The eight most important charts of the week

The resolution of the US debt fight was the biggest story of the week, overshadowing plenty of interesting economic updates from around the world. In case you missed them, here they are:

The resolution of the US debt fight was the biggest story of the week, overshadowing plenty of interesting economic updates from around the world. In case you missed them, here they are:

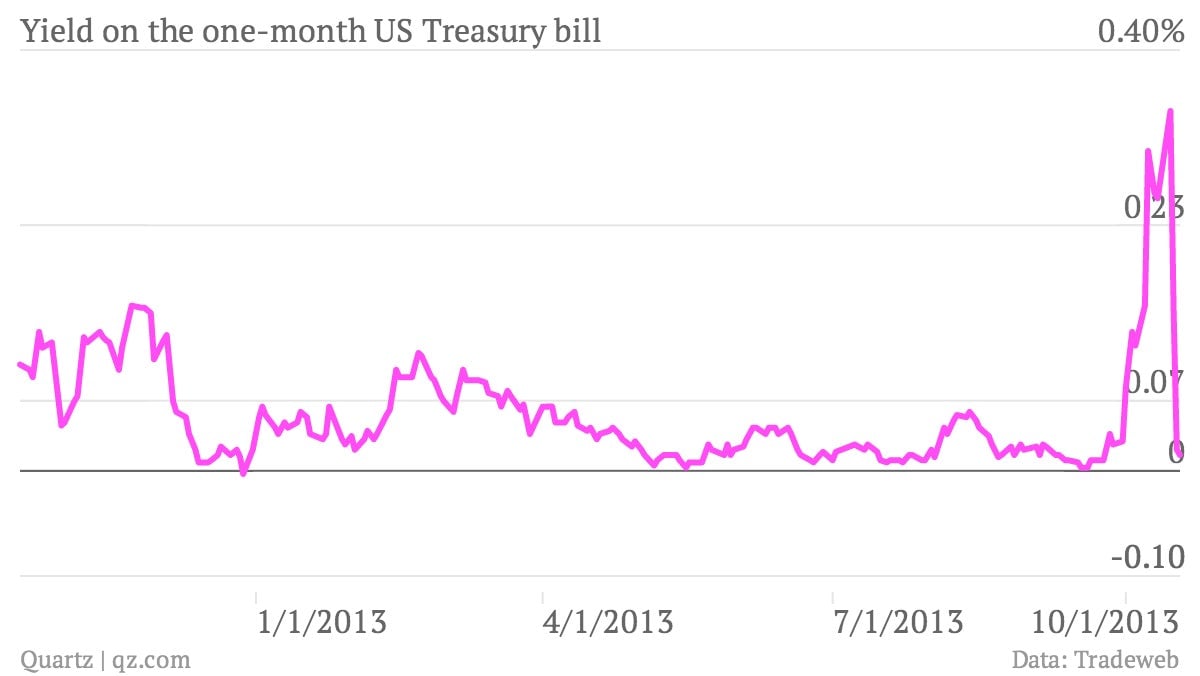

1. The spike in the one-month Treasury bill yield. Rates on this normally super-safe financial instrument shot higher along with concern that the US actually might default. But the passage of the Congressional deal to raise the debt ceiling and fund the government sent them crashing back to earth.

