Nvidia stock climbs another 12% after record earnings

The AI chipmaker saw $26 billion in first-quarter revenue, up 262% from last year

Shares of Nvidia rose 12% in afternoon trading on Thursday to $1,060 a share following its hotter-than-expected first-quarter earnings report.

Suggested Reading

The chipmaker’s stock price passed $1,000 for the first time during after-hours trading on Wednesday after it reported its first-quarter earnings. Its shares ended the trading day down by 0.4% at $949.50 per share. It closed at a record-high $953.86 the day before.

Related Content

Nvidia is one of the world’s largest semiconductor manufacturers. The company has seen its bottom line boosted by demand for chips that can power the artificial intelligence boom, like its Blackwell and H200 chips. The chipmaker was the first to reach a $2 trillion market cap in February and snagged the title of third-most valuable company in the world in March.

Record revenues and a stock split

Nvidia reported a record first-quarter revenue of $26 billion for the 2025 fiscal year — a 262% increase from a year ago. Its revenue for the quarter ending April 28 climbed 18% from its last quarter revenue of $22 billion that had beat Wall Street’s sky-high expectations and was up nearly 270% from the previous year.

Analysts at Wedbush called Nvidia’s record performance a “masterpiece quarter” and the “ultimate barometer of the AI Revolution.” Nvidia’s results showed that “AI demand is accelerating....not slowing down,” the analysts wrote in a research note published Thursday.

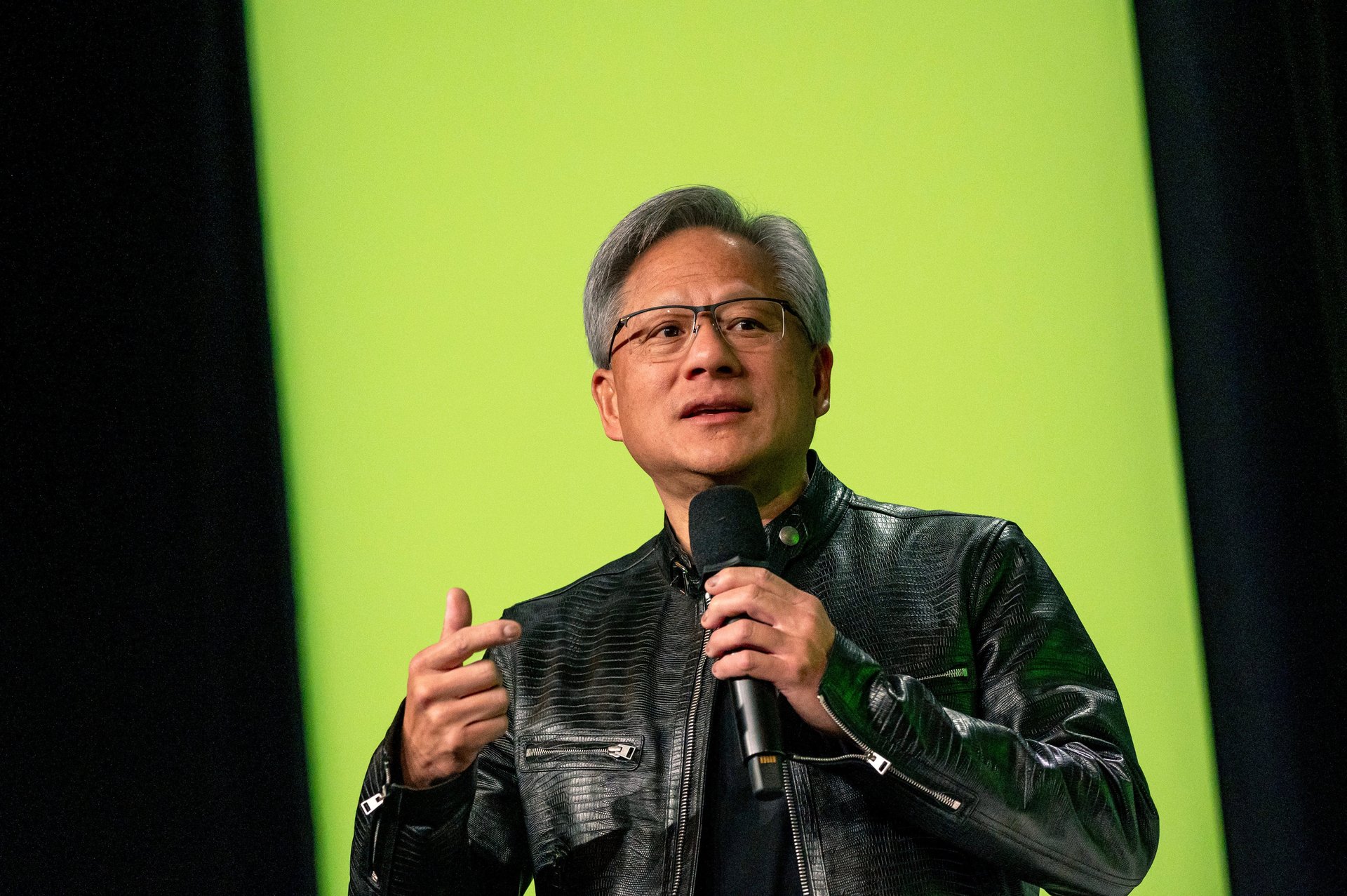

Nvidia founder and chief executive Jensen Huang said in a statement that “AI will bring significant productivity gains to nearly every industry and help companies be more cost- and energy-efficient, while expanding revenue opportunities.”

The company reported its data center quarterly revenue was a record $22.6 billion, up 23% from the previous quarter, and up a whopping 427% from a year ago. This revenue was driven by high demand for Nvidia’s Hopper GPUs, or graphics processing units, which are used in training and developing leading large language models (LLMs), Nvidia said. Demand for Nvidia’s H200 and Blackwell chips is exceeding supply, Nvidia said on its earnings call.

“Nvidia’s GPU chips are in essence the new gold or oil in the tech sector as more enterprises and consumers quickly head down this path with the 4th Industrial Revolution well underway,” Wedbush analysts said.

The chipmaker set its second-quarter revenue expectations at $28 billion, plus or minus 2%. The chipmaker also announced a 10-for-1 stock split, under which shares will begin trading when the market opens on June 10.