The Fed just made life easier for European governments but harder for European exporters

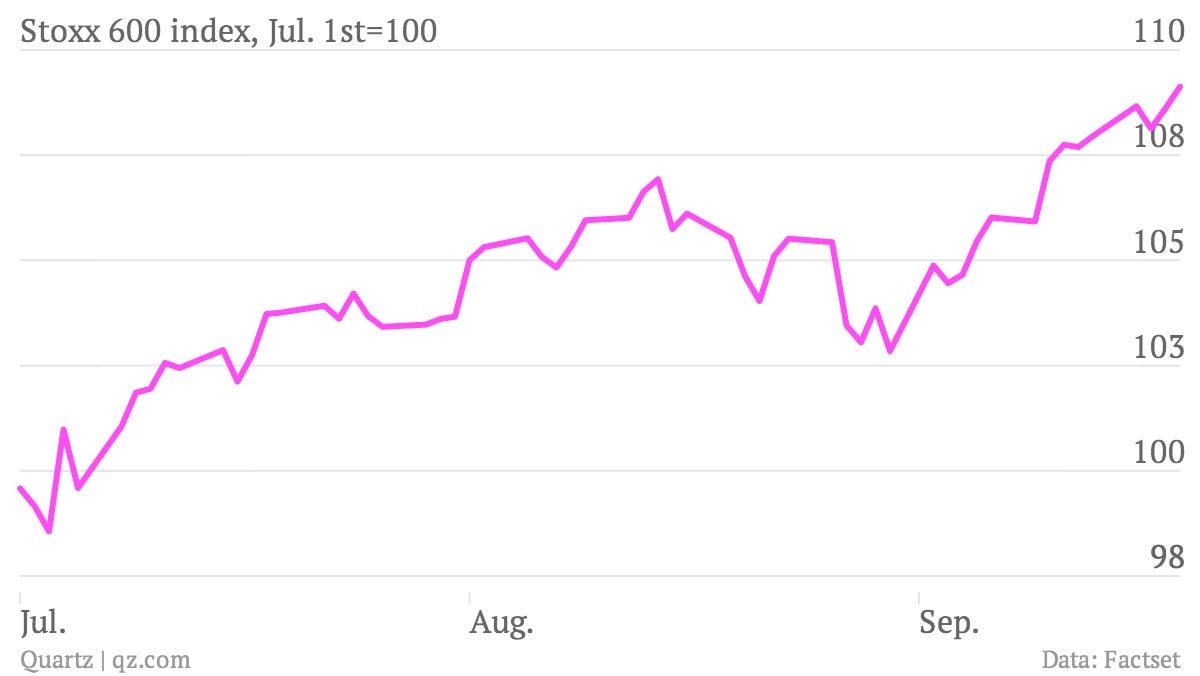

The US Federal Reserve’s surprising decision to keep its foot on the monetary-stimulus pedal came yesterday when European markets were closed. Like everywhere else that woke up to the news from Washington, DC today, stocks in Europe posted strong gains. The regional Stoxx 600 index set a fresh five-year high, with gains across the board, particularly in Italy, Spain and other members of the euro zone’s beleaguered “periphery”.

The US Federal Reserve’s surprising decision to keep its foot on the monetary-stimulus pedal came yesterday when European markets were closed. Like everywhere else that woke up to the news from Washington, DC today, stocks in Europe posted strong gains. The regional Stoxx 600 index set a fresh five-year high, with gains across the board, particularly in Italy, Spain and other members of the euro zone’s beleaguered “periphery”.

