It was supposed to be Tesla’s coronation. After narrowly escaping bankruptcy, the Silicon Valley automaker—profitable and dominant in an industry that once dismissed it—was to enter the S&P 500 index on Sept. 4. To sweeten the symbolism, the oil and gas giant ExxonMobil had just been ejected from the Dow Jones index, marking the fossil fuel industry’s ignominious decline during the energy transition.

Only Tesla didn’t make the cut. Despite four profitable quarters and a market cap exceeding $400 billion, it wasn’t enough for the index. The company’s share price plummeted by a third following the bad news. Tesla’s unexpected slight may have had something to do with the composition of its earnings: Its $368 million in profits over the last four quarters were eclipsed by $1.05 billion in sales of regulatory credits to other carmakers for zero-emission vehicles.

True to form, however, Tesla’s exclusion from the S&P 500 barely dented the carmaker’s momentum. Tesla has since regained more than half its losses since being passed over for the index, and has lined up plenty of good news to keep investors interested. A pickup, a heavy-duty semi, a Roadster sports car, and battle-ready Cybertruck are on the way. Tesla is making plans to enter the German energy market. Its vehicles—the Models S, 3, X, Y lineup—are selling well despite the coronavirus pandemic. And the company’s “Battery Day” Sept. 22 added more fuel to the fire as Tesla committed to striking out on its own to become the world’s best battery manufacturer.

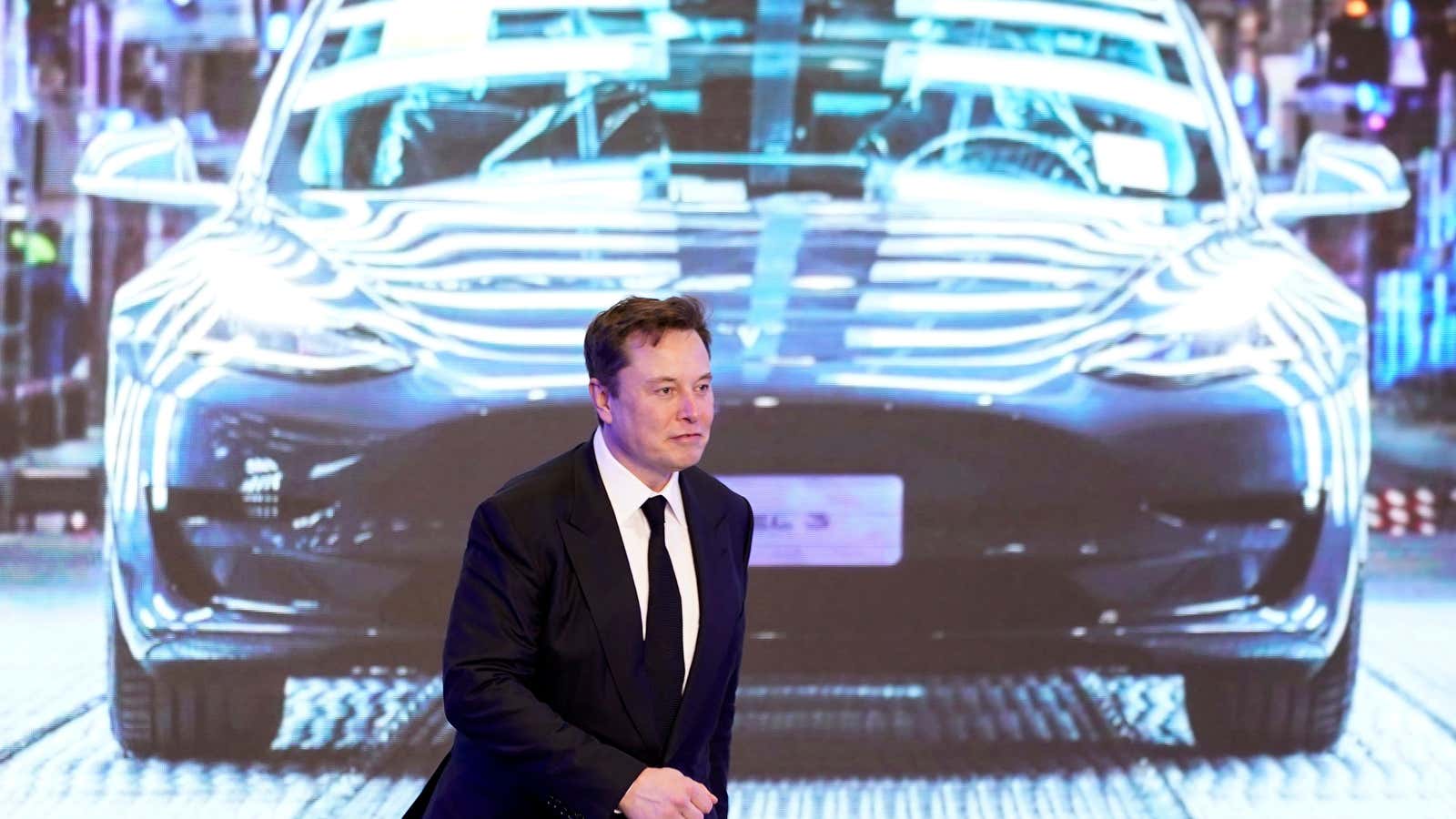

In fact, the coronavirus crisis has changed little about its plans, Musk said on an earnings call earlier this year: “We came to the conclusion that the right [path] was actually to continue to expand rapidly, continue to invest in the future in new technologies, even though it is risky.”

