What to look for in the biggest banks’ woeful second-quarter earnings

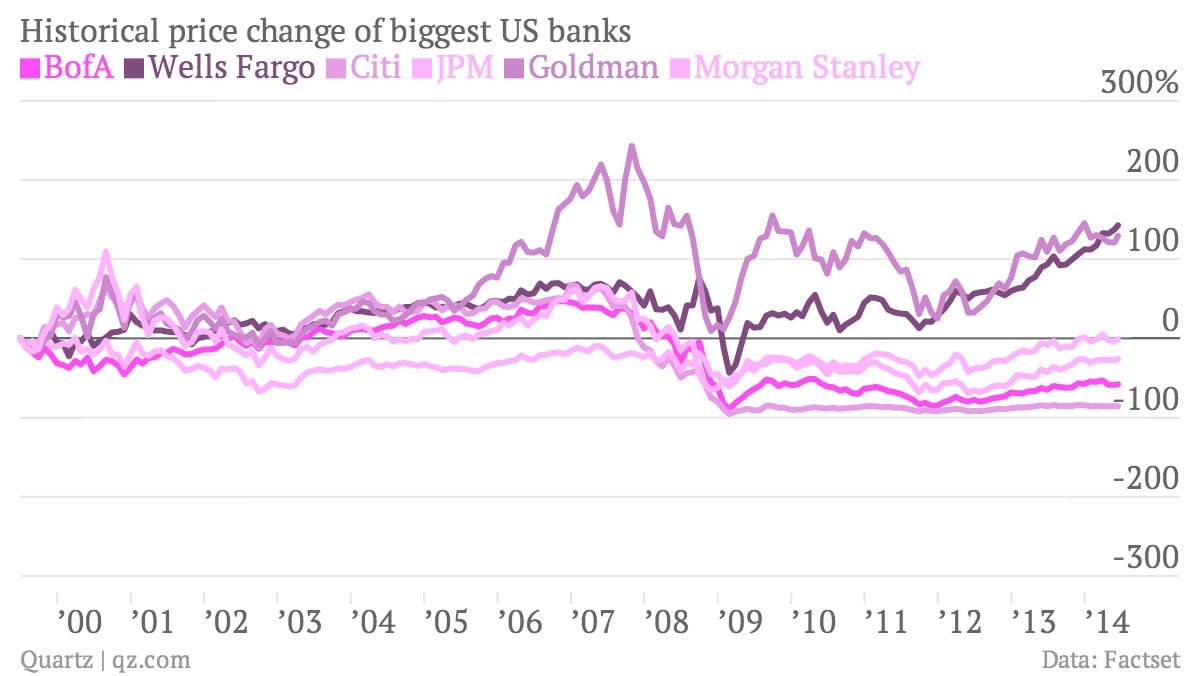

US bank earnings for the second quarter probably won’t be pretty. At best, most of the biggest US banks—JPMorgan Chase, Citigroup, Goldman Sachs and Morgan Stanley—are likely to show pretty lackluster results. At worst, they may report more year-over-year declines in revenues.

US bank earnings for the second quarter probably won’t be pretty. At best, most of the biggest US banks—JPMorgan Chase, Citigroup, Goldman Sachs and Morgan Stanley—are likely to show pretty lackluster results. At worst, they may report more year-over-year declines in revenues.

