The emergence of non-traditional bank lenders (paywall) in the US home lending market has drawn intense scrutiny from regulators, and a look at the eye-popping growth of one non-bank mortgage lender, Ocwen Financial, can help explain why.

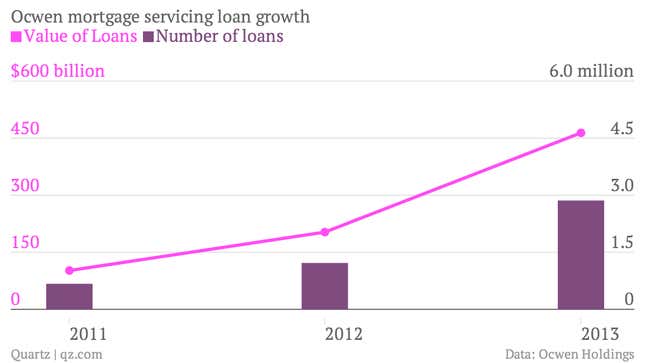

In roughly two years, the value of the loans Ocwen services—by collecting mortgage checks from homeowners and parceling out payments to investors—grew by 355%, to $465 billion at the the end of last year (pg. 44). That compares to a $102-billion loan-servicing book at the end of 2011. Over the same period, the sheer number of loans the Atlanta, Georgia-based mortgage lender oversees also has ballooned by a similarly hefty 326%, from 672,000 home loans in 2011 to almost 3 million by the end of last year.

Such fast growth is part of the reason that Ben Lawsky, New York state’s head of the Department of Financial Services, has been taking a hard look at the industry. Lawsky has placed on indefinite hold (paywall) the sale of a loan portfolio from the giant California lender Wells Fargo to Ocwen.

One of the regulator’s main complaints is that Ocwen doesn’t currently have the staff or technology to manage this growing mortgage-servicing book, sources told Quartz. A person familiar with Lawsky’s review of the mortgage servicer said that the company has at times been slow to deliver loan documents requested by the DFS. Ocwen did not immediately return calls requesting comment, and a spokesman at Lawsky’s office declined to comment.

Lawsky has expressed concerns publicly about the growing ranks of non-bank mortgage-servicers such as Ocwen, Nationstar Holdings and Walter Investments. He has said he wants such entities to make sure they have the capacity to work with homeowners who find themselves under financial strain. (Lawsky demanded more details on staffing levels from Nationstar Holdings earlier this month, citing “hundreds of complaints from New York consumers.”)

The concern is that some of the shoddy practices that got banks into trouble throughout the financial crisis—including improper fees and evictions—could crop up again among these new non-bank firms taking a larger share of the business.