Here’s what else you need to know about the world’s most valuable automaker:

The Tesla essentials:

- How much is a Tesla? They start at $35,000! But good luck buying one on the website at that price. Most Teslas roll off the assembly line with features pushing the price closer to $45,000 or more for the base Model 3 or Model Y. The premium Model S sedan and Model X SUV start near $90,000.

- Who are Tesla’s competitors? Almost everyone at this point. Most major automakers are scrambling to roll out an electric line-up. While no global automaker has a full range of electric vehicle (EV) models in the market, GM, Nissan, Ford, and Audi are racing ahead.

- Where are Tesla’s vehicles made? The original factory is in Fremont, California, but Tesla now has (Giga)factories for its vehicles and batteries in Nevada, China, Germany, and (soon) Texas.

- Is Tesla profitable? Tesla has posted four consecutive quarterly profits, a new record. In September, investment bank UBS expects Tesla will become “the most profitable carmaker globally” as vehicle sales quadruple to 2 million units by 2025.

- How many teslas have been sold? More than 1 million

- Would Elon Musk ever sell Tesla? When’s he ready to go to Mars, perhaps. But the number of firms that could afford an acquisition has dwindled: Who has $400 billion lying around?

How much is Tesla stock?

Tesla keeps baffling Wall Street. The stock quadrupled this year—as of Sept 24, shares were trading at $387 after a stock split—allowing the company to raise an astounding $7.3 billion in 2020. In August, the investment bank RBC told investors Tesla is “fundamentally overvalued,” echoing widespread sentiment on Wall Street.

For Tesla’s stratospheric share price to make sense, it argued, the carmaker must grow more than 30% per year for the next decade. And the comparable companies to pull off such a feat—Apple, Amazon, and Google—don’t operate under the auto industry’s razor-thin margins.

Yet nothing seems to dent investors’ faith in Musk, whose (mis)behavior as head of the company’s board has made him “effectively uninsurable.” And the showman always has more pyrotechnics for his fans: new autopilot features, expanding factories in Berlin and Shanghai, and who knows what’s next.

Maybe that’s the point. Musk has never disputed today’s valuation makes little sense given Tesla’s track record. “Tesla is absurdly overvalued if based on the past, but that’s irrelevant,” Musk tweeted in 2017 when its valuation was a mere $70 billion. “A stock price represents risk-adjusted future cash flows.” And he knows investors are betting on a very, very bright future.

What goes into a Tesla battery?

The batteries of electric vehicles are a minefield of environmental and human rights problems. They rely on a variety of metals and minerals—cobalt, nickel, lithium, and more—most often sourced from mines in developing countries that are rife with instances of child labor, corruption, toxic pollution, and deforestation.

Tesla is no exception. On Sept. 22, Musk said Tesla would be redesigning its batteries to drop cobalt and other expensive metals. In the meantime, he’s shopping for better sources: Last week the company joined an alliance to support improved cobalt mining practices in the Democratic Republic of the Congo. It’s also in talks to buy low-carbon-footprint nickel from a specialized mine in Canada.

Elon Musk’s grand plans

Since Henry Ford’s first black Model T rolled off the assembly line in 1908, automakers have been building gasoline cars and trucks roughly along the same lines. Tesla was the first and only auto firm to envision itself as an energy company. As Musk wrote in his “Secret Tesla Motors Master Plan” in 2006, Tesla would “help expedite the move from a mine-and-burn hydrocarbon economy towards a solar electric economy.”

Since then, Tesla has ventured into batteries, solar panels, self-driving software, photovoltaic roof tiles, underground transportation (via The Boring Company), and even interplanetary travel. Musk hurled a Model 3 toward Mars aboard his SpaceX Falcon Heavy rocket in 2018.

Some of those ambitions nearly bankrupted the company more than once. But they might also pay off. For Tesla, after having strong-armed the entire industry to commit to electric batteries, it now faces unprecedented competition. Despite all the detours and delay, Tesla has never wavered much from the “master plan” Musk laid out more than a decade ago:

- Build sports car

- Use that money to build an affordable car

- Use that money to build an even more affordable car

- While doing above, also provide zero emission electric power generation options

- Don’t tell anyone about the secret plan.

The Tesla fan club

To spread the word, Tesla relies on super fans like Will Fealey. President of the Tesla Owners Club UK, Fealey and his fellow club members spend their spare weekends at car shows, offering “10,000 test drives” to prospective Tesla owners. “Staff from companies like Pagani, Aston Martin, BMW, and Porsche had to pick up their jaws from the floor once they realized we were volunteers from the official UK owners club and not employed by Tesla,” he tweeted

No other car company can claim this. Tesla just isn’t like other car companies. It spends virtually nothing on paid advertisements. Ford must spend roughly $2,000 per sale advertising its Lincoln sedan. Even luxury heavyweights like BMW pony up about $200 a piece to move cars off the lot.

That’s a durable competitive advantage, but Tesla still faces huge headwinds. It’s a new, relatively small automaker in a cutthroat market where EVs make up just 2.6% of global sales. Tesla’s zero-emission credit sales, rather than margins on vehicle sales, represent all of its profits and more. Next year, more than 30 new EV models from rival carmakers will hit the market, a “watershed year” for EVs, says Herbert Diess, Volkswagen’s CEO.

But when you have an army of customers ready to sell your car, maybe you’re doing something right.

Keep reading

- Tesla’s Cybertruck is ridiculous, but who wants to bet against Elon Musk?

- We’re about to enter a world where Tesla is the cheaper electric car

- Tesla’s success during the coronavirus crisis, in charts

- Electric cars got crushed in 2020, but next year could be their best

- The world’s best known short seller says Tesla traders are feeding on testosterone

- The past, present, and future of electric vehicles

- Electric cars are changing the cost of driving