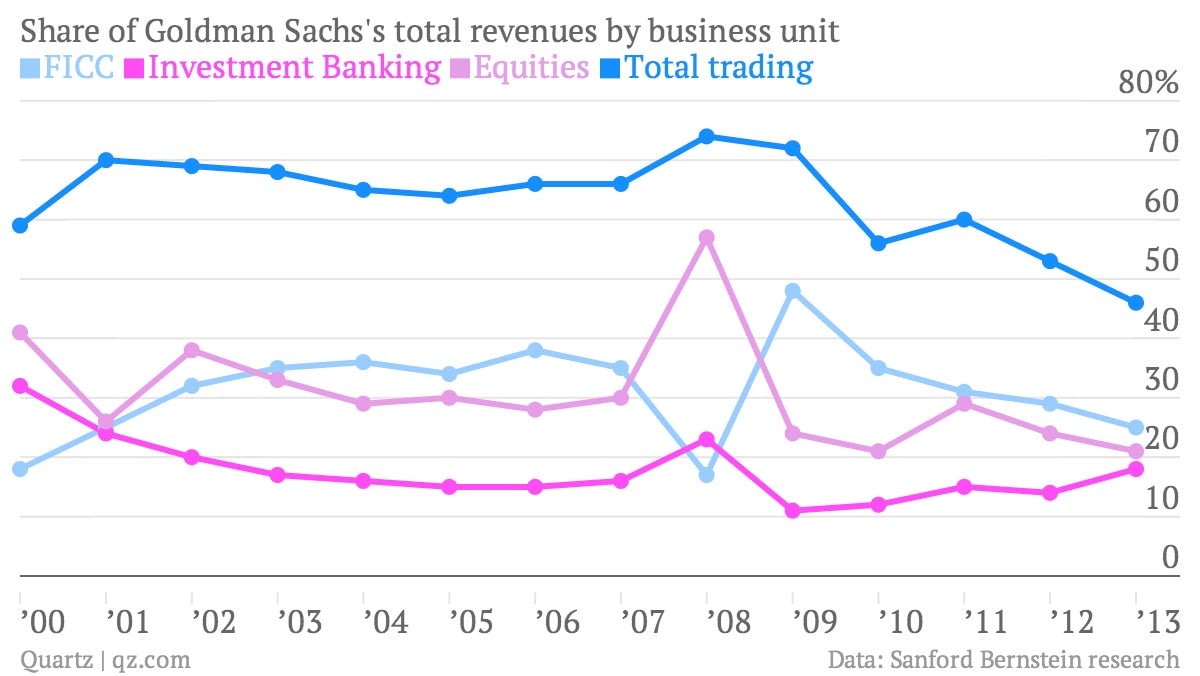

Fixed-income trading continues to be an Achilles heel. And that looks unlikely to change anytime soon, with analysts forecasting revenues in trading to be down 20% or worse due to a lack of volume and low volatility in stocks. The good news is that segments of investment banking, notably the fees banks collect from helping firms buy and sell companies and from bringing startups public, have been a bright spot in what may be otherwise dour quarterly results.

