The road ahead for EVs depends on these 7 factors

There’s a lot riding on EVs going mainstream globally. There are also a lot of challenges for companies and governments alike.

The widespread adoption of EVs is coming faster than anticipated, with new electric vehicles hitting the road daily. Car owners are buying EVs at a record pace, while electrification is catching on with commercial and public operators, too.

Suggested Reading

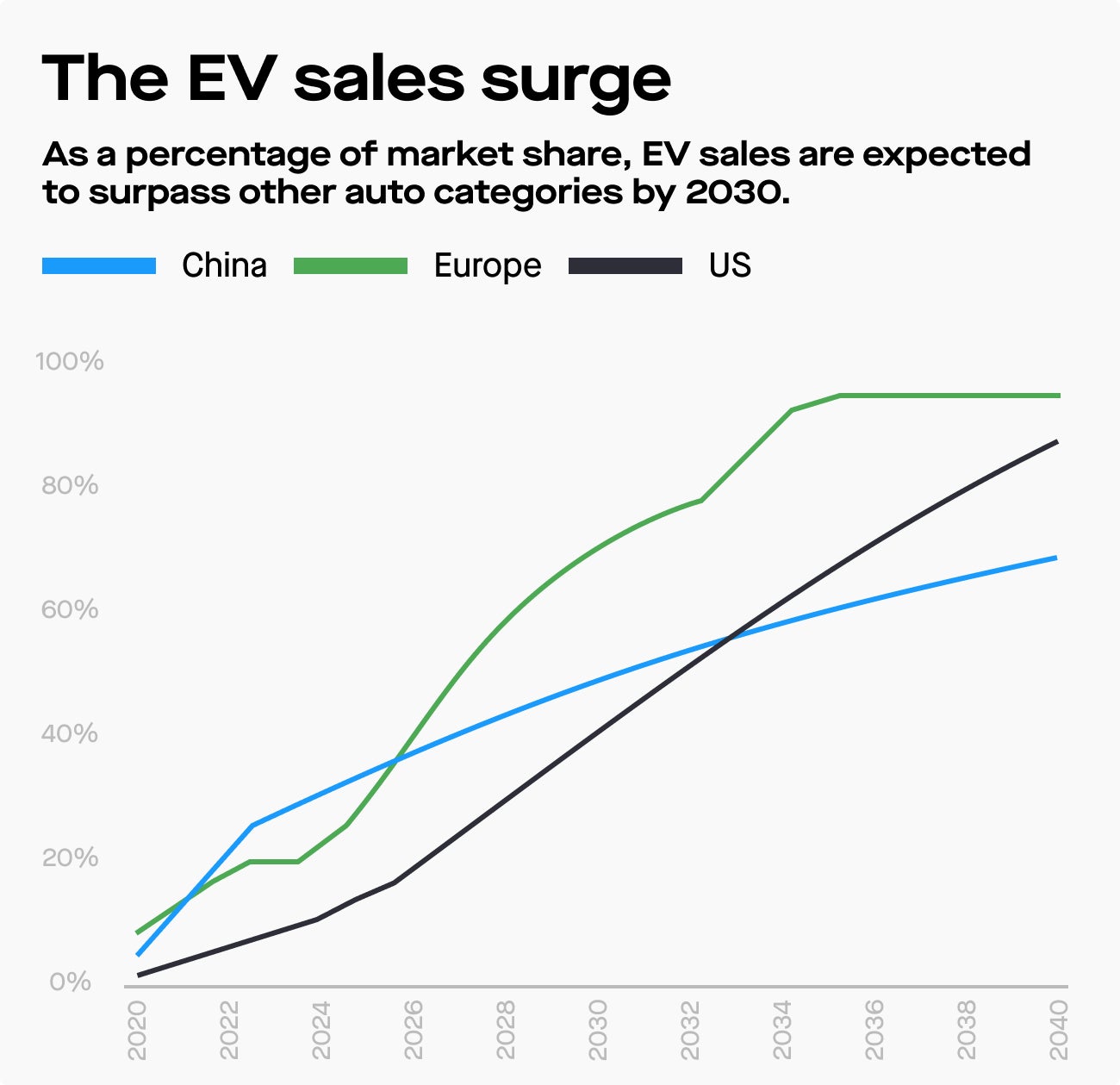

Worldwide EV sales doubled in 2021 and increased by 55% in 2022, making up 13% of all vehicle sales globally and more than 20% in Europe. EY-Parthenon forecasts that by 2030, 55% of all vehicles sold will be EVs or plug-in hybrid EVs

Related Content

Despite the hype, EVs still only make up a small portion of overall car sales in many major markets. For EVs to truly go mainstream, there’s also a whole ecosystem that needs to develop — one that involves consumers, auto parts suppliers, utility companies, electrical grids, and policymakers.

