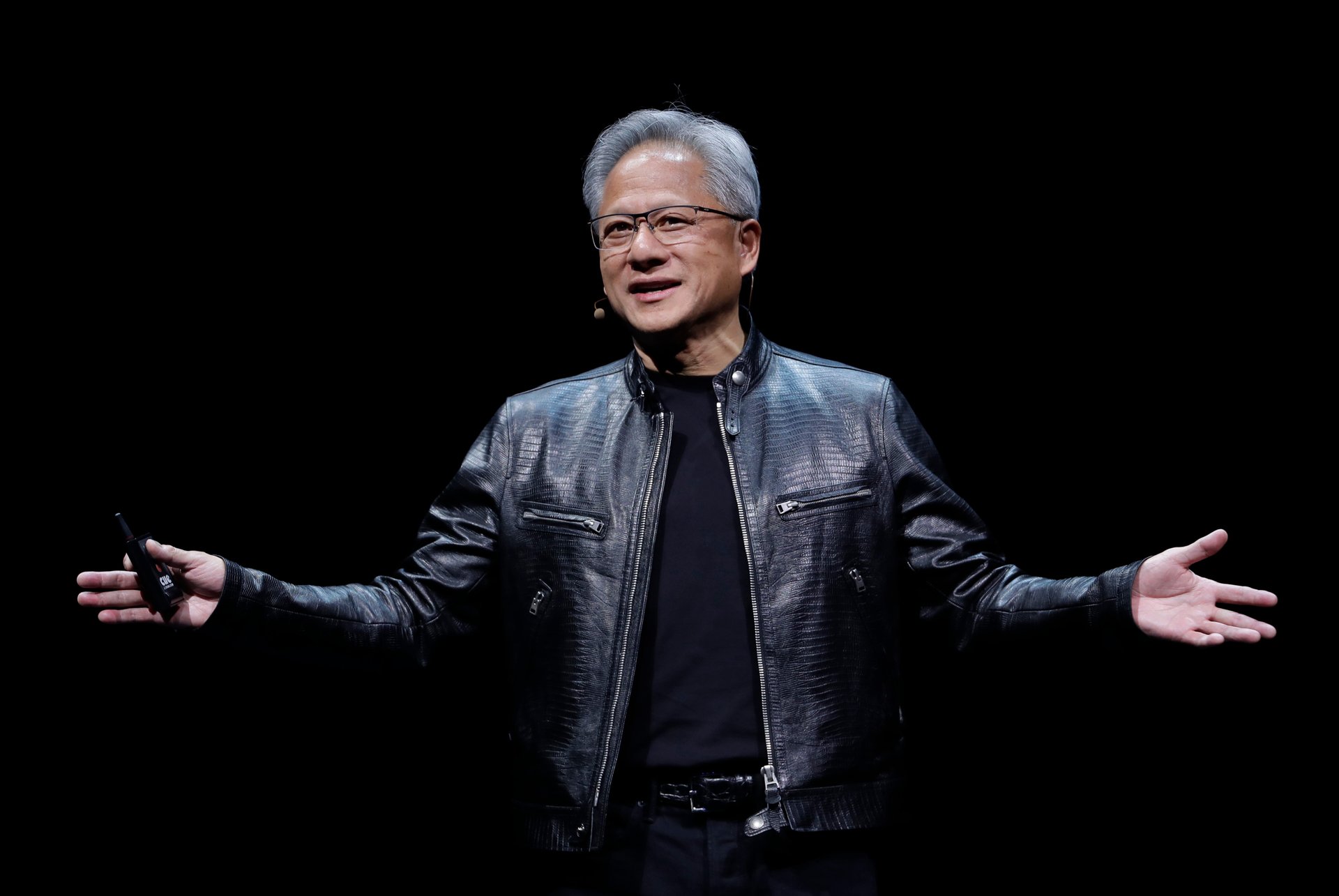

“Hopper demand remains strong, and the anticipation for Blackwell is incredible,” Jensen Huang, founder and chief executive of Nvidia, said. “Nvidia achieved record revenues as global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI.”

Nvidia was expected to report revenue of $28.7 billion for the second quarter — more than double its revenue of $13.5 billion a year ago, according to analysts’ estimates compiled by FactSet.

The company’s data center quarterly revenue was a record $26.27 billion for the second quarter, up 16% from the previous quarter, and a year-over-year increase of 154%. Data center revenue growth was driven by demand for Nvidia’s Hopper graphics processing units, or GPUs, which are used for training and inferencing some of the world’s most powerful large language models (LLMs), the company said.

Nvidia shipped customer samples of its Blackwell artificial intelligence platform during the second quarter, it said, adding that its production will ramp in the fourth quarter into fiscal year 2026. To “improve production yield,” Nvidia made a change to Blackwell’s GPU mask, it said. However, “there were no functional changes necessary,” Huang said on a call with analysts. The company expects to “ship several billion dollars in Blackwell revenue,” in the fourth quarter, it said. Meanwhile, demand for its Hopper chips remains strong, and the company expects shipments to increase in the second half of the fiscal year.

During its first-quarter earnings call, Huang said Blackwell would start shipping in the second quarter, ramp up in the third quarter, and be with customers in the fourth quarter. However, earlier this month, Nvidia’s shares fell after a report that Blackwell is delayed due to design flaws, possibly pushing deliveries back by at least three months.

The chipmaker set its third-quarter revenue expectations at $32.5 billion, plus or minus 2%.

Ahead of its earnings report, Nvidia’s shares were down around 2% at the market close on Wednesday. The company’s shares were down almost 7% in after-hours trading, but are up 160.76% so far this year.