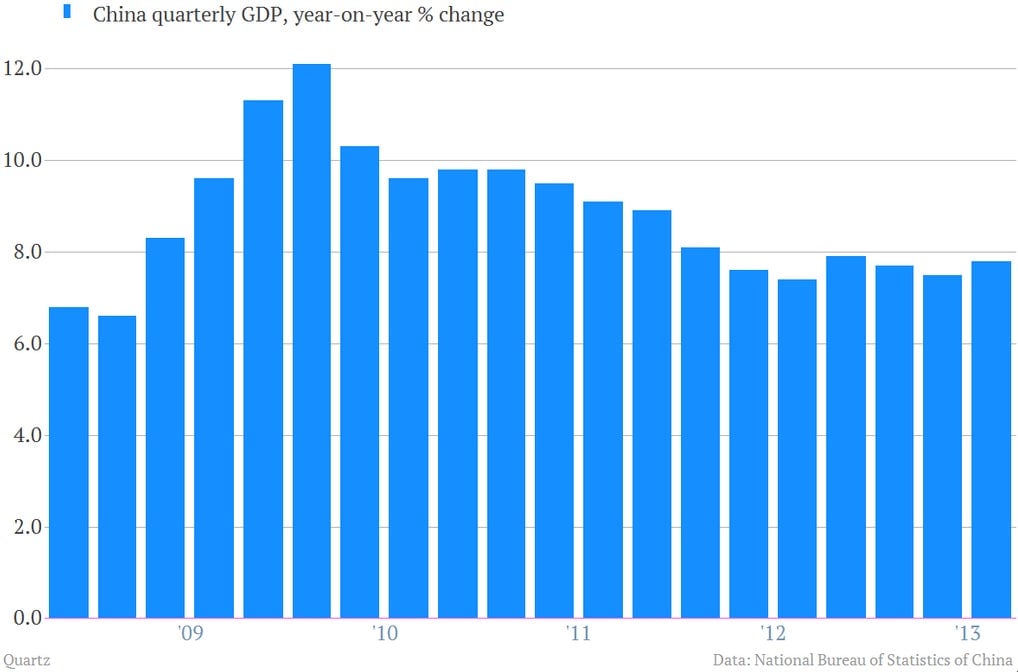

2. China’s economy grew at a better-than-expected clip in the third quarter thanks to a dollop of government spending.

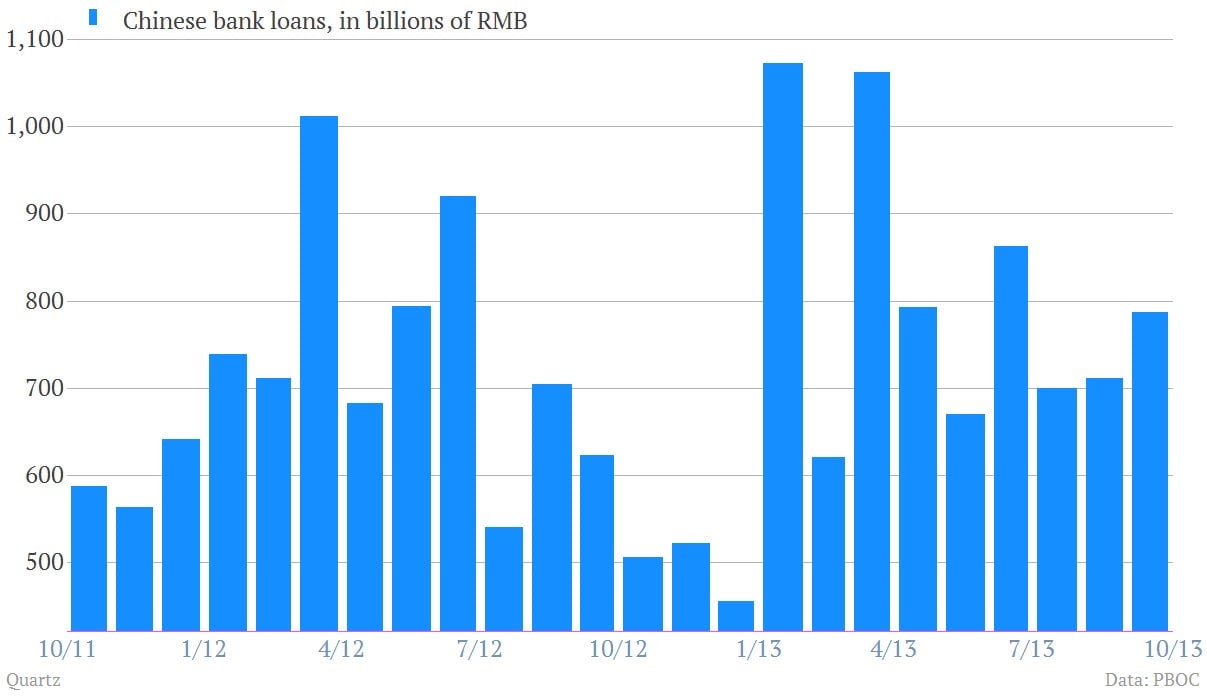

3. The peppier-than-expected growth is driven in part by increased action from Chinese lenders, despite plenty of concern in recent months about the sustainability of China’s credit boom.