Global strategy consultancy EY-Parthenon, working with Eurelectric, the European energy industry body, has identified six enterprise challenges, while EY’s latest Mobility Consumer Index report, a study of 14,500 participants in 20 countries, studied consumer barriers.

Challenge #1: Converting skeptical consumers

EV sales are growing quickly but many consumers remain cautious. Concerns about battery performance, driving range, price, reliability and comfort continue to hold back many car shoppers, particularly those who aren’t up to date on recent EV advancements on all of these fronts.

EY’s 2023 Mobility Consumer Index identified three ways automakers could win over the skeptics: showing how EVs can be practical on a day-to-day basis, providing clear information about what to expect from an EV, and offering ways to optimize battery performance through good driving and charging practices.

For worries around high upfront costs or expensive ongoing liabilities such as battery replacement, automakers and dealers alike can help ease these hesitations by expanding the menu of mid-market and budget EVs, devising alternative ownership models, such as rentals and lease to own, and even offering subscriptions on both EVs and batteries.

Challenge #2: Strengthening the battery supply chain

Electric vehicles rely more on critical minerals such as copper, lithium, nickel, manganese, cobalt, graphite and rare earths than conventional cars. Already, the ramped-up demand for EVs wreaked havoc on supply chains, pushing up the price of various battery metals and creating challenges for automakers.

Batteries are the most expensive part of EVs, and the rising cost of raw materials could raise prices and hamper demand. As it stands now, Europe and the US rely heavily on elements and batteries from China. Companies are trying to shift to domestic or more local production to reduce that dependency. They’re moving quickly to manufacture EV components and move up the battery value chain.

