For struggling soda companies like PepsiCo, munchies, not fizzies, are the business of the future.

The beverage giant posted yet another quarter of mixed results, after quarter upon quarter of dowdy sales of carbonated drinks, especially in the US. Beverage sales, which make up roughly half of PepsiCo’s global business, are becoming a bigger and bigger sore spot as soda sales decline in the company’s major markets. Soda consumption has been falling since its peak in 2005 in the US and tapering in emerging markets.

And yet, Pepsi’s profit estimates beat the street, saved by the likes of potato chips and granola bars. The company’s snack sales jumped 3% in the Americas and nearly 10% in emerging markets including China, Brazil, Mexico and Turkey. By contrast, its soda sales now represent a mere 15% of its North American business, according to the company’s earnings call today. Analysts fear a new soda tax in one of PepsiCo’s largest international markets, Mexico, will worsen the soda scourge (Mexico is the world’s second-largest consumer of carbonated soft drinks per capita after the US).

“We expect about two-thirds of our revenue growth will come from snacks,” CEO Indra Nooyi said today in Pepsi’s earnings call. Not everyone believes that’s the right direction. Activist investor Nelson Peltz has been pushing the company, already the world’s biggest snacks maker, to spin off its American food business and spread Doritos, Lays and Fritos around the globe on its own, potentially by buying international food purveyor Mondelez.

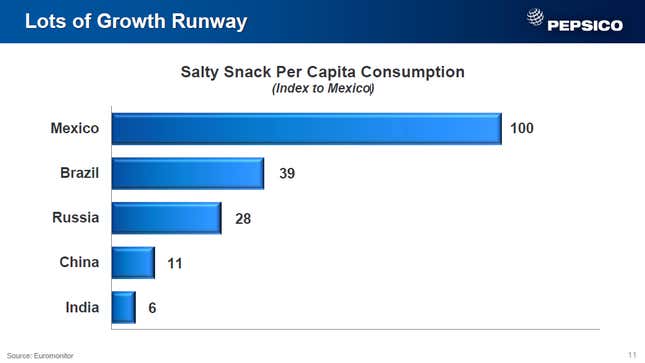

The low-hanging fruit, er, chips, are in markets like Mexico and Brazil, where consumers are already hooked on snacks. Snacks are among the first products emerging market consumers tend to splurge on as their countries urbanize. That leaves far more room for PepsiCo to run in underserved markets like India, where rural-to-urban migration, long hours and office life have yet to hook the bulk of consumers on pre-made snacks.