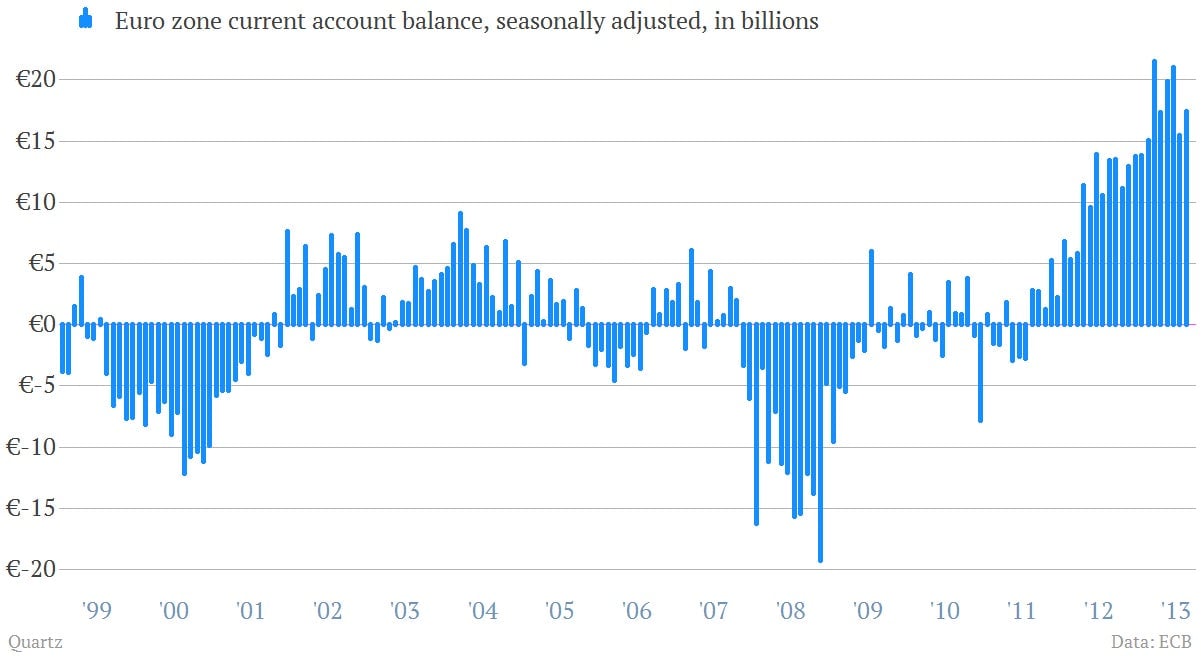

4. The euro zone continues its painful adjustment. As we’ve spotlighted before, heavily indebted countries such as Spain and Italy have been making a tough transition to current account surplus. And the monetary bloc as a whole has followed suit. While the adjustment might be seen as good news by some, other counter that it merely reflects the fact that heavily depressed domestic demand is collapsing incredibly quickly. (Imports did post a modest rise during August.)