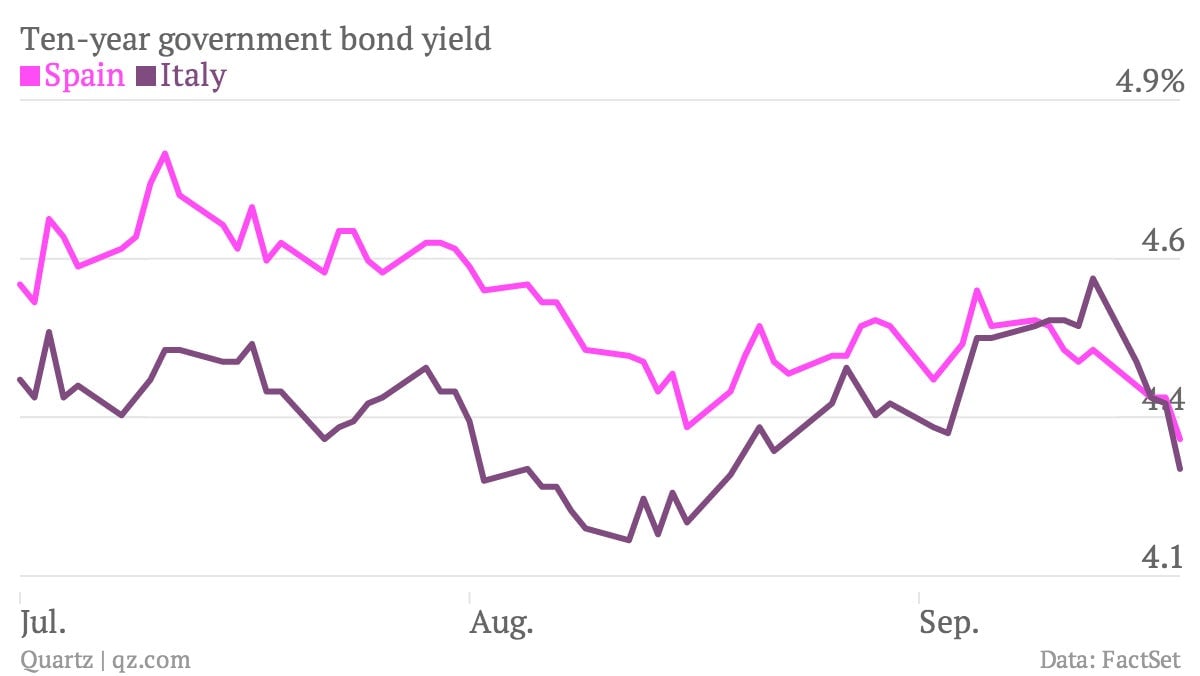

Bonds rallied too, which takes some of the pressure off the countries struggling to maintain their nascent recoveries. Ever since May, when the Fed began to talk of “tapering” its monthly purchases of US Treasury bonds, European interest rates have crept higher, making borrowing for those debt-laden countries more expensive. In addition to their fear that the Fed might reduce the monetary stimulus washing over from America, investors in Europe fretted about France’s ballooning budget deficit, a fresh outbreak of political instability in Italy, another potential bailout for Portugal, and the usual ructions and backsliding in Greece, to name just a few recent worries.

Now, the Fed’s decision to continue its largesse has pushed borrowing costs back down across the continent, a relief to embattled finance ministers. Spain looks particularly shrewd after issuing more than €3 billion ($4.1 billion) in bonds this morning, fetching funds at a much lower cost than in other recent auctions.

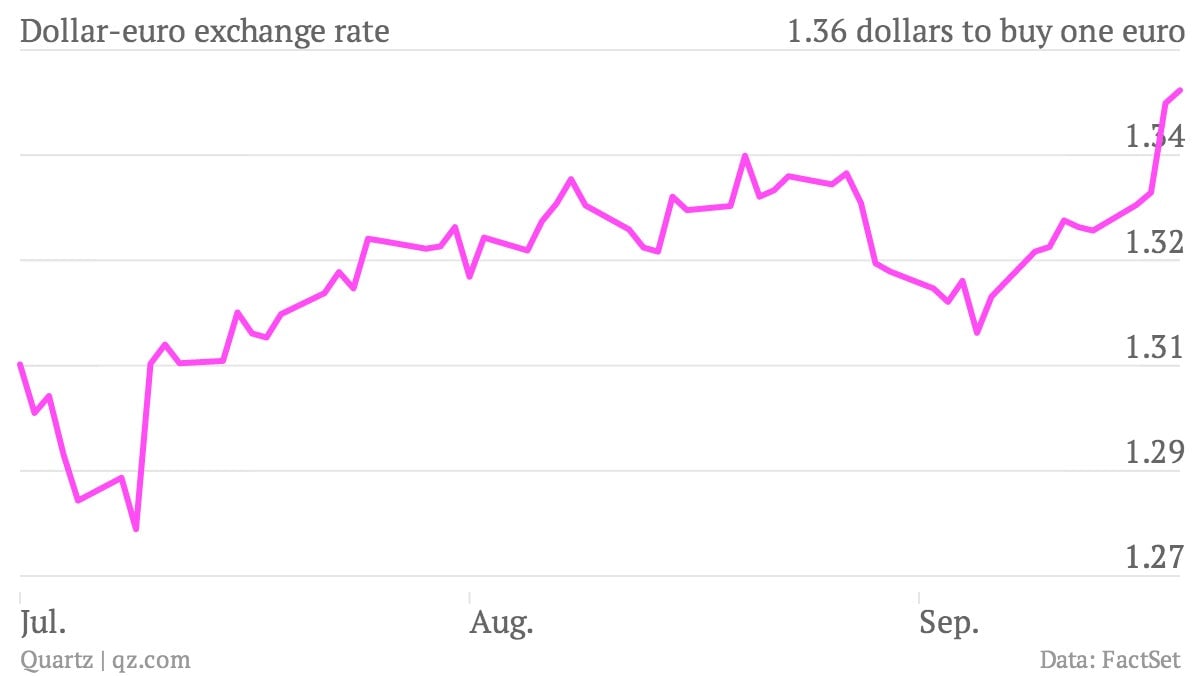

There is, however, a sting in the tail. Expectations that lower US interest rates will continue for longer have strengthened the euro against the dollar, which could hurt European exporters. The European Central Bank has long been the least accommodative of the world’s major central banks, so the Fed’s pledge not to ratchet down its stimulus made this even more clear. The currencies managed by other free-spending central banks, like the Bank of England and Bank of Japan, also sank against the euro.

A stronger euro is bad particularly for Ireland, whose return to economic growth reported today is thanks in part to a boost in exports. The mighty German export machine, which isn’t humming along particularly smoothly at the moment, also works better when fueled by a weaker euro.

This, however, is a worry for another day. The comforting green glow of stock and bond traders’ screens is what’s making headlines today, all because of what Fed chair Ben Bernanke didn’t say yesterday.