Get ready for self-driving money

The tantalizing future of robot taxis is just on the horizon, as self-driving cars are scheduled to hit the road as early as 2019. Money is going through a transition that could be just as revolutionary, as our finances may also soon be able to drive themselves, says Kenneth Lin, CEO of Credit Karma.

The tantalizing future of robot taxis is just on the horizon, as self-driving cars are scheduled to hit the road as early as 2019. Money is going through a transition that could be just as revolutionary, as our finances may also soon be able to drive themselves, says Kenneth Lin, CEO of Credit Karma.

Lin thinks “autonomous finance” could come about in the next five or so years. And eventually, all of our most important financial decisions could be automated without asking for permission. After all, do you know the best time to refinance your mortgage (and where to get it)? Your student loan? Your car loan? Me neither.

He envisions a time when computers refinance our debts when it’s most advantageous, while investing our cash into longer-term investments (and rebalancing them) when it makes sense. Life insurance and other protections would be on autopilot. The technology has its roots in the fintech projects cropping up now.

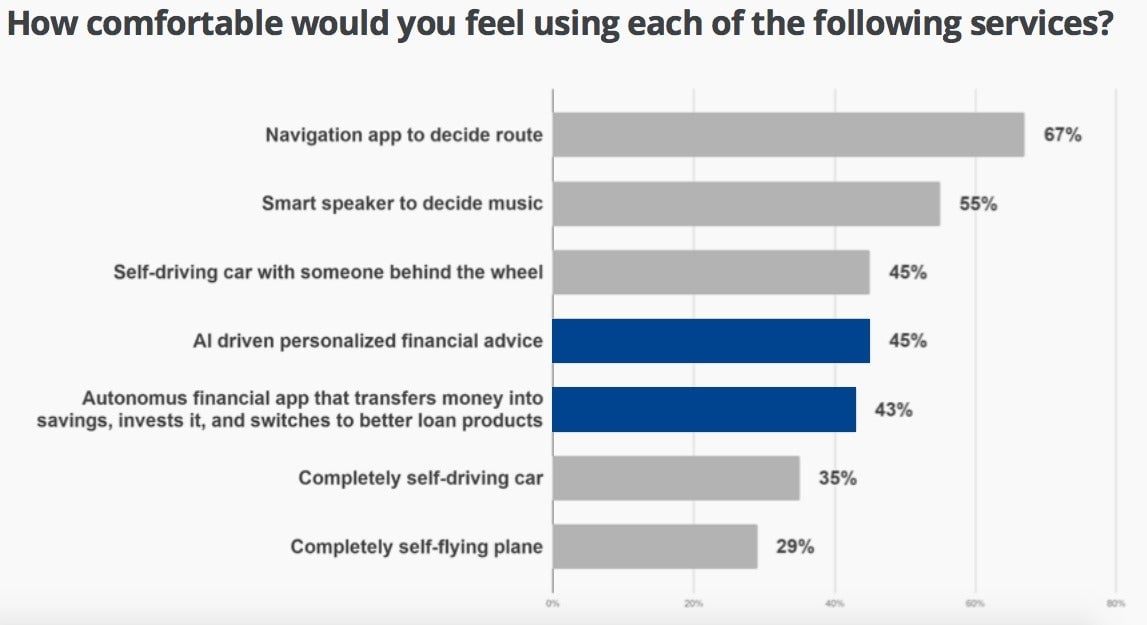

American overspending on auto loans amounted to $37 billion last year, according to a Credit Karma presentation at MoneyConf in Dublin. For home mortgages, that amount comes to almost $100 billion. Consumers, meanwhile, are more comfortable with autonomous financial advice than they are fully self-driving cars and planes. (Yet we are strangely controlling when it comes to music selection.)

Wealthfront, a robo advisor, is pursuing a future similar to Lin’s vision. CEO Andy Rachleff said this week at a CB Insights conference that the company wants to automate all of its customers’ finances. A client could one day deposit her paycheck with Wealthfront and the company would take care of just about everything else from there.

This brighter, better future seems pretty Utopian, which of course means it’s not assured. With every industry where automation is proliferating, the cyber risk will have to be contained if consumers are going to trust it, for example.

Robo advisors managed $98.5 billion in 2016, more than double the year before, according to Charles Schwab, which has a robo service. Schwab predicts the segment’s assets will climb to $460 billion by 2020. That compares with Edward Jones, a 96-year-old incumbent with around 20,000 advisors, that managed some $1 trillion as of October. In a sign that algorithms may not have been wooing enough new customers, Betterment, originally an all-digital service (paywall), added a human advisor option last year.

But Lin thinks these concerns are manageable and that self-driving finance isn’t even that radical. Just as wealthy people have long enjoyed chauffeurs to drive them around, the elite have also benefitted from specialized financial advice to help them get the most out of their money.

If all goes well, ordinary people will soon have the benefit of optimized finances. If so, some of us might find we have enough extra cash for that self-driving car.

The future of finance on Quartz

- When a crypto token turns out to be a security, the US legal implications can be dizzyingly complicated.

- People aren’t giving up over-hyped blockchain projects: The Queen of Crypto is selling a stake in an Andy Warhol silkscreen via blockchain art auction, and Microsoft thinks the technology is great for royalty payments.

- Brits, meanwhile, are giving up on cash, while Square’s market capitalization goes stratospheric.

The future of finance elsewhere

- There was another crypto exchange hack: South Korean platform Bithumb said about $32 million was stolen. A more novel way of stealing money from crypto investors is to start a fake exchange.

- In the US, former FDIC chairwoman Sheila Bair noted that “trying to jam crypto trading into state money transmission laws” doesn’t work. R3 showed some of its financial documents to Forbes.

- PayPal bought payout platform Hyperwallet for $400 million and fraud prevention specialist Simility for $120 million. The owner of Shake Shack is looking to go cashless.

- In trading, humans are under-rated, and superforecasting (paywall) could improve the accuracy of financial projections by using the wisdom of crowds.

Previously, in Future of Finance Friday

June 15: A philosopher thinks technology could make anarchists’ dreams come true