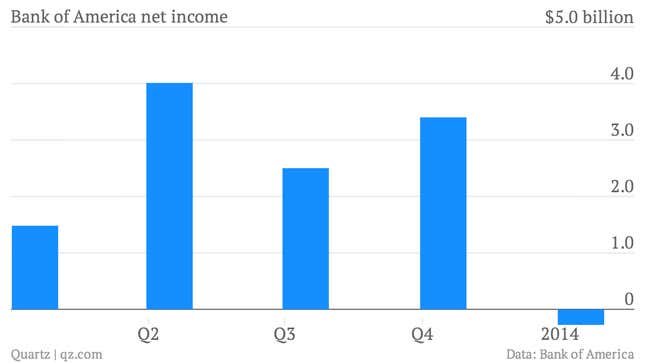

The numbers: Less than stellar. The US’s second largest bank by assets spent $6 billion during the first quarter on settlements tied to disputes with the mortgage firms Fannie Mae and Freddie Mac–its biggest legal expense this quarter. The bank came in short of analyst expectations, losing $276 million in the first quarter, compared to a $1.48-billion profit during the same period last year. Even without the legal costs, the news wasn’t good: revenues slipped 4% to $22.7 billion.

The takeaway: This quarter was especially ”noisy,” with the bank’s actual operational performance obscured by one-time costs. Yet another BofA quarter was marred by higher litigation costs, this time the bank’s settlement with the Fannie and Freddie. ”The cost of resolving more of our mortgage issues hurt our earnings this quarter,” CEO Brian Moynihan said in a statement.

What’s interesting: After filtering out the noise, it’s clear that BofA, like its peers, experienced headwinds in fixed-income trading. Revenue from fixed-income, currencies and commodities trading were down 15% at $2.95 billion, compared to a year ago. This is slightly better than Citigroup’s decline in trading, which was 18%, and JPMorgan Chase’s slump of 21%. But the pattern is clear. Weak trading revenues, along with a decline in fees from mortgage origination, could hurt the biggest banks in coming quarters.