Banks in China make as much profit as those in the US, Europe, and Japan combined

Euphoric indeed. A day after a key financial institution, the Bank for International Settlements, warned of excessive “euphoria” in the markets, new data shows that the world’s banks made a whopping $920 billion in profit, up more than 20% from the previous financial year. This was the industry’s largest-ever annual haul, comfortably beating the pre-crisis peak of $786 billion in 2007, according to The Banker magazine (paywall).

Euphoric indeed. A day after a key financial institution, the Bank for International Settlements, warned of excessive “euphoria” in the markets, new data shows that the world’s banks made a whopping $920 billion in profit, up more than 20% from the previous financial year. This was the industry’s largest-ever annual haul, comfortably beating the pre-crisis peak of $786 billion in 2007, according to The Banker magazine (paywall).

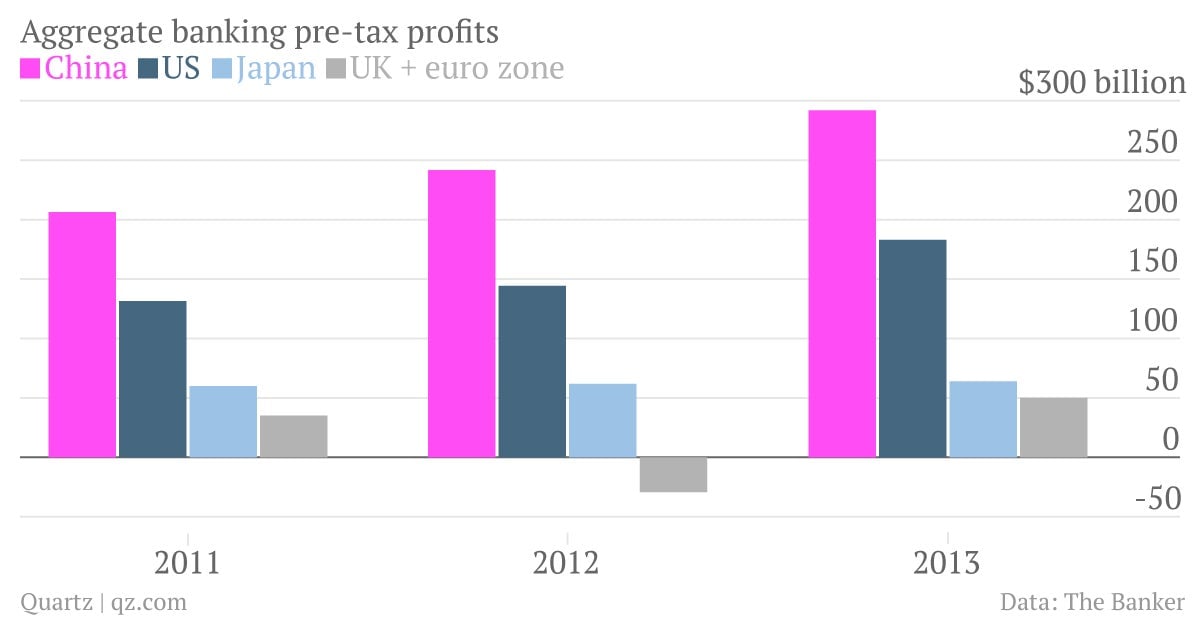

Improvements at American and European banks contributed to this increase, but the real story is all about China. Chinese banks made $292 billion in pre-tax profit in 2013, or around a third of the global total. The biggest Chinese lenders take the top four spots, with ICBC’s $55 billion in profit alone larger than the country-wide totals for all but the US and Japan. In total, Chinese banks made roughly as much in profit as their counterparts in the US, Europe, and Japan combined.

But as we have written previously, a wobbly housing market is only one of the big risks now threatening China’s economy. Fearing faltering growth, Chinese officials are ramping up infrastructure investment via the state-controlled banking system. This could give the banks a further boost, but building more ghost towns is hardly the route to sustainable riches. And then there is the $5 trillion question—the health of China’s huge, lightly-regulated “shadow banking” sector, and the implications for the financial system as a whole.

Still, it could be worse for China. Italian banks lost $35 billion last year, and occupy four of the top five spots in terms of the biggest annual losses. And European banks accounted for 24 of the top 25 losses.