Will France’s gripes about the dollar’s dominance change anything?

“This is not a fight against dollar imperialism.” That’s what French finance minister Michel Sapin said recently as he argued for increasing the use of the euro in international transactions to restore “global balance.” But it kind of looks like it.

“This is not a fight against dollar imperialism.” That’s what French finance minister Michel Sapin said recently as he argued for increasing the use of the euro in international transactions to restore “global balance.” But it kind of looks like it.

French officials are cross with the US for the $9-billion fine slapped on BNP Paribas last week. The French banking giant fell foul of American sanctions against dollar transactions with Cuba, Iran, Sudan, and other countries. Over the weekend, French bigwigs grumbled about the rules that come with using the dollar, even when the transactions have nothing to do with the US. (Like, say, $1.7 billion in transfers between a French bank and Cuba, which is not subject to EU sanctions.)

This is hardly a new gripe. In the 1960s, the French finance minister Valéry Giscard d’Estaing coined the term “exorbitant privilege” to describe the benefits to the US that come from the dollar’s position as the world’s de facto reserve currency. More recently, critics of the BNP Paribas fine (paywall) said that this amounts to “extraterritorial powermongering”—forcing US foreign policy on the world via the financial markets.

“There is obviously a need to rebalance to give better regulation and a better position to each of the world currencies,” Sapin said at a conference yesterday. Euro zone finance ministers are meeting today in Brussels, and they’re sure to hear more from him about it.

Another world leader who has seized upon the latest bout of complaining about the dollar’s dominance is Russian president Vladimir Putin. He has theorized that the US punished BNP Paribas in retaliation for France selling warships to Russia.

Facing increasingly painful US sanctions for its role in the unrest in Ukraine, Russia is one of the most stringent critics of dollar-based trade. Recent energy and finance agreements with China are pitched as a means for both countries to reduce their reliance on the US currency. Or, as a state-owned Russian media outlet puts it, “the ultimate goal would be to break the Washington’s money printing machine that is feeding its military-industrial complex and giving the US ample possibilities to spread chaos across the globe.”

No French official would ever use such spicy language, no matter how peeved they are. However, the suggestions of (sensible) alternatives to the dollar from key figures in France and elsewhere do chip away at the US currency’s central role in global commerce. But this won’t happen quickly—unravelling the positive network effects that come from the dollar’s ubiquity will take time.

And then there’s the question of how desirable the alternatives are. It wasn’t that long ago that the main contender for the dollar’s crown, the euro, was on the brink of breaking apart. China’s inscrutable yuan and Russia’s volatile ruble are not widely used outside of those countries. Stateless crypto-currencies are not ready for prime time.

The dollar’s privileged position is not assured, of course, but it will take more than official bluster to dismantle the dollar’s global dominance, considering how embedded the currency is in just about every aspect of the world’s economy.

The dollar is on one side of nearly 90% of all foreign-exchange transactions

Around 60% of cross-border bank loans in foreign currencies are in dollars

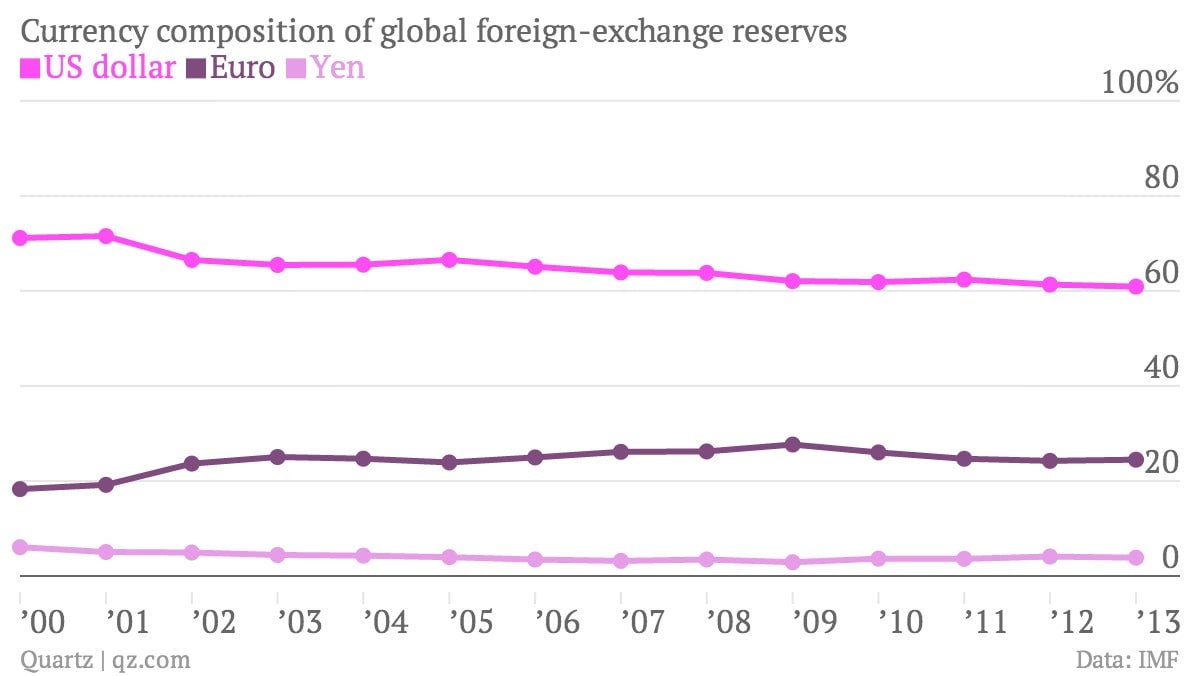

Central banks’ foreign-exchange reserves are mostly held in dollars, although there has been a slow but steady decline in recent years—a sign of things to come?