Challenge #3: Building more charging infrastructure

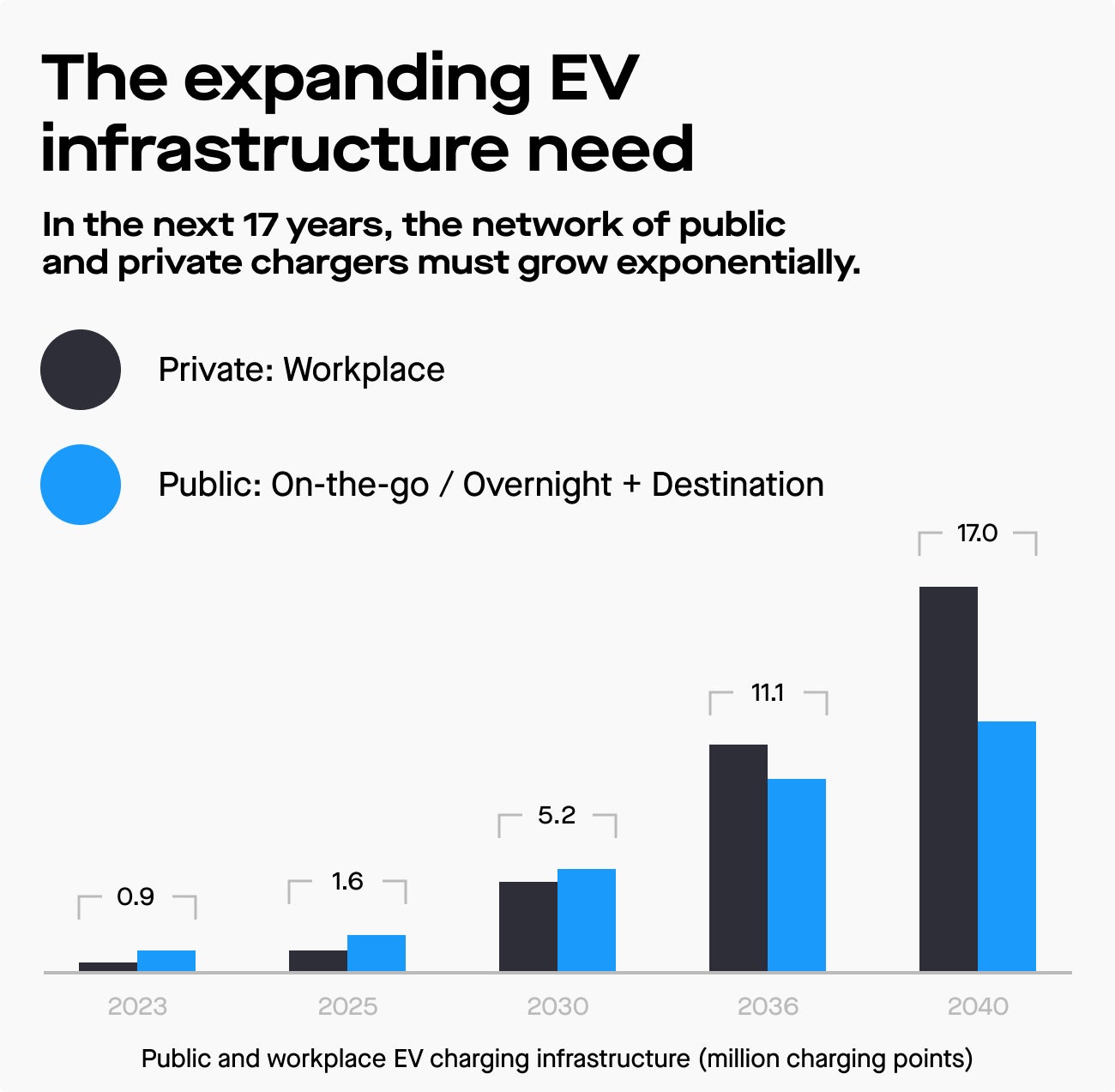

Based on the EY-Parthenon and Eurelectric research, the number of electric vehicles on the streets is increasing every day, but the number of chargers isn’t keeping pace. About 80% of drivers currently charge at home or work, according to their report. But for full-scale EV adoption to occur, there needs to be a public network of high-speed chargers for those who can’t plug-in at home or who need to travel further distances.

Europe currently has an estimated 482,000 publicly accessible charging points, but 71% are concentrated in just five countries — Germany, France, Italy, the UK, and the Netherlands. Seven European countries have fewer than 1,200 charging points.

There will need to be a massive increase in both public and private chargers; in fact, public chargers globally will need to increase by a factor of 11 by 2040.

Digging in, EY-Parthenon estimates Europe requires 5.2 million non-residential chargers by 2030, while the US, plans to triple the number of its domestic chargers for a total of half a million by 2030.

To reach these goals, there needs to be a coordinated effort to remove regulatory barriers, improve access to land for infrastructure, and expedite the local permitting process.

Challenge #4: Ramping up green power

A big part of the push for electric vehicles is the desire to reduce dependence on fossil fuels and shift to clean energy. Currently, only 3% of the transport sector runs on renewable energy — much of that in biofuels — says EY-Parthenon’s research. EVs may eventually become the biggest buyers of clean electricity, but first, there needs to be adequate renewable energy available. This is a complex global challenge.

Governments are taking steps to expedite the transition to lower carbon energy. The EU’s REPowerEU plan proposes to increase its 2030 renewable target to 45% from 40%, while the US is aiming for 100% no-carbon electricity by 2035. For these ambitious goals to come to fruition, governments must encourage renewable energy and a more flexible market.

Challenge #5: Constructing a smart grid

Electric vehicles are expected to put more demand on the electrical grid. EY-Parthenon’s eMobility studies show that in the US, EVs are anticipated to account for 10% of overall US power demand by 2035 and 5% of total demand in Europe by 2030. EY-Parthenon also predicts an 86% increase in peak load in multi-unit dwellings and a 90% increase in highway corridors.

To cope with the increased usage, there will need to be many adaptations so EVs don’t threaten the stability of power grids.

Adaptations could include better energy storage systems or bidirectional charging technologies, which add flexibility to the grid. There will also need to be incentives to encourage EV owners to charge their vehicles during off-peak hours so as not to overload the system with everyone plugging in simultaneously. Utility companies play a crucial role in all this, and coordinated plans for grid expansion and enhancements will be vital.

Challenge #6: Protecting and mining vehicle and charger data

The EV ecosystem will create a new kind of data highway. EVs generate massive amounts of new data, as do chargers. That data can be shared when vehicles connect with the energy grid and to buildings through chargers. Capturing and analyzing this data creates valuable insights about infrastructure needs, traffic density, and the capacity of the grid network and are the building blocks of hyper-personalized product offerings for customers.

But for this to happen, regulators must first resolve issues about data storage, ownership, usage and regulation. There will need to be harmonized protocols for supporting the connections between vehicles, charge point operators, and eMobility service providers which help customers access charging stations through an app.

Challenge #7: Reskilling the auto workforce

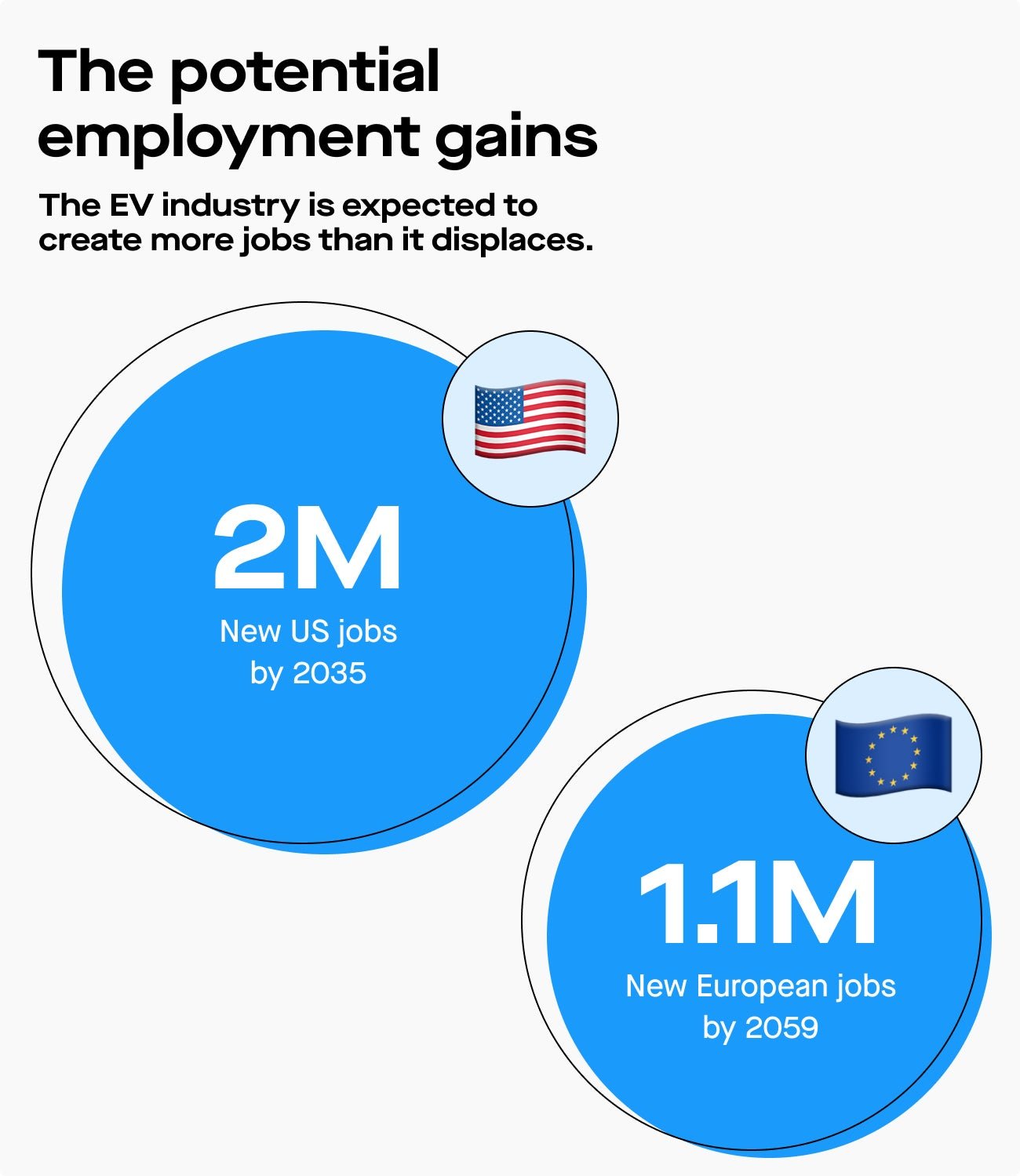

The transition from combustion engines to electric powertrains creates new job opportunities in the auto manufacturing and related industries, especially battery technology. While the transition will disrupt legacy businesses, the EV industry is expected to create more jobs than it displaces, the EY-Parthenon report finds.

For example, in the US, the transition is expected to usher in a net gain of two million jobs by 2035, while in Europe, around 1.1 million permanent new jobs could be created by 2059 if the entire EU fleet is fully electric.

Creating these new jobs depends on governments and companies retraining employees and retooling factories. Some governments are taking notice, including Japan, which aims to educate 30,000 more battery-related workers by 2030.

According to EY’s 2023 Mobility Consumer Index research, much of the public, especially younger consumers, is largely sold on the benefits of electric vehicles. Now companies, industries and policymakers will need to work — together — to get through the remaining roadblocks to widespread EV adoption.

Learn more about the impacts of EV adoption on your industry with EY-Parthenon.

This content was produced on behalf of EY-Parthenon by Quartz Creative and not by the Quartz editorial staff. Sources are provided for informational and reference purposes only. They are not an endorsement of EY-Parthenon or EY-Parthenon’s products or services. This publication contains information in summary form and is therefore intended for general guidance only. It is not intended to be a substitute for detailed research or the exercise of professional judgment. Member firms of the global EY organization cannot accept responsibility for loss to any person relying on this article.