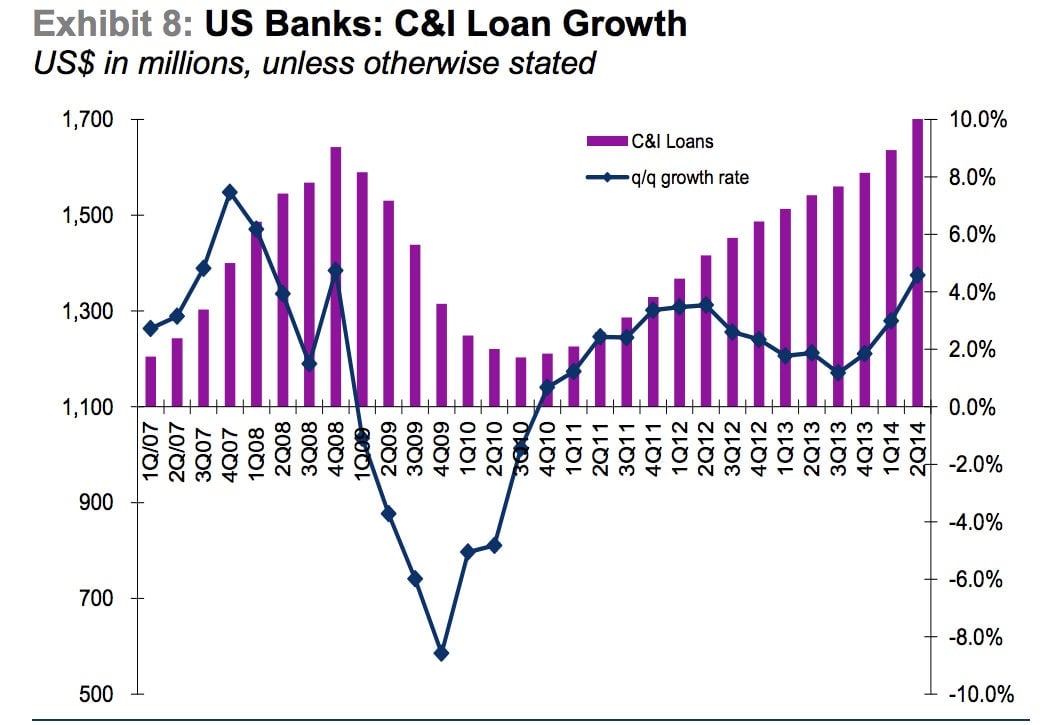

Another upbeat sign: Consumer banks appear to be growing loans, mainly to small businesses in an area known as commercial and industrial lending:

But that good news is tempered by concerns from regulators that the growth may be a result of bank lending getting riskier.

The consumer giant Wells Fargo, among the biggest banks by deposits and one of banking’s better performers, will kick off the earnings convoy on Friday. Citigroup’s reports arrive on Monday. Tuesday will deliver a duo of results, from JPMorgan and Goldman Sachs, with Bank of America on Wednesday and Morgan Stanley bringing up the rear on Thursday.

Here’s a quick overview of what the industry may be looking at in the coming days, as the market takes stock of the US banking system:

JPMorgan

The biggest US bank by assets, JPMorgan Chase & Co. delivered the stunning news on July 1 that CEO Jamie Dimon is being treated for throat cancer. The firm has emphasized that the outspoken CEO’s prognosis looks promising because the cancer was caught early and hasn’t spread. But Dimon’s diagnosis likely will be front of mind as analysts assess the bank’s succession plans. That development may overshadow the bank’s other trouble spots, in trading as well as mortgage lending: but both areas are likely to be weak compared with a year ago.

Wells Fargo

The sprawling San Francisco lending giant is expected to report second-quarter earnings that are better than last year’s, driven in large part by its push into other areas beyond mortgages. Wells has emerged as the biggest auto lender, surpassing Ally Financial, formerly the car loan arm of General Motors, last quarter. So far, shareholders have loved the stock, which has outperformed its peers over the past several years.

Citigroup

The US bank with the broadest international scope, Citigroup is dogged by worries about fines and troubles at its Mexican unit, Banamex. Citi also faces a $10-billion fine on charges that it misled investors about mortgage bonds during the housing crisis. The legal penalty brings to mind the $13-billion fine JPMorgan had to resolve last year. Given all that, analysts are predicting that Citi’s second-quarter earnings will be down significantly, compared to last year.

Morgan Stanley

Morgan Stanley’s shift in focus to managing wealthy people’s money, and away from risky trading, has gained some serious traction. The bank, headed by the Australian-born CEO James Gorman, is one of the few expected to post an increase in second-quarter profits. Morgan also has enjoyed a resurgence in mergers and acquisitions and equity capital markets—notably initial public offerings, a sector where it is one of the top-ranked underwriters. The bank still lags Goldman in return on equity, a measure of the bank’s ability to return capital to shareholders, delivering an 8.9% return on equity from continuing operations in the first quarter, compared with nearly 11% at Goldman.

Goldman Sachs

President Gary Cohn already set the stage for a weak performance in Goldman’s core trading area by noting that revenues would be down. There’s a chance that Goldman could eliminate more trading jobs as its trading swoon continues. If that’s the case, Goldman will have to hitch its wagon to more investment banking to grow its franchise and retain its title as one of the best banks on Wall Street.

Bank of America

Like Citi, Bank of America has a large mortgage cloud looming overhead. The bank also is reportedly negotiating with the Department of Justice to resolve its past mortgage transgressions. But after acquiring the mortgage lender Countrywide Financial and the investment house Merrill Lynch during the worst of the 2008 financial crisis, BofA may have to settle civil probes with the DoJ for as much as $12 billion to put its housing problems behind it, and the Federal Housing Finance Agency, which oversees mortgage giants Fannie Mae and Freddie Mac, is looking for a $6-billion penalty from the bank related to shoddy mortgages. Haggling over potentially sizeable fines is likely to drag on the bank’s upcoming results.