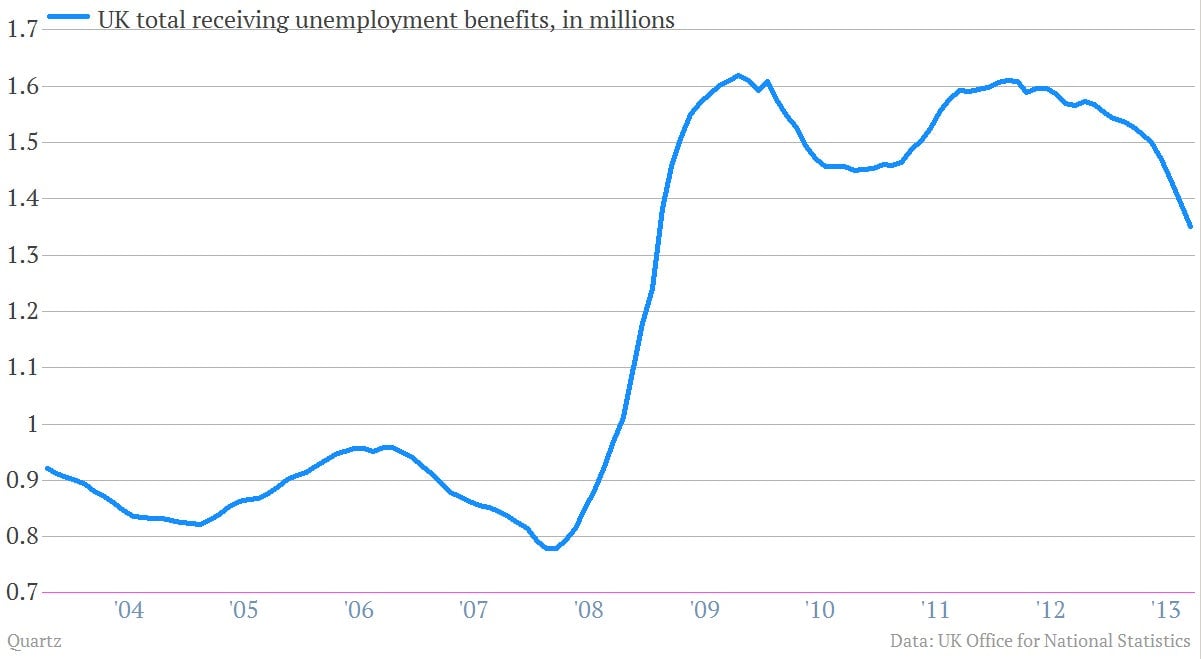

5. The number of Brits claiming unemployment benefits continued to decline sharply. (Though falling wages and high unemployment remain bad news for workers.)

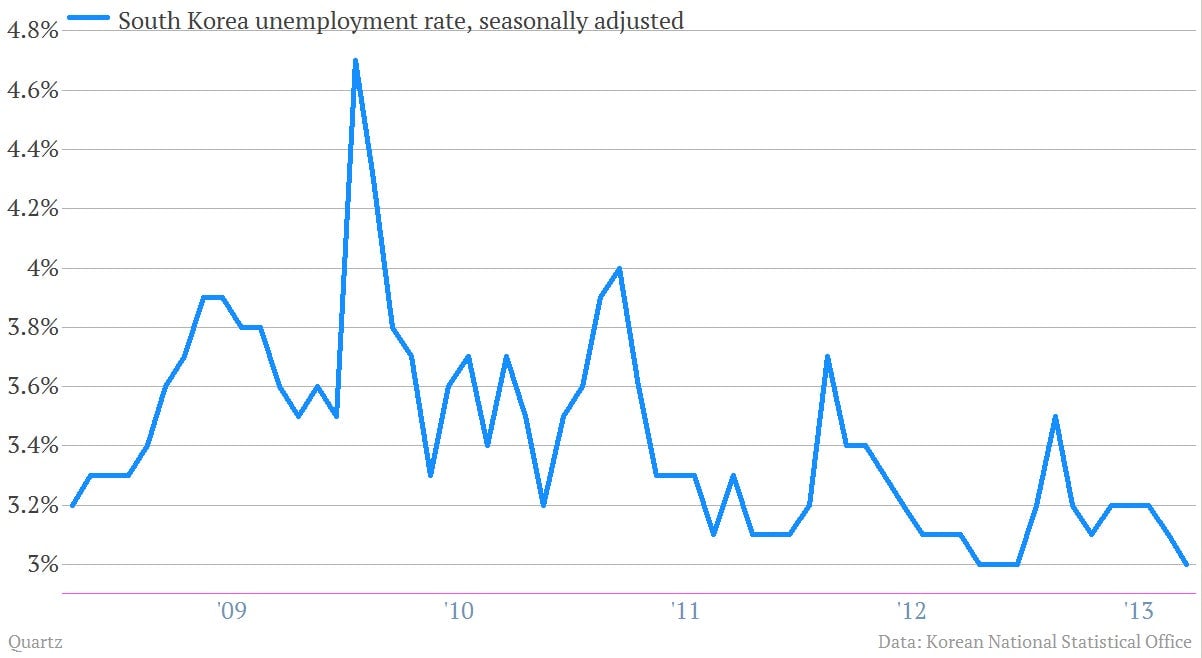

6. South Korea’s economy continues cranking away. Its unemployment rate dropped to a seasonally adjusted 3.0% in September, as construction jobs surged.

7. Indian inflation reared its pesky head again, with the September wholesale price index—India’s main inflation benchmark—rising 6.46% versus the prior year.

8. Oh, and Google’s stock price hit $1,000 after a smoking earnings report. It’